US Futures red - Watch INTC, GS, TSLA, TWTR, HON, AXP, SLB, ETFC

Due later today are reports on Markit U.S. Manufacturing Purchasing Managers' Index (a rise in July preliminary reading to 52.0 expected) and New Homes Sales (an increase in June annualized rate of 700,000 units expected).

European indices are in the red. Research firm Markit has published preliminary readings of July Manufacturing PMI for the eurozone at 51.1 (vs 50.0 expected), for Germany at 50.0 (vs 48.0 expected), for France at 52.0 (vs 53.2 expected) and for the U.K. at 53.6 (vs 52.0 expected). Also, preliminary readings of June Services PMI was published for the eurozone at 55.1 (vs 51.0 expected), for Germany at 56.7 (vs 50.5 expected), for France at 57.8 (vs 52.3 expected) and for the U.K. at 56.6 (vs 51.5 expected). The U.K. Office for National Statistics has posted June retail sales at +13.9% (vs +8.0% on month expected). The July Gfk Consumer Confidence was released at -27.0 vs -24.0 expected.

Asian indices all closed in the red. Government data showed that New Zealand recorded a trade surplus of NZ$0.43 billion in June (NZ$0.45 billion surplus expected), where exports totaled NZ$5.07 billion dollars (as expected).

WTI Crude Oil futures are under pressure. Later today, Baker Hughes will report the oil rig counts for the U.S. and Canada.

Gold rose 4.58 dollars (+0.24%) to 1892.02 dollars.

USD/JPY fell 61pips to 106.25.

U.S. Equity Snapshot

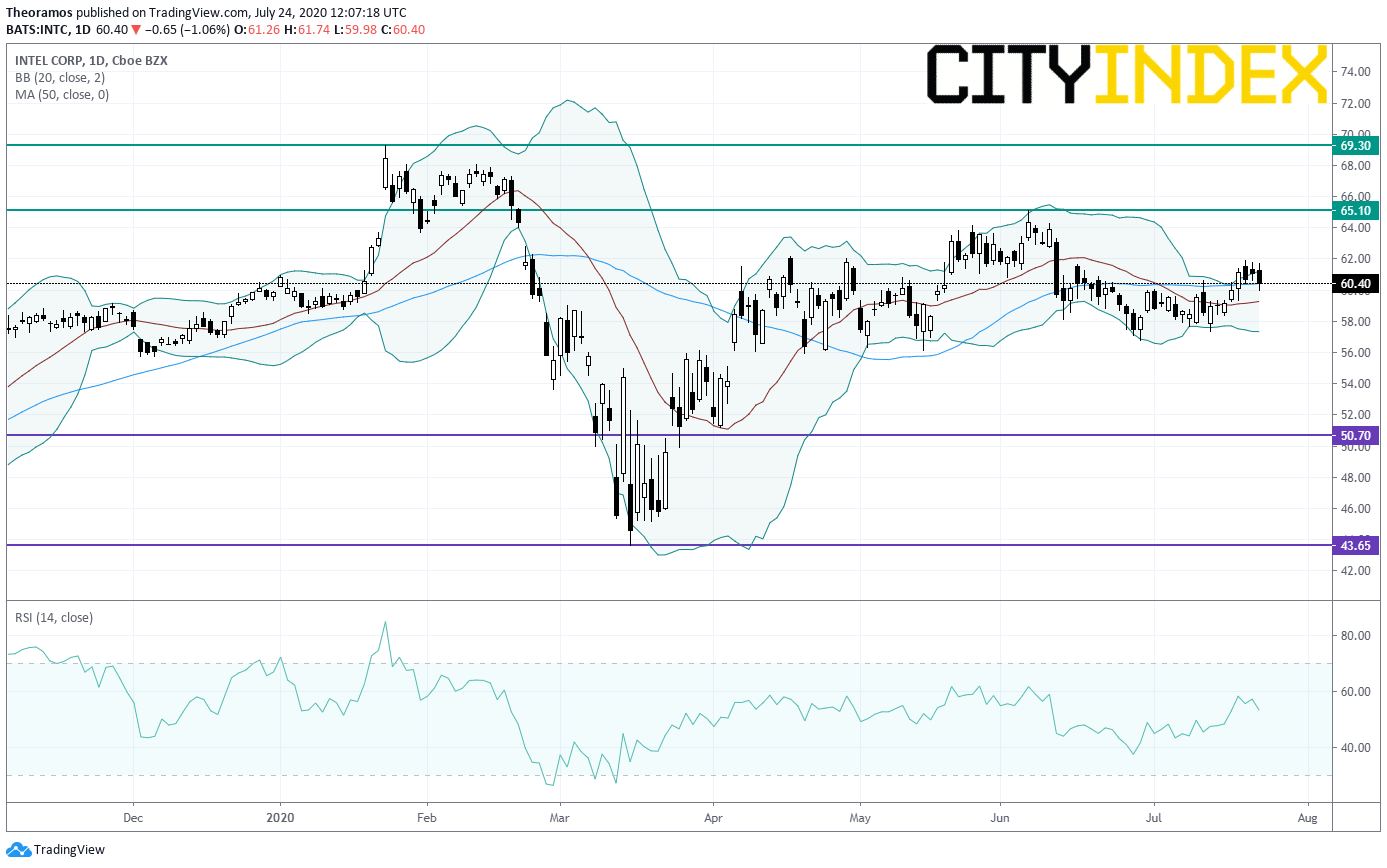

Intel (INTC), a designer and manufacturer of microprocessors, plunged after hours after warning that the "company's 7nm-based CPU product timing is shifting approximately six months relative to prior expectations." Rival Advanced Micro Devices (AMD) gained ground following that release.

Source: TradingView, Gain Capital

Goldman Sachs (GS), the banking group, reached a 3.9 billion dollars agreement to settle charges related to Malaysian sovereign wealth fund 1MDB.

Tesla's (TSLA), an electric vehicle manufacturer, credit rating was upgraded to "B2" from "B3" at Moody's, outlook "Stable". The rating agency said: "The upgrade reflects Tesla's sustainable position in the auto industry as a specialized producer of pure battery electric vehicles (BEVs)." Separately, the stock was downgraded to "neutral" from "outperform" at Daiwa.

Twitter's (TWTR), the social network, price target was raised to 36 dollars from 25 dollars at UBS.

Honeywell (HON), a diversified technology company, reported second quarter adjusted EPS down to 1.26 dollar from 2.10 dollars a year earlier, on sales down 19% to 7.48 billion dollars. Both figures beat estimates.

American Express (AXP), a globally integrated payments company, unveiled second quarter sales down 29% to 7.7 billion dollars, below estimates. EPS was down to 0.29 dollar from 2.07 dollars a year earlier.

Schlumberger (SLB), the world's largest supplier of oil and gas products and services, posted second quarter adjusted EPS down to 0.05 dollar, above estimates, from 0.35 dollar a year earlier, on sales down 35% to 5.4 billion dollars, in-line with expectations.

E*Trade (ETFC), an online brokerage service, announced second quarter EPS of 0.88 dollar, better than expected, down from 0.90 dollar a year ago.