Woolworths Group Ltd (WOW) is an Australian retail group operating primarily in the supermarket and grocery sector. Woolworths and Coles form a near-duopoly of Australian supermarkets, accounting for just over 60% of the Australian market. It reports its full-year numbers on Thursday, the 25th of August.

For the first six months of FY22, Woolworths reported sales rose by 8% to $31.9bn; however, its profitability declined. Underlying earnings before interest and tax (EBIT) slumped by 11% to $1.38bn, and underlying profit after tax (NPAT) fell 6.5% to $795mn.

CEO Brad Banducci, called the first half of FY22 “one of the most challenging” ever as COVID-19 costs and stock shortages on shelves because of supply chain disruption crunched profitability.

The arrival of the Omicron variant in December and flooding in NSW and QLD again wreaked havoc on supply chains, amplified by labour shortages. At one point, Woolworths had 35% of its distribution centre workers in isolation, leaving Woolworths shelves bare.

Taking advantage of this, IGA and other independent supermarkets have gained market share as their more localised supply chains kept food on shelves during the Omicron wave.

The pandemic is now behind Woolworths, and in the companies favour the pace of inflation has picked up and is expected to peak above 7% later this year. Higher inflation is generally believed to be positive for retailers such as supermarkets, who can pass on higher costs to consumers, due to inelasticity of demand.

Analysts expect Woolworths to report an NPAT of $1.5bn for FY22 and an interim dividend of $0.49c per share.

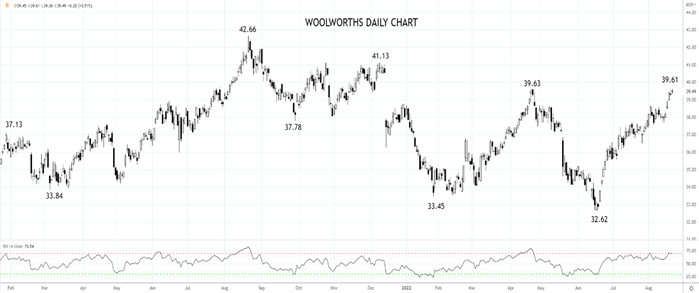

Woolworths Share Price Chart

Reflecting the challenges of COVID-19 and the broader share market sell-down in 2022, the share price of Woolworths dropped over 20% from its August 2021 $42.66 high to a low of $32.62 in June two months ago. The selloff appears countered or corrective.

Since then, the share price of Woolworths has rebounded, to be testing the April 2022 high of $39.63. Although a break of this level should see a retest of the $42.66 high, I don’t see the value in chasing the share price so close to all-time highs.

Instead, I would prefer to be a buyer of Woolworth’s shares back towards $35.00, leaning against a band of support between $33.50 and $32.50.

Source Tradingview. The figures stated are as of August 19, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade