US futures

Dow futures -0.7% at 34111

S&P futures -0.8% at 3993

Nasdaq futures -0.7% at 11680

In Europe

FTSE -0.45% at 7429

Dax -1% at 14390

Learn more about trading indices

China demonstrations as COVID lockdowns ramp up

US stocks are pointing to a weaker start on Monday, paring gains from last week, weighed down by weaker risk sentiment. Civil unrest on the streets of China as more COVID lockdowns are imposed has unnerved the markets. As cases continue to climb, demonstrations took place across the weekend as the population become increasingly frustrated by the zero-COVID restrictions.

The hit to sentiment comes after stocks pushed higher last week, despite the holiday-shortened week. Optimism that the Fed is close to slowing down the pace of rate hikes helped boost the mood last week.

This week is set to be a busy week with a speech by Federal Reserve Chair Jerome Powell, core PCE, the Fed’s preferred gauge for inflation and the US non-farm payroll.

Today is quiet in comparison with a speech from Fed official John Williams and James Bullard.

Corporate news:

Apple is falling 1.8% pre-market on reports that it could see a 6 million iPhone -pro shortfall in units due to the unrest at its Foxconn plant in China.

Chevron is falling as crude oil prices tumble and despite Chevron receiving a US license to expand production in Venezuela.

Pinduoduo jumped 14% after the Chinese online retailer beat Q3 forecasts as COVID lockdowns forced shoppers in China to go online.

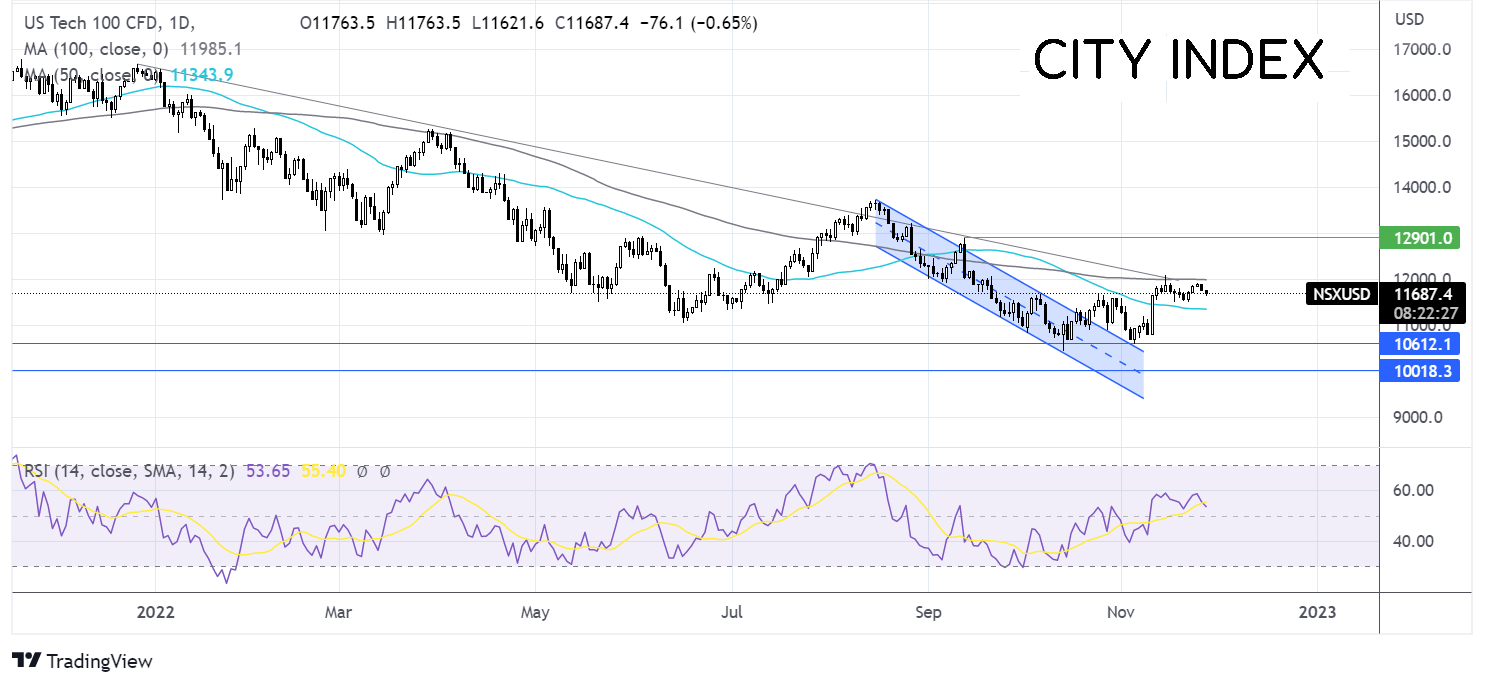

Where next for the Nasdaq?

The Nasdaq is consolidating, caught between the 100 sma capping gains and the 50 sma limiting losses. The RSI is approaching neutral. A breakout trade could be eyed here. Buyers will look for a rise over the 100 sma at 12030 to bring 12900 the September high into focus. Sellers could look for a move below 11380 the 50 sma to open the door to 10600 the November low.

FX markets – USD falls, EUR rises

The USD is falling despite the risk-off mood in the broader market. The USD continues to fall, extending losses from last week as investors bet that the Fed will slow the pace of rate hikes.

EURUSD has rebounded from earlier losses, regardless of the risk-off mood in the market. ECB President Christine Lagarde is due to speak later and could provide more clues on where interest rates could be heading. ECB officials appear split over whether the slow the pace of hikes in December.

GBP/USD is falling after a Confederation of British Industry reported a slump in sales in November as consumers reined in spending amid the deepening cost of living crisis. The CBI reported a sales decline of -19 from +18 in October. With economic headwinds showing no signs of easing the outlook remains bleak.

GBP/USD +0.6% at 1.1900

EUR/USD +0.39% at 1.0270

Oil falls to an 11-month low

Oil prices are falling sharply on Monday, extending losses from the previous week. Oil is falling amid concerns over the demand outlook in China as localized COVID lockdowns ramp up across the country. Without China loosening the zero-COVID, the demand outlook is likely to remain weak.

On the supply side, OPEC+ are due to meet on December 4th to discuss oil output. In October, the group agreed to reduce output by 2 million bpd through 2023.

The G7 and the EU have been discussing a price cap for Russian oil around $60- $75 pb which is due to come into force on 5th December. The EU is split on the level the price cap should be set at.

WTI crude trades -3.8% at $73.90

Brent trades at -3.4% at $81.12

Learn more about trading oil here.

Looking ahead

17:00 Fed Williams speech

17:00 Fed James Bullard speech