US futures

Dow futures +0.10% at 31910

S&P futures +0.53% at 3916

Nasdaq futures +0.7% at 12269

In Europe

FTSE +0.66% at 7360

Dax +1.01% at 13190

Euro Stoxx +1.2% at 3610

Learn more about trading indices

Apple Amazon impress

US stocks are set to open higher and are set for weekly gains thanks to strong earnings from tech giants Amazon and Apple.

Indices are set for the second straight week of gains, boosted by broadly upbeat corporate earnings, even as the Fed hikes rates by 75 basis points and US GDP contracted for a second straight quarter putting the US in a technical recession.

Data from Europe also helped to boost sentiment after the Eurozone avoided negative growth in the second quarter, even as inflation rose.

Inflation in the US was also under the spotlight with core PCE data, the Fed’s preferred inflation gauge coming in higher than expected at 4.8% YoY, up from 4.7%. Still with two months until the next Fed meeting, equity markets took the reading in its stride.

Separately President Biden and China’s Xi reportedly spoke for two hours over the phone, suggesting that relations between the two leaders could be improving.

In corporate news:

Amazon trades 11% higher after posting its second consecutive quarterly loss but posted strong earnings. Sales rose 7% in the three months to June to $121 billion, which marked one of the slowest growth periods in history, although it was still better than forecast. Amazon reported a quarterly loss of $2 billion against a profit of $7.8 billion in the same period a year earlier. Amazon’s strong revenue guidance also reassured Wall Street.

Apple is also rising pre-market after beating on revenue and profits. Apple recorded revenue of $83 billion despite high inflation.

Where next for the S&P500?

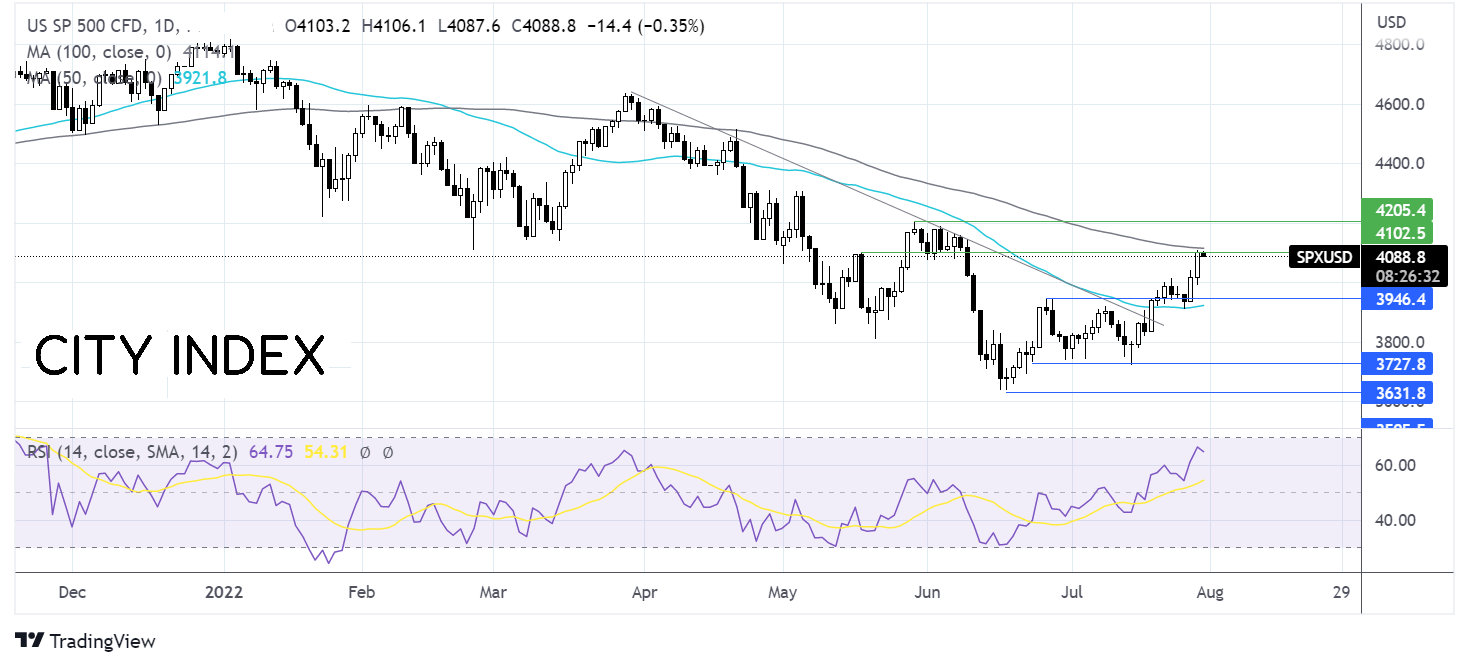

The S&P500 has run into resistance at the 100 sma at 4100, round number and May 19 high. The RSI is bullish supporting further upside. Buyers need to break over 4100 to bring 4200 into play the June high. On the flip side, failure to break over 4100, could see the price slip lower to support which can be seen at 3940, the June 27 high, and at 3910 the 50 sma, a break below here could open the door to 3735, the July low.

FX markets – USD falls, EUR rises

The USD continues to fall for a third straight session as investors continue reining in aggressive Fed bets after the Fed meeting this week and after US GDP data showed that the world’s largest economy has slipped into a technical recession.

EURUSD is rising after data revealed that inflation in the region jumped to a fresh record high of 8.9%, ahead of the 8.7% forecast. The hot inflation print will pile pressure on the ECB to hike rates aggressively again in September, after raising rates by 50 basis points this month. German economic growth slowed but managed to remain out of negative at 0% year on year.

GBP/USD is falling after data showed that UK consumer borrowing rose at the fastest pace in three years as the cost-of-living crisis affects more households. Furthermore, the fewest number of mortgages were approved since June 2020, suggesting that the housing market is cooling.

GBP/USD -0.27% at 1.2150

EUR/USD +0.23% at 1.0220

Oil rises across the week

Oil prices are rising and are set for a weekly gain after three straight weeks of losses as the market looks ahead to the OPEC decision next week, with the group expected to dash hopes of higher output.

A source from OPEC+ which includes Russia said that it will keep output unchanged for September. However, given the fact that many producers are already struggling to meet their output quota there almost doesn’t appear much point in upwardly revising. Any decision not to raise output would disappoint President Biden who travelled to Saudi Arabia earlier in the month.

Also helping oil prices higher is the weaker USD and stronger equities. The oil market has seen some choppiness this week as ionvestors weigh up tight supply against fears of falling demand.

WTI crude trades +2.27% at $98.01

Brent trades +2.16% at $103.94

Learn more about trading oil here.

Looking ahead

15:00 Michigan consumer confidence

18:00 Baker Hughes rig count