Trading with leverage

Overnight financing explained

Any leveraged trade held overnight is subject to a small fee to maintain that position. Let’s take a look at what that means in practice.

- Understanding overnight financing

- Which rates will be used to calculate overnight fees?

- When does the overnight financing apply?

- Financing on long positions

- Financing on short positions

Understanding overnight financing

Overnight financing is a fee that you pay to hold a trading position overnight on leveraged trades. It is essentially an interest payment to cover the cost of borrowed capital that you’re using.

It’s only applied to positions that have no set expiry date. You will not pay a finance charge on futures trades as they already have the cost of carry built into the spread.

Financing charges reflect the cost of borrowing or lending the underlying asset and are charged at 2.5% +/-the relevant interest rate benchmark on the total value of the position. These charges are competitive in order to keep the cost of trading low.

Which rates will be used to calculate overnight fees?

| Country | Financing on long positions | Financing on short positions |

|---|---|---|

| Singapore | 2.5% + SONIA | 2.5% - SONIA |

| US | 2.5% + SOFR | 2.5% - SOFR |

| EU | 2.5% + €STR | 2.5% - €STR |

| UK | 2.5% + SONIA | 2.5% - SONIA |

| Australia | 2.5% + Deposit | 2.5% - Deposit |

| Other international | Contact Client Management | Contact Client Management |

When does the overnight financing apply?

The daily financing fee will be applied to your account each day that you hold an open position (including over the weekend).

How are overnight fees calculated?

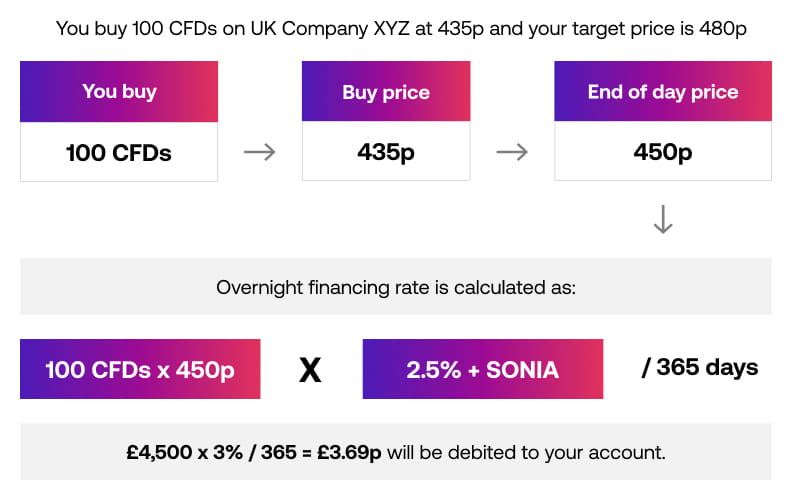

Financing on long positions

You will pay an overnight financing charge of the relevant rate added to 2.5%.

In this example, you buy 1,000 CFDs on SG Company ABC at $4.35. The trade is doing well, and the price has increased to $4.50 at the end of the day. However, as you’re waiting for the market to hit $4.80 before closing the trade, you decide to keep it open overnight.

As it is a long position, you will pay an overnight financing fee to keep the position open, this fee consists of 2.5% + SORA. In this example, the current rate of SORA is 0.5%.

So, the overnight financing is then calculated as:

(1000 x 4.50) x (2.5% + 0.5%) / 365

$4,500 x 3% / 365 = $0.369

This would result in $0.37 being debited to your account.

*Note: US and EU stocks are divisible by 360 rather than 365.

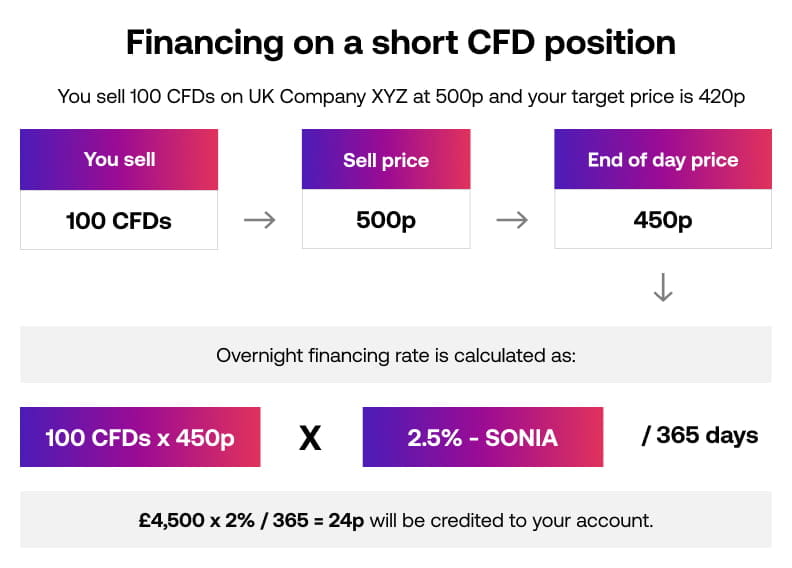

Financing on short positions

On short positions, you’ll receive an overnight financing fee of the relevant rate subtracted from 2.5%.

For example, you sell 1,000 CFDs on SG Company XYZ at $5.00. The price falls to $4.50 at the end of the day, but it is still some way from your target price of $4.20. You decide to keep the trade open overnight.

As it is a short position, you’ll receive an overnight financing fee to keep the position open. The SORA rate is currently 0.5%.

The overnight financing is calculated as:

(1,000 x 4.50) x (2.5 - SORA) / 365

$4,500 x 2% / 365 = $0.246

This would result in $0.25 being credited to your account.