When will Microsoft release Q1 earnings?

Microsoft will release first quarter earnings after US markets close on Tuesday October 26.

Microsoft Q1 earnings preview: what to expect from the results

Microsoft is expected to gain further momentum in the first quarter, driven by continued growth in demand for cloud-based solutions and its array of software and digital tools.

Wall Street is expecting first quarter revenue to rise to $43.97 billion from $37.15 billion the year before. Microsoft will be coming up against tougher comparative periods this year following the boom in business during the pandemic, but this will be felt more from the second quarter onwards. Current forecasts suggest the topline will grow by over 18% compared to the 12% year-on-year growth delivered one year ago.

Analysts expect net income will rise to $15.7 billion from $13.9 billion last year, with diluted EPS forecast to grow to $2.07 from $1.82.

Margins will be under the radar this quarter and for the rest of this financial year. Its gross margin this quarter is expected to see a mild contraction of around 100 basis points thanks to the continued shift by businesses to lower-margin cloud-based products from more profitable on-premise packaged software.

Its operating margin is expected to remain broadly flat from last year, when it came in at 18%, on expectations that the pressure on gross margins will be countered by lower sales and marketing costs. However, it is likely to come under greater pressure later this year after Microsoft pushed $2.7 billion worth of depreciation charges related to its server and network equipment from the recently-ended financial year into future periods and as around $1.2 billion worth of cost savings during lockdown unwind as restrictions ease.

It said operating margins will contract as a result this year, but will continue to expand when these one-off charges are excluded. Still, Microsoft has said it is targeting double-digit growth in both revenue and operating income over the full year.

Let’s breakdown what to expect and dive deeper into Microsoft’s sprawling business.

Microsoft has said its Intelligent Cloud unit, its largest division by sales that is underpinned by Azure, is expected to report revenue of $16.40 billion to $16.65 billion in the first quarter, which would represent up to 28% growth from the $13.00 billion delivered last year, when the segment reported 20% year-on-year growth.

That is expected to have been driven by the continued shift among businesses to the cloud as industries strive to digitally transform themselves as they build back better from the pandemic. Recent figures out from Salesforce and Workday suggest spending on the cloud has continued to grow and Microsoft will benefit in a similar fashion. Last month, Salesforce reported 23% year-on-year growth in revenue in the three months to the end of July while Workday posted 18.7% growth.

Microsoft has said it expects revenue growth from Azure in the first quarter to remain broadly stable from the 45% growth at constant currency delivered in the last quarter. Meanwhile, its on-premise server unit is expected to deliver high single-digit growth thanks to growing demand for its hybrid and premium offerings, and because it will come up against weak comparatives from last year.

Margins in the commercial cloud business are expected to be weighed down by the deferral of depreciation charges into this year, adding to existing pressure from the shift to its lower-margin Azure business from on-premise spending, increased usage of its cloud services and from ongoing investments.

Microsoft has said its Productivity and Business Processes division is set to book quarterly revenue of $14.50 billion to $14.75 billion in the third quarter, up from $12.3 billion a year earlier. Demand for its Office 365 and Microsoft 365 software is expected to have remained strong among both consumers and businesses. On-premise spending is expected to have fallen about 20% in the quarter as more businesses shift to the cloud.

Meanwhile, LinkedIn is set to report revenue growth toward the upper end of 30% to 40% year-on-year, underpinned by the strong online advertising market and scramble for workers in a tight labour market. Dynamics, which homes its business applications such as Teams, is also expected to report revenue growth in toward the upper end of 20% to 30% thanks to continued momentum for its Power Apps.

In its last major division, More Personal Computing, revenue is guided to come in between $12.4 billion to $12.8 billion, up from $11.8 billion the year before. Slower growth here compared to the rest of the business is partly down to $300 million worth of revenue from Windows 11 being deferred into the second quarter. It said Search should deliver growth toward the upper end of 30% to 40% (excluding traffic acquisition costs) thanks to the buoyant advertising market, while its Gaming segment, the home of the Xbox, will deliver low double-digit topline growth as Microsoft continues to navigate the tough supply environment and strong comparatives from last year when demand for gaming exploded during lockdown. Xbox content and services is expected to report slower growth in low single-digits.

Microsoft shares have rallied over 67% since the start of the pandemic after being one of the biggest beneficiaries during lockdown as people and businesses shifted their lives online and accelerated the digital transformation of the global economy. The 42 brokers that cover the stock are bullish and have an average Buy rating on Microsoft shares, with an average target price of $337.04 implying there is over 8% potential upside from the current share price.

Where next for the Microsoft share price?

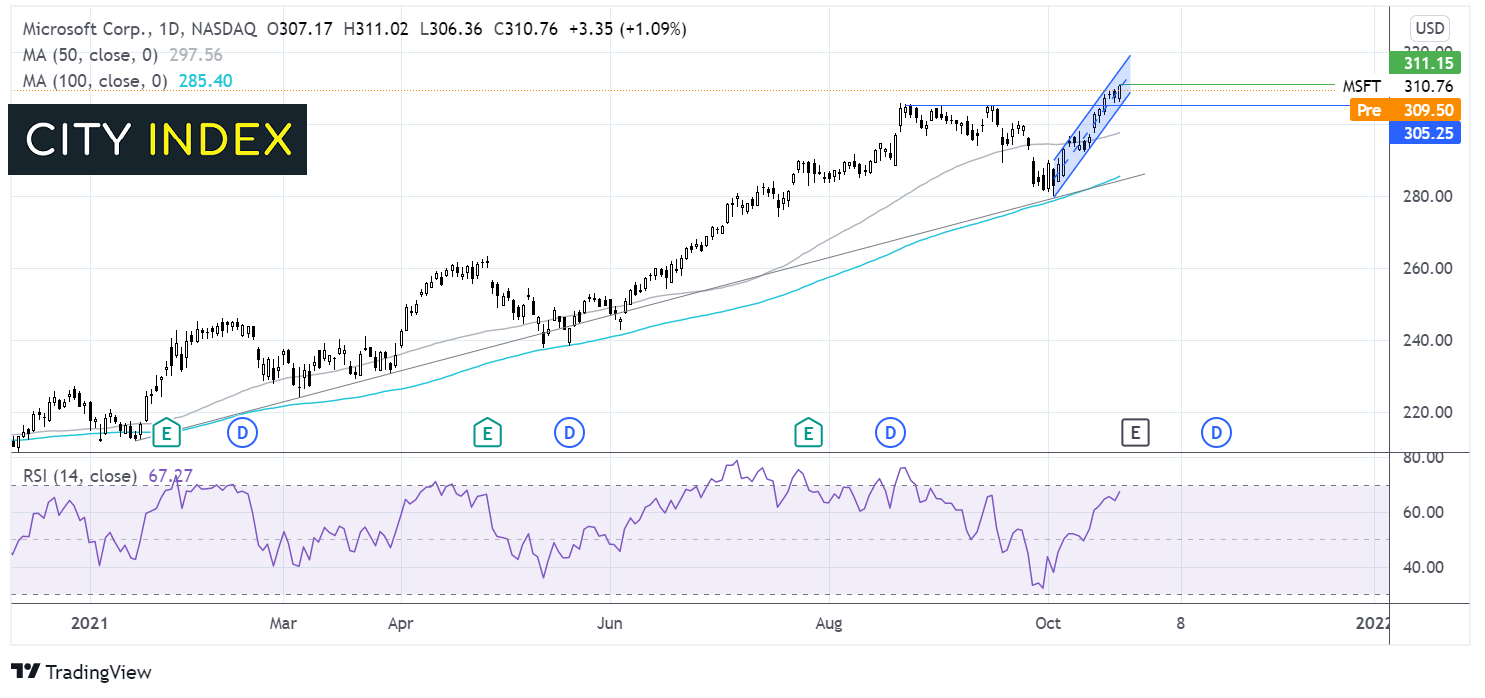

Microsoft share price is extending its rebound off the 100 sma and the trendline support dating back to the start of the year.

The rebound sees Microsoft trading within an ascending channel at all-time highs. The RSI supports further gains to new record levels whilst it remains out of overbought territory.

Support can be seen at $305. It would take a fall below the 50 sma at $297 to negate the recent uptrend and expose the 200 sma and trend line support at 285 which could prove a tough nut to crack.

How to trade Microsoft shares

You can trade Microsoft shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Microsoft’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade