How to trade

Take profits and stop losses

Now that you know how to open traders with orders, let’s look at using orders as risk management tools to close active trades.

- What is a limit close order?

- What is a stop-loss order?

- What is a trailing stop-loss-order?

- What is a guaranteed stop-loss order?

- What is an OCO close order?

- What is an 'if-done' order?

What is a limit close order?

A limit close order is an instruction to your broker to automatically close a trade at a better price than the current available price of a market. This is why they’re commonly known as ‘take-profit’ orders.

Take profits can help you to be disciplined with your trading strategy and not chase profits unnecessarily. If the price doesn’t reach the limit level, the take-profit order does not get filled and your trade will remain active. Limit close orders are commonly paired with stop losses to ensure the risk of the market moving against you is also managed.

Limit order example

| Scenario | Long example | Short example |

|---|---|---|

| You open a position on ABC index | Go long 10 CFDs at 4,250 | Go short 10 CFDs at 4,000 |

| You want to place a limit order to close out your position with a profit of 50 points | Place a limit order at 4,300 | Place a limit order at 3,950 |

| The market moves in your favour by 100 points in the next 3 days | Your limit is triggered at 4,300 | Your limit is triggered at 3,950 |

| Your profit/loss | $500 profit | $500 profit |

What is a stop-loss order?

A stop-loss order is an instruction to your broker to automatically close a trade at a worse price than the currently available price of a market. This normally means your trade would have made a loss. Stop-loss orders are a key tool in helping you minimise your losses if a price moves against you.

The placement of your stop loss will depend on your strategy and risk tolerance, but typically when buying a stop loss will be attached below a known support level and when short selling it would be placed above a level of resistance.

It’s important to note that in periods of high volatility, your stop loss may not be filled at the level you set.

Stop-loss order example

| Scenario | Long example | Short example |

|---|---|---|

| You open a position on ABC index | Go long 10 CFDs at 4,250 | Go short 10 CFDs at 4,000 |

| You want to place a stop loss to close out your position with a loss of 50 points | Place a stop loss at 4,200 | Place a stop loss at 4,050 |

| The market moves 100 points in the next 3 days | Your stop loss is triggered at 4,200 | Your stop loss is triggered at 4,050 |

| Your profit/loss | $500 loss | $500 loss |

This was an example of a basic stop loss order, but there are two other variants that traders use: trailing stops and guaranteed stops.

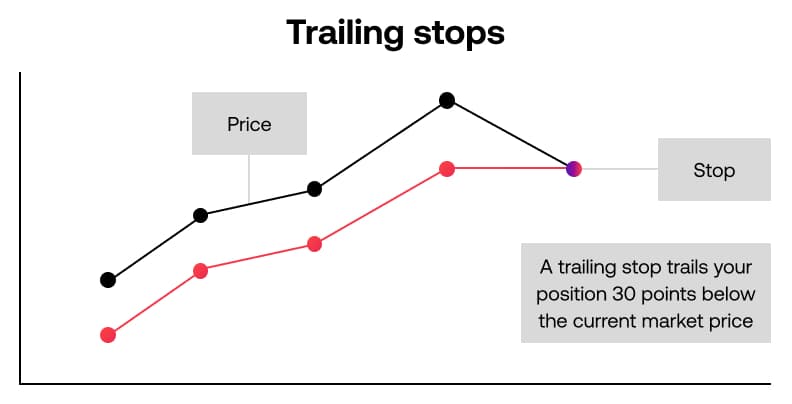

What is a trailing stop-loss order?

A trailing stop is created by setting up a stop order that ‘trails’ your position by a specific number of points. This is useful for ensuring that you lock in profits if the market moves in your favour, but keep a stop loss in place if the market moves against you.

If your trade moves in the direction you predicted, the trailing stop moves with the market, in the same direction as your potential profit. It remains the set amount of points away from the market price that you chose and will only be executed when the market moves against you by that amount.

As with standard stop loss orders, trailing stops may not be triggered at the specified price during volatility.

Trailing stop-loss order example

A trailing stop has been set up to trail the market price 30 points below the market order. So, if the market increased by 10 points, the trailing stop would move up by 10 points to maintain its position 30 points away from the current price. Should the market price fall by 30 points, the stop loss would be triggered, and the position closed.

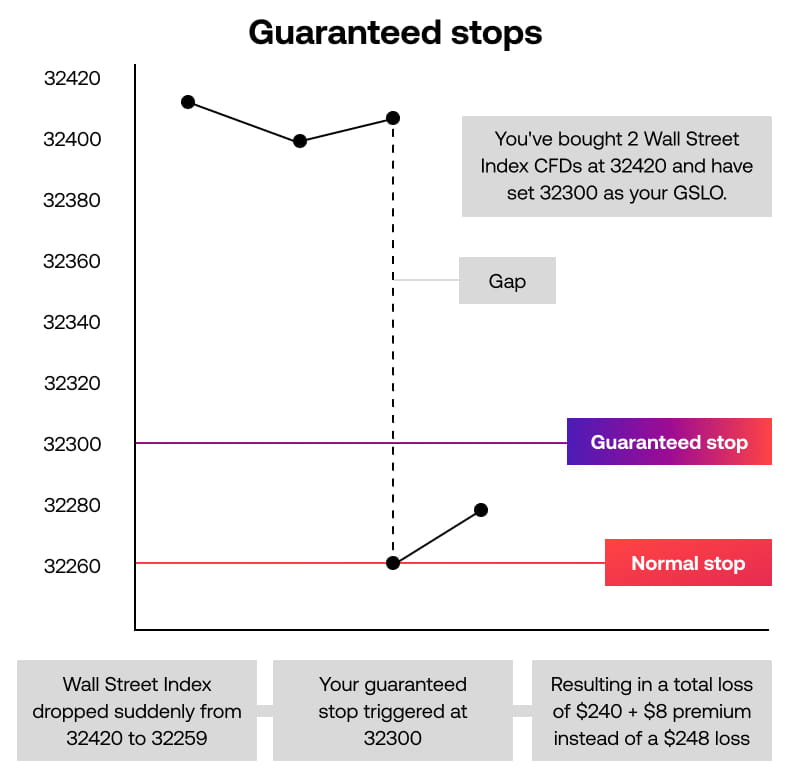

What is a guaranteed stop-loss order?

A guaranteed stop loss order (GSLO) is an instruction that works in the same way as a basic stop loss order, except it will be filled at the exact trigger value you set, regardless of underlying market volatility. This is useful if you want the added assurance that your position will be closed out at the precise price you specify.

Why? Because a standard stop doesn’t protect you against gapping or slippage.

- Market gapping occurs when prices literally ‘gap’ between one price and the next, without trading at the prices in between. If a market gaps over a standard stop, then it will trigger at the next best available price

- Slippage is when there’s a difference between the expected price of your trade and the level it’s actually filled at. This can happen in particularly volatile markets, when prices are moving quickly and your bid or ask price is no longer available – in this situation, your broker will accept the next best available price

A standard stop loss order doesn’t fully protect you from gapping or slippage, but GSLOs do.

What you should know about GSLOs:

- GSLOs are free to attach and amend, but you’ll pay a premium for your GSLO if your order is triggered

- You can use GSLOs on a wide range of markets during trading hours only

- You have to place GSLOs a minimum distance above and below the current quoted price

For specific GSLOs on a particular market, please refer to the 'Market Information' tab within the City Index trading platform.

Example of a guaranteed stop loss order

Let’s say you bought two Wall Street Index CFDs at 32,420 and placed a guaranteed stop at 32,300. If triggered this would equate to a $240 loss ((32,420 – 32,300) x 2).

The GSLO premium for Wall Street is 2x the quantity of CFDs or stake charged in the base currency of your account. In this case, the premium is calculated as 2 x 2 = $4, but it would only be charged if your GSLO was triggered.

Two days after you have placed your order, high market volatility leads to the price of the Wall Street Index suddenly dropping lower from 32,420 to 32,259.

With a GSLO in place, your trade has been closed out at the pre-determined level of 32,300 for a total loss of $244 ($240 loss on your position + $4 premium on GSLO when triggered), preventing further losses as a result of market gapping which occurred.

If you had placed a normal stop loss on your position, your losses would have been greater as you would only have been closed out at the next available price which was 32,259.

(32,420 – 32,259) x2 = $322 total loss

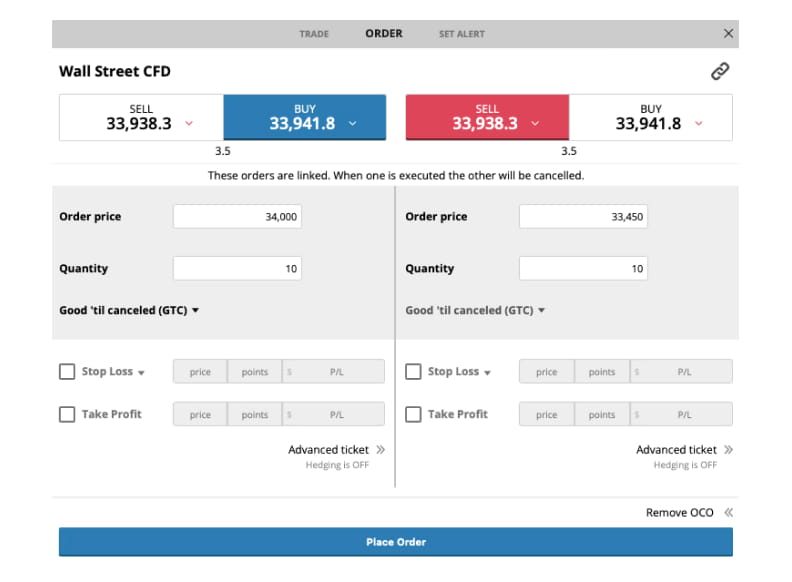

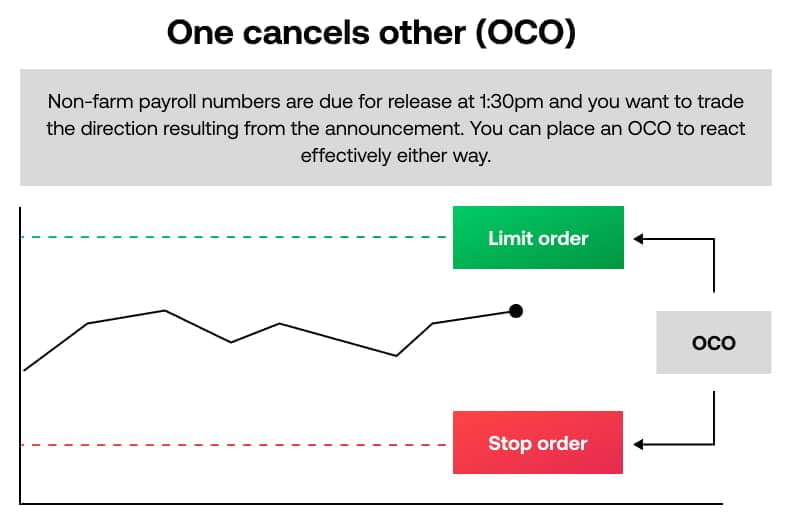

What is an OCO close order?

An OCO close order, meanwhile, is a type of exit order that involves setting both a stop and a limit at the same time. So if one executes, the other is cancelled.

We’ve already seen OCO entry orders, so let’s look at how they’re used to close trades.

Imagine non-farm payroll numbers are due for release at 1:30pm. You think the numbers will be positive and have a long position open. You want to protect your long position with a stop loss should the market not move in your favour but also want to ensure you could lock in your profits.

The market is currently at 5,500, so you place an OCO with a stop to sell at 5,450 and a limit to sell at 5,550. This way, whichever order is hit first will execute and the other order will be cancelled.

What is an 'if-done' order?

'If-done' orders, also known as contingent orders, are two-step orders where the second part is activated only if the criteria of the first has been met.

- Part 1 – An order to open a position (such as a limit entry)

- Part 2 – An order that is only activated once the first order has been executed (such as a stop loss or take profit)

If-dones protect your position and can cover multiple outcomes to ensure the best outcome for your trade.

In this example you can see an OCO order to open a sell or a buy order for Procter & Gamble shares, should the price move approximately 5 points either way.

Each OCO order has an if-done order attached that adds on a stop and a limit to both parts of the order. The term if-done is derived from the idea that if one of these orders is triggered (or done), the stop and limit will then be activated, and orders on the opposing side cancelled.