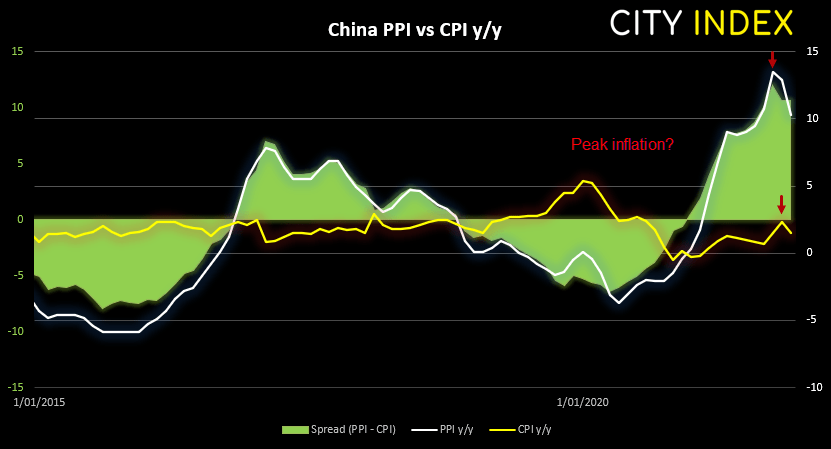

In the month of December, China’s headline inflation rose 1.5% y/y compared with 2.3% in November. During a time that inflationary concerns linger this may not seem such a bad thing. Yet what needs to be considered is that lower inflationary pressures also erode growth potential, at a time where Q4 GDP for China is already a slight concern.

Back in December, poor retail sales and investment data already had analysts revising growth lower. And to underscore the potential for inflation pressures to remain sanguine, producer prices also fell for a second month after hitting a 26-year high. As this is a key inflationary input and CPI has continually lagged PPI in recent year, do we now need to be concerned over disinflation form China?

Back in December, poor retail sales and investment data already had analysts revising growth lower. And to underscore the potential for inflation pressures to remain sanguine, producer prices also fell for a second month after hitting a 26-year high. As this is a key inflationary input and CPI has continually lagged PPI in recent year, do we now need to be concerned over disinflation form China?

If so, we could expect further stimulus from Beijing in Q1, and helped explain why the China A50 rose around 0.7% today after the release. Whilst it is too early to call a bottom we continue to suspect price could rally from 15,200 and head for 16,000 over the near-term.

Read our guide on the PBOC (People's Bank of China) and inflation

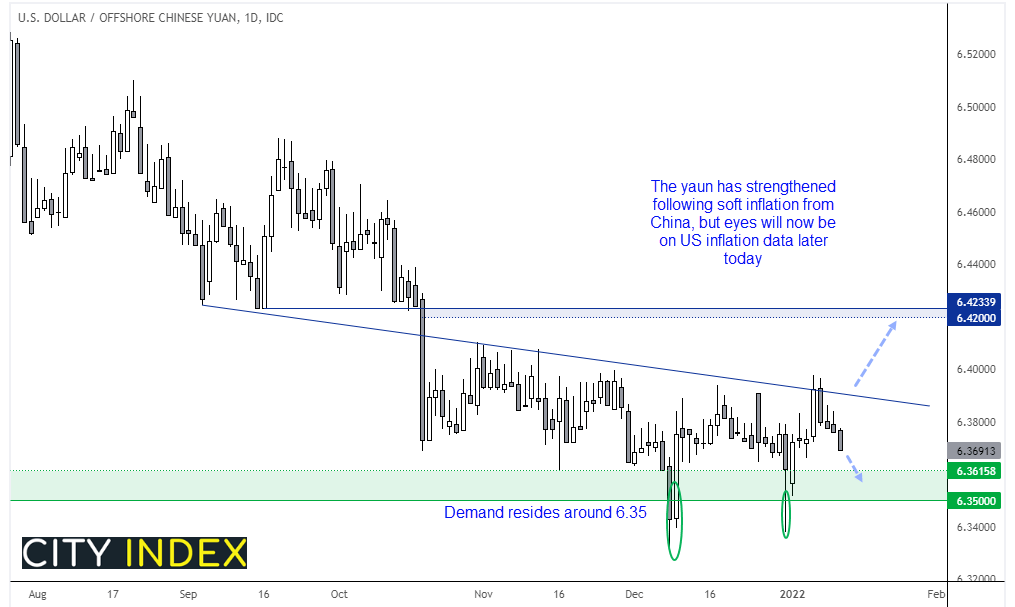

USD/CNH touches a 5-day low

We outlined yesterday that we saw the potential for USD/CNH to break higher from bearish reversal pattern, given its stubbornness to hold below 6.3500. And that remains a possibility, even if USD/CNH has fallen to a 5-day low today. Momentum favours more downside from here, but keep in mind that all eyes will be on US inflation data later today – where a soft print could push it further low, whilst a strong print could help it recover bac towards/above 6.3800.

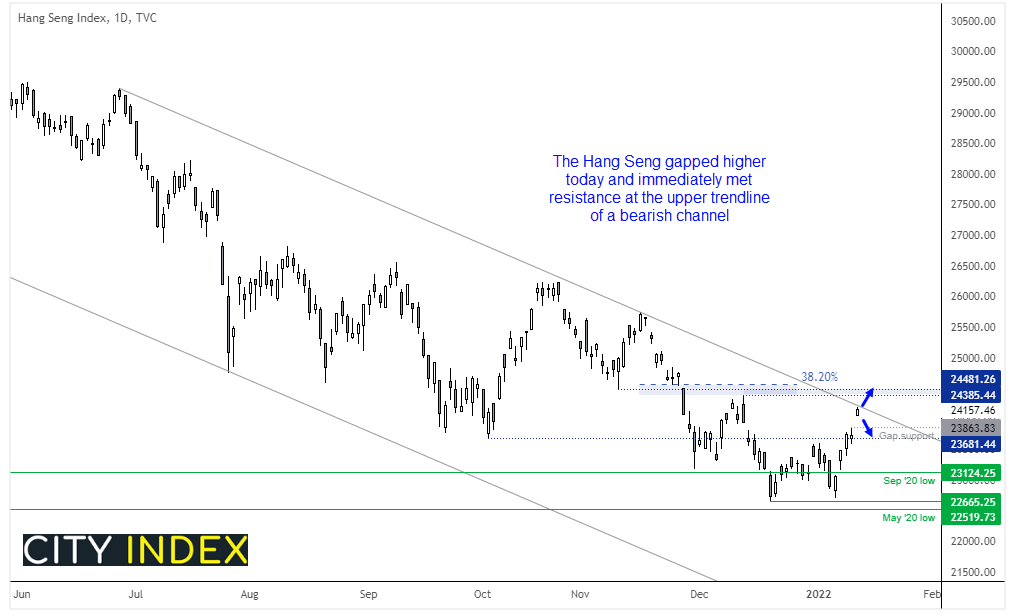

The Hang Seng rallies to upper trend channel

Wall Street’s rebound, which was led by tech stocks, has helped the Hang Seng gap up to a 1-month high and extend it rally from the January low to 6.5%. A double bottom has formed around 22,600which projects an approximate upside target around 22,650. However, its rally has stalled at the upper trendline of a multi-month bearish channel, just above 24,000. Purely from a technical perspective it is plausible to expect a pullback from these levels, especially if US inflation is to come in strong and weigh on Wall Street once more. If the trendline holds we’d look for the gap to fill and target 28,863. Yet should we simply see an upside break then the immediate target for bulls is near the 24,385 high. Which way it breaks will likely be dictated by sentiment for global equities over the near-term.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade