- USD/JPY tumbled on Thursday on speculation the BOJ may move pre-emptively to lift interest rates before wage pressures have materialised

- Such a move would be economically risky and go against recent BOJ statements

- The stronger yen helped boost AUD/USD but weighed on the Nikkei 225

Preemptive normalisation screams of policy error

For a central bank seeking to foster a virtuous cycle of stronger economic growth, higher inflation and sustained wage pressure, lifting rates before other central banks cut would be counterproductive for a large, trade-exposed nation such as Japan.

It would almost certainly lead to a rapid strengthening in the Japanese yen, leading to a lower import prices that will intensify disinflationary forces while making Japanese exports less competitive, creating downside risks for an already wobbly Japanese economy. That’s why it’s hard to see the Bank of Japan (BOJ) deciding to go down this route – it screams mega-policy error.

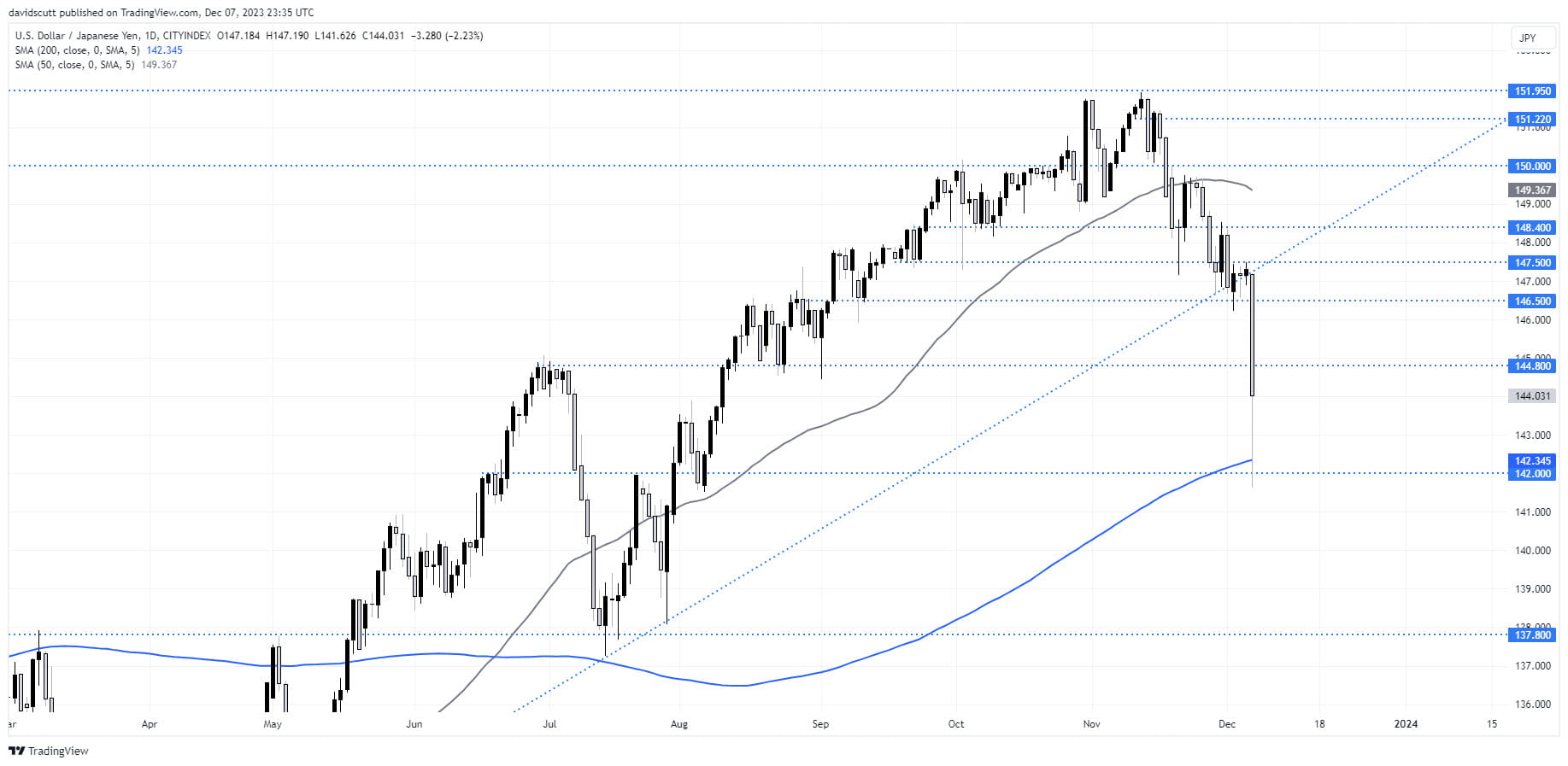

USD/JPY tumbles as BOJ speculation swirls

We got a small taste on Thursday with speculation swirling that the BOJ may attempt to normalise policy later this month, seeing the USD/JPY tumble multiple big figures. It’s not the first time we’ve seen speculation over a preemptive move from the BOJ generate a substantial reaction. Back in September, an interview with BOJ Governor Ueda in the Nikkei newspaper sparked a similar reaction, forcing him to walk back the comments quickly.

There’s nothing to suggest we won’t see something similar on this occasion given the macro backdrop is far darker than a few months ago, pointing to the risk of a least a partial retracement of Thursday’s move. The BOJ have also been insistent that it needs to have confidence the inflationary pulse rippling through the economy will lead to higher wage demands from workers. We’re nowhere near that point yet.

If we don’t see some form of pushback from Ueda or well informed “sources who spoke on the condition of anonymity” on Friday, it will only act to fan the flames of speculation pulsing through markets.

USD/JPY may see some retracement

Looking at USD/JPY, the pair bounced sharply from just below 142 to around 144 on the daily chart, attracting bids at horizontal support and 200-day moving average. On the topside, the first test for potential longs would be 144.80 with 146.50 the level after that. With 142 the first key level on the downside, there is little visible protection to place stops below, meaning traders should set protection at appropriate levels for what their end target is.

Nikkei 225 hit by stronger yen

Given the sensitivity of Japanese exporter earnings to fluctuations in the yen, it comes as no surprise Nikkei futures have fallen sharply on the back of the currency move. The 50-day moving average and horizontal support at 32250 managed to repel the downside thrust in overnight trade, but whether that will remain the case when physical trade resumes later Friday less certain. Depending on the price action, the level will provide two-way optionality for trades, allowing stops to be placed on the opposite side to the direction you expect the index move. With a retracement in the yen favoured, that would normally help to support the Nikki near-term.

On the topside, the first level of resistance is located at 32825. Below, the 200-day moving average and horizontal support around 31300 would provide a stern test for shorts, should the index get there.

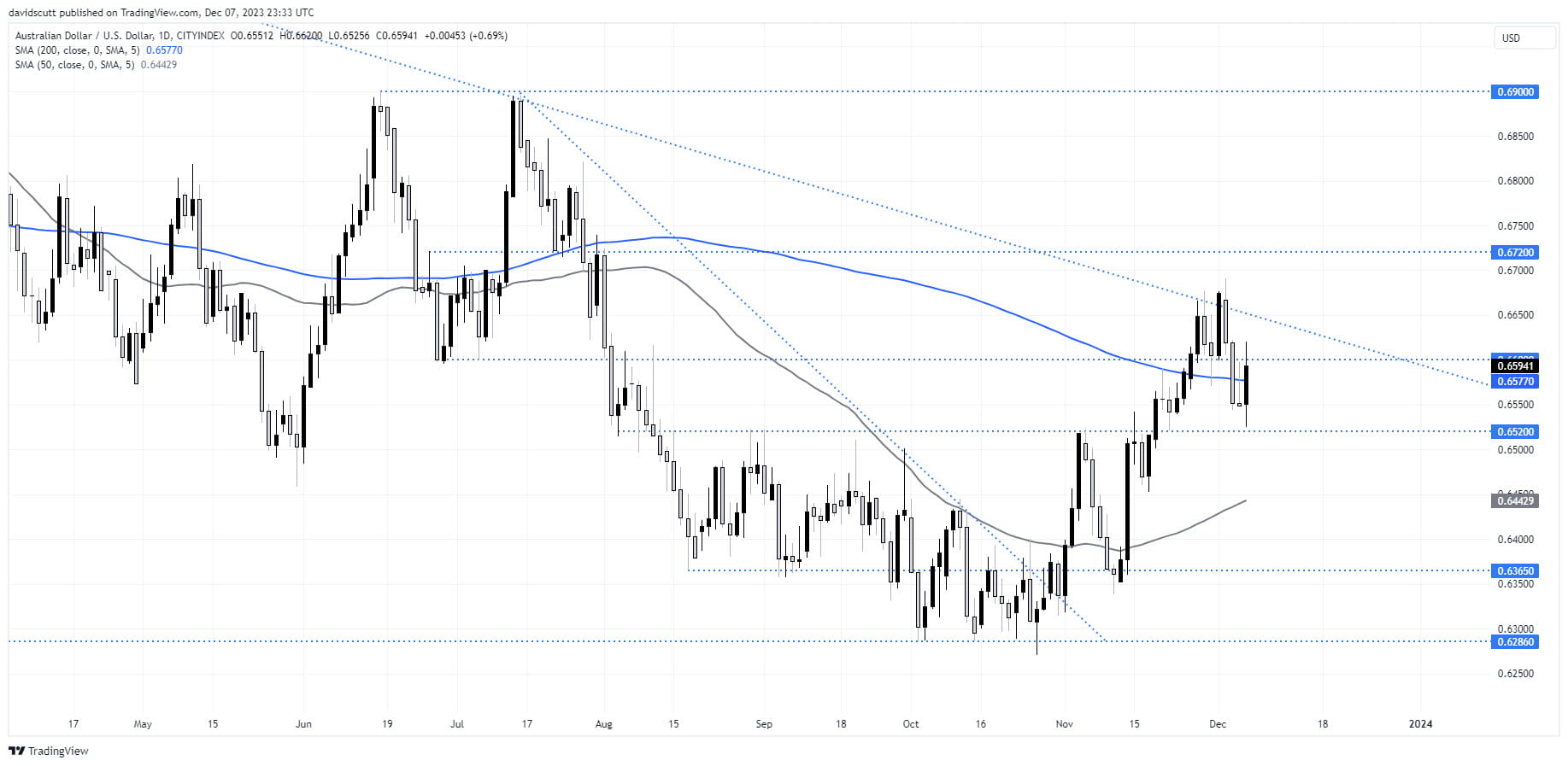

AUD/USD bounces on dollar weakness

The yen move has not just impacted Japanese markets but also other currencies, such as the Australian dollar. Having fallen back towards former resistance located at .6520 before the JPY move started, AUD/USD has now bounced back to resistance at .6600, bringing key downtrend resistance into range again. Up until Thursday’s move, the path of least resistance for AUD/USD had been lower in the near-term. With the Chinese yuan not strengthening by anywhere near the same degree as the yen, it gives the impression that it may be easier to sell rallies than buy dips around these levels.

For those considering shorts, the first logical target would be .6520. A stop above the overnight high of .6620 would provide protection. Later in the session, the big known risk event is US nonfarm payrolls for November. With a soft outcome widely favoured following similar trends in other labour market data, the outcome likely to generate the largest market reaction would be a surprisingly weak or strong number. Both would normally play into the hands of USD strength, the latter on increased risk aversion with the latter wider US rate differentials.

-- Written by David Scutt

Follow David on Twitter @scutty

Visit David's profile on our news and analysis page of our website

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade