Trading strategies

Optimising your trade entry

There are many different approaches to analysing markets and spotting trading opportunities.

Regardless of which trading strategy you use, it’s worth reminding yourself of some constant principles that will help you to place your trade in the right direction at the best possible price.

“The trend is your friend” is an old adage in trading and successful investors are known to trade the prevailing trend so they are moving with the momentum of the market.

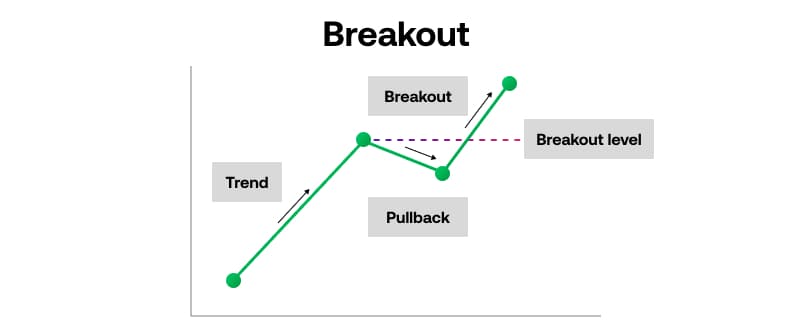

A popular method used by investors to ensure they are moving with the momentum of the market is to firstly identify a trend, watch for an event called a pullback and then trade what’s known as a break out.

Trading with the trend

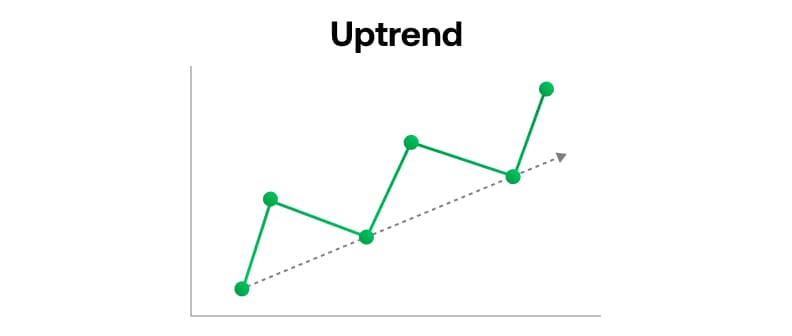

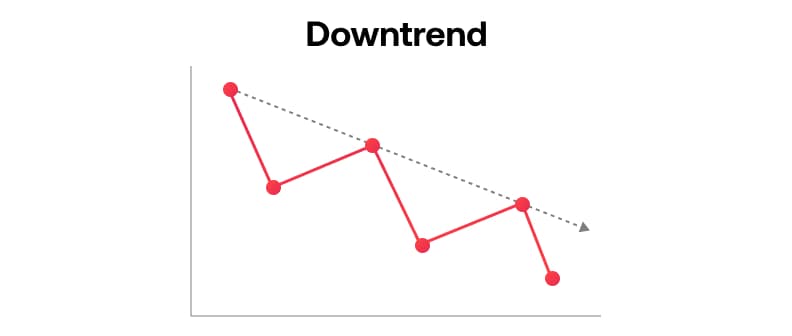

It is important to remember that a trend can move in three ways: upwards, downwards and laterally.

Upwards movement is often called an “uptrend” and reflects bullish or positive price movement.

Downward movement reflects a bearish or downwards trend, while lateral movement is considered range-bound and usually travels between a floor and a ceiling.

Ideally, traders want to enter the market during a trend as early as possible, rather than at its peak, to maximise their chance of success.

Identify a trend

The first step in trading with the momentum of a market is to identify a trend over a period of time using a chart as this will indicate whether there is momentum is behind the market.

When entering a trade it is important to know which direction the markets are currently trading, to ensure a higher probability of a successful trade.

One of the simplest ways to determine and define the direction of a market is to use trend lines. Chartists define trends by drawing lines at angles directly onto charts for the greatest level of accuracy.

To find out more about identifying trends, check out our ‘trading with the trend article’.

When the market is moving up or is said to be experiencing an uptrend, the trend line will have a rising slope. Investors will consider trading on the bullish or long side of the market until the uptrend comes to an end.

In a downtrend, the trend line would have a negative slope.

If, when you join two highs together with a trend line, the second high is lower than the first high, then this would indicate a falling market.

When markets are forming lower lows and lower highs, this is considered a downtrend. In this phase, traders would consider trading on the short side of the market, or selling.

Watch for a pullback

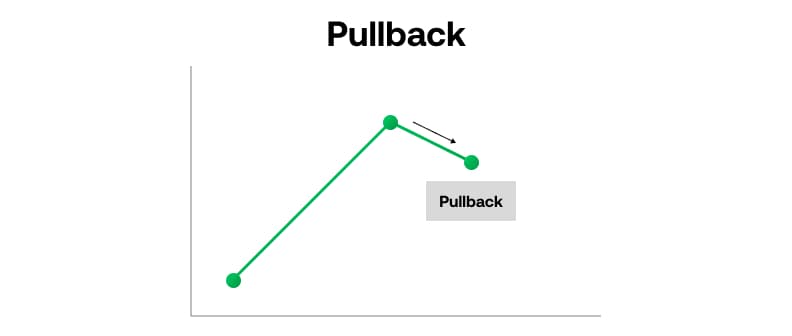

Once you have identified the trend, the next step in working out the best time and price to enter the market, is to look for a pullback.

A pullback is when a market that has been moving in a particular direction then pulls back in the opposite direction. For example, if an asset price moves lower when the trend has previously been upward or bullish.

Trade the breakout

Next, look for a breakout. This is where the trend resumes its original direction and is the point at which short term momentum agrees with the longer term trend.

Before placing a trade, look for an indication that the price is recovering, and turning back to the upside.

In this example, a suggested entry level might be the blue line above the breakout level.

In summary, it is important to aim to enter the market at a point that ensures you trade the market momentum. You can do this by first identifying the trend and watching carefully for a pullback and finally trading the breakout which reflects momentum agreeing with the longer term trend.