Earnings Play: PepsiCo

On Thursday, before market, PepsiCo (PEP) is expected to release third quarter EPS of $1.49 compared to $1.56 last year on revenue of approximately $17.2 billion, in line with the year before. PepsiCo is an international beverage and food company, and its expected move based on front-month options is 2.7%. The last time the company reported earnings the stock rose 0.3%.

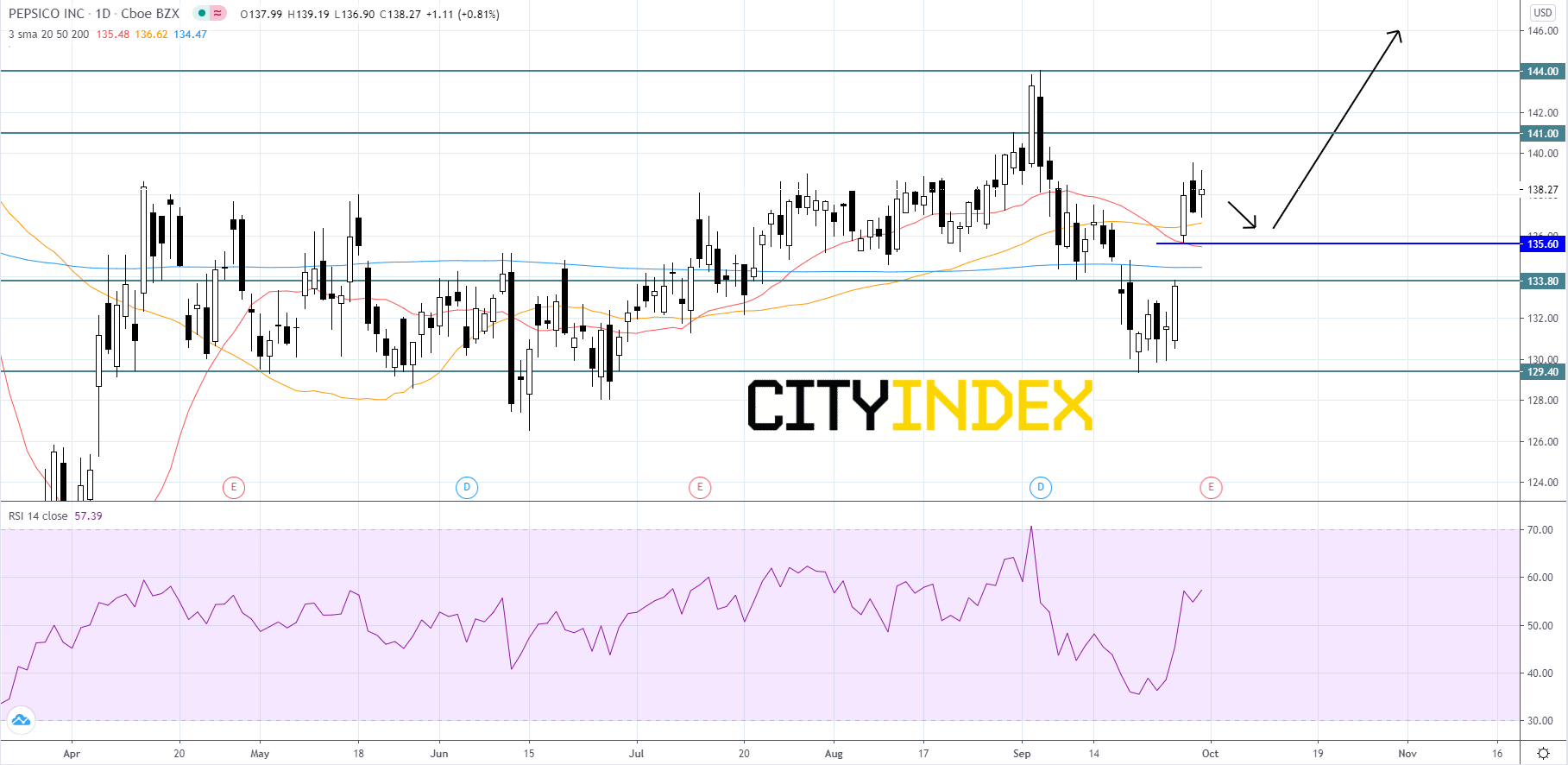

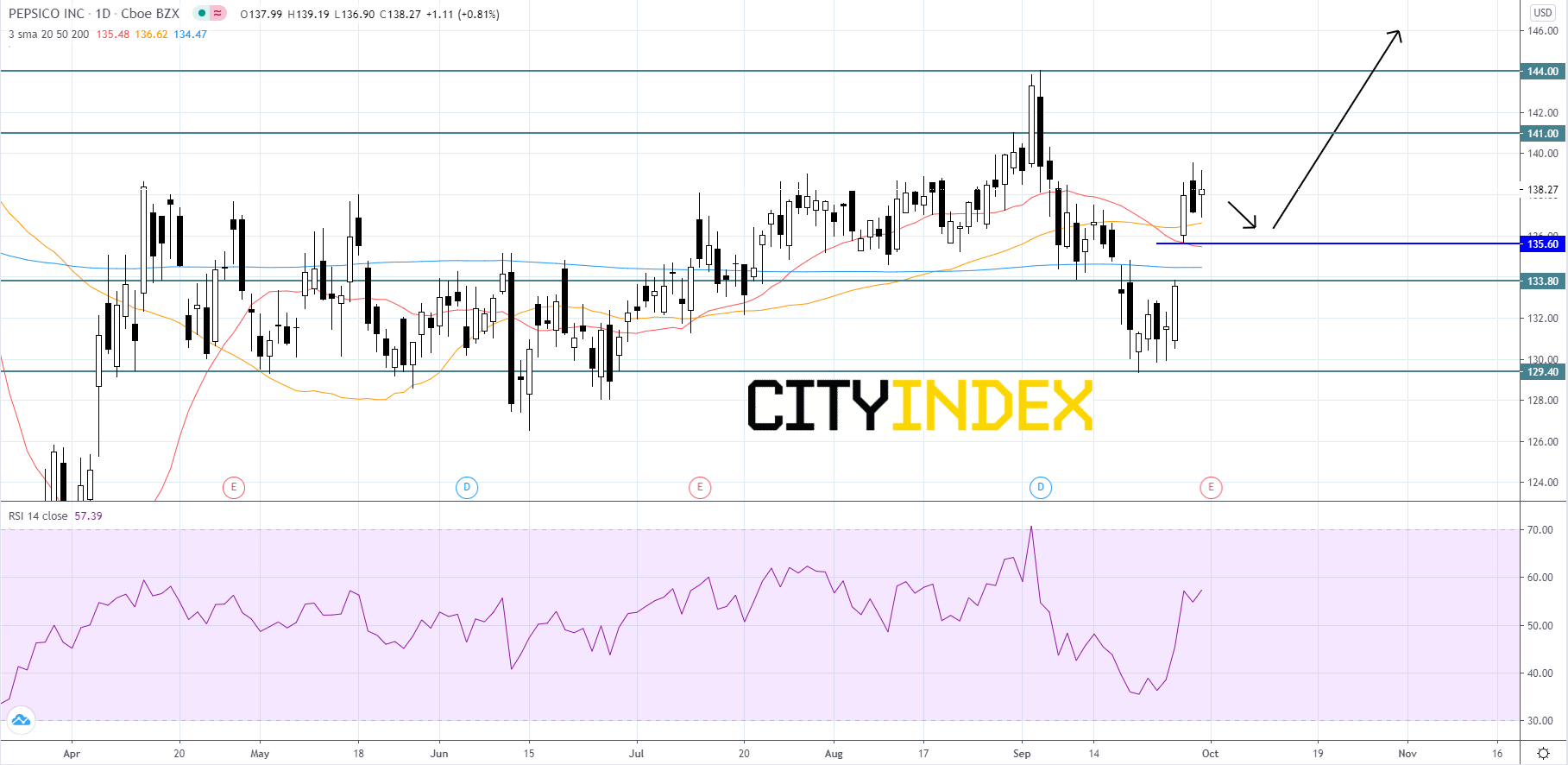

Technically speaking, on a daily chart, PepsiCo's stock price is currently holding above an opening gap from Monday, after price gapped up 1.9% from Friday's close. Looking back further it appears PepsiCo's stock price has been chopping around the 200-day simple moving average (SMA) in a consolidation range since April. The RSI shows upside momentum and is above its neutrality area of 50. As long as price can hold above the low from the opening gap day on Monday, which is 135.60, the bias should remain bullish. Price will likely retest its first resistance level of 141.00. If price can breakout to the upside of 141.00, traders should look for price to reach for 144.00. However, if price closes below the gap day low of 135.60, it would be a bearish signal that could cause price to fill the gap and fall back to 133.80. If price cannot find support and bounce off of 133.80, price could potentially continue its descent and hit 129.40.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, PepsiCo's stock price is currently holding above an opening gap from Monday, after price gapped up 1.9% from Friday's close. Looking back further it appears PepsiCo's stock price has been chopping around the 200-day simple moving average (SMA) in a consolidation range since April. The RSI shows upside momentum and is above its neutrality area of 50. As long as price can hold above the low from the opening gap day on Monday, which is 135.60, the bias should remain bullish. Price will likely retest its first resistance level of 141.00. If price can breakout to the upside of 141.00, traders should look for price to reach for 144.00. However, if price closes below the gap day low of 135.60, it would be a bearish signal that could cause price to fill the gap and fall back to 133.80. If price cannot find support and bounce off of 133.80, price could potentially continue its descent and hit 129.40.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 10:44 PM

Yesterday 05:00 PM

Yesterday 03:13 PM