US futures

Dow futures +0.7% at 31078

S&P futures +0.8% at 3900

Nasdaq futures +0.67% at 12167

In Europe

FTSE +1% at 73283

Dax +1.3% at 12960

Euro Stoxx +1.3% at 3670

Learn more about trading indices

Fed speaks up next

US stocks are heading higher and are set to end the week higher for the first time in a month as the market mood improves. Investors are shrugging off Powell’s comments from yesterday that the Fed will continue fighting inflation until the job is done.

With oil prices set to fall again across the week and treasury yields also declining, we could be getting to the stage when peak inflation has been priced in.

CPI inflation data next week could help the markets determine whether cooling inflation is a new trend.

With no big data release expected, Fed official Waller is due to speak later and could provide further direction for what to expect from the September FOMC.

Corporate news:

DocuSign jumps 16% pre-market after posting better than expected Q2 results. The software firm also raised its revenue guidance for the year.

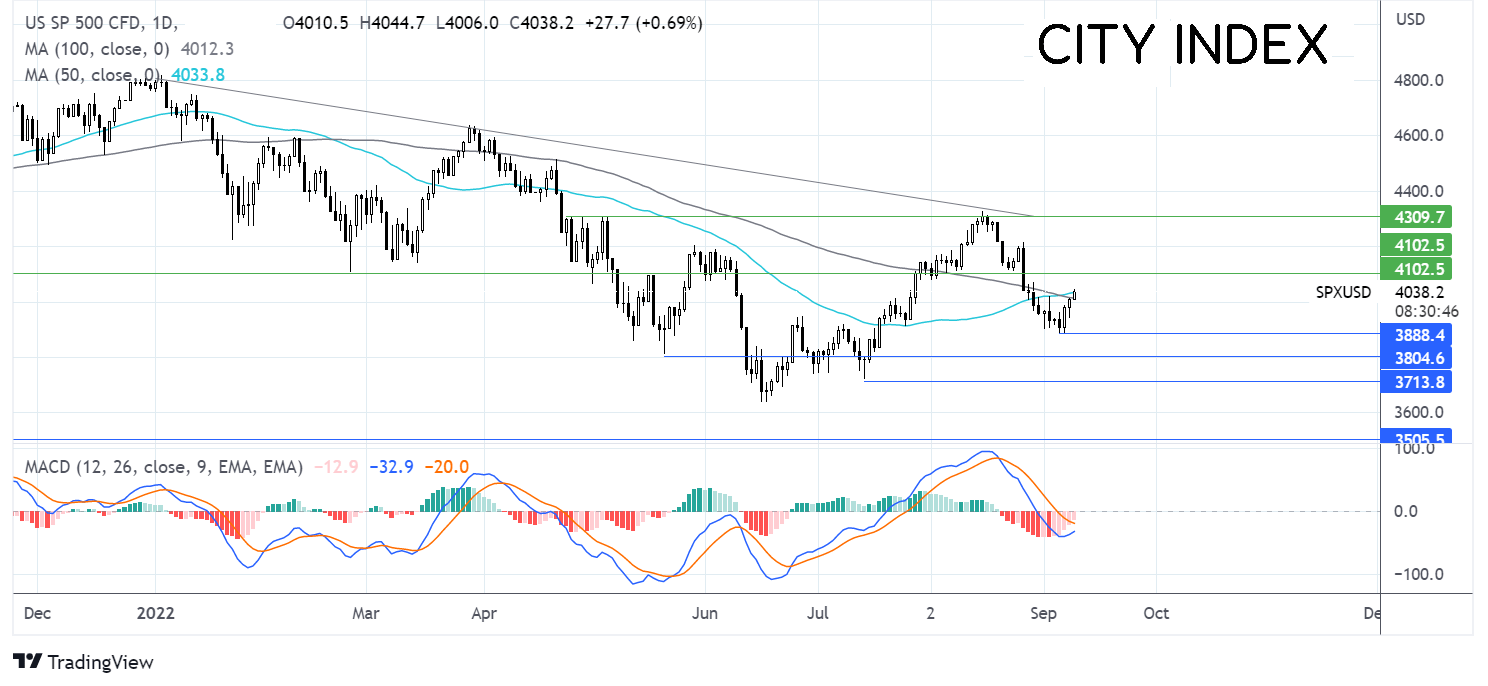

Where next for the S&P500?

The S&P500 is extending the rebound from 3880, rising above the 100 sma and testing resistance of the 50 sma. The receding bearish bias on the MACD keeps buyers hopeful of further upside. Buyers need to break above the 50 sma at 4035 to extend the recovery to 4000 round number and 4100 the February low. A rise above here negates the near-term downtrend. Sellers could look at the 50 sma crossing below the 100 sma as a sell signal, with a move below 3880 creating a lower low and brings 3720 the July 14 low into focus.

FX markets – USD falls, EUR rises

The USD is falling, extending losses from the previous session as investors reassess the hawkishness of other central banks such as the ECB alongside the Fed. Optimism that inflation could cool further as next week’s CPI comes into view adds to the drag on USD. USD/JPY falls 1% as the BoJ says that it is watching the exchange rate closely.

EUR/USD is rising as ECB policymakers continue to hammer home the hawkish stance after hiking interest rates by 75 basis points yesterday. Today. In a speech, Lagarde reaffirmed that taming inflation was the central bank’s top priority. She added that the ECB is prepared to provide liquidity to banks but not energy firms

GBP/USD is rising, capitalizing on the weaker USD as investors continue to digest Liz Truss’ ene5rgy relief package. Credit Suisse has upwardly revised the UK economic forecasts for 2023 on the back of the announcement and now expects GDP -0.2%, up from 2023. The BoE will postpone the MPC to September 22nd due to the period of national mourning.

GBP/USD +0.57% at 1.1570

EUR/USD +0.5% at 1.0042

Oil falls to 8-month lows.

Oil prices are rising today but are set for a second straight week of losses. Demand worries as central banks across the globe rate interest rates, slowing growth and hitting the demand outlook. The ongoing, strict zero-COVID policy in China is dragging on the demand outlook further.

Oil has lost around 18% since the start of August as demand worries dominated. However, supply concerns remain. As talks surrounding a price cap on Russian oil and gas gather momentum the risk of Russia withdrawing supply completely rises.

WTI crude trades +1.6% at $84.5

Brent trades +2.7% at $90.20

Learn more about trading oil here.

Looking ahead

17:00 Fed Waller speech

18:00 US Baker Hughes Rig count