US futures

Dow futures +0.3% at 29222

S&P futures +0.15% at 3650

Nasdaq futures -0.17% at 11250

In Europe

FTSE -0.7% at 6950

Dax =0.67% at 12073

Learn more about trading indices

Bond yields fall supporting stocks

US stocks are edging cautiously higher after a mixed close yesterday and as the benchmark treasury yield falls.

Treasury yields across the board have dropped after the BoE intervened in the UK. The BoE’s decision to buy long-dated gilts over the next 2 weeks has boosted the market mood, helping equities pair earlier losses and grind higher.

However, recession fears will continue to loom, particularly after reports that Apple has dropped plans to boost the production of its new iPhone. This news could feed into fears that consumer demand is slowing and a recession will be increasingly hard to avoid as the Fed continues to hike rates.

Given Apple’s wide reach across industries, this sort of news often has a knock-on effect.

The economic calendar is relatively quiet, with pending home sales due later.

Federal Reserve Chair Jerome Powell is due to speak and could offer further insights as the where the Fed is heading with its rate hikes in the coming meetings.

Corporate news:

Apple falls pre-market after the tech giant has reportedly dropped plans to increase production of its new iPhones this year after demand falters.

Netflix rise after a broker upgrade from Atlantic Equities, who consider that the ad-supported subscriber tier can trigger a rally of 26% from current levels.

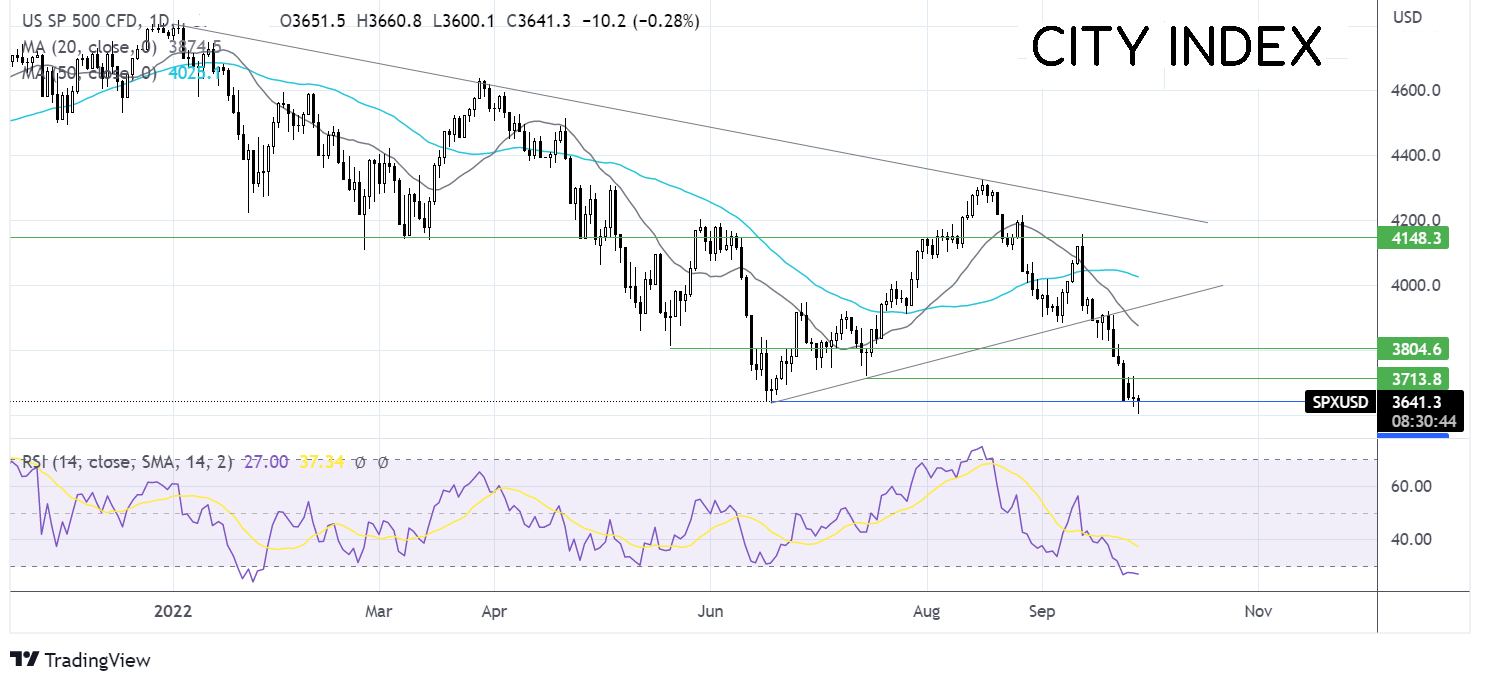

Where next for the S&P500?

After falling to a 2 year low of 3600, the S&P500 has stabilsed and is attempting to climb higher. The long lower wick suggests that there was little appetite at the lower price. The RSI is still in oversold territory so sellers should be cautious. Buyers are attempting to rise over 3640 the June low, with a move above here opening the door to 3720 the July 14 low. On the flip side, should sellers defend 3640, bears will look for a break below 3600 to extend the downside.

FX markets – USD rises, GBP tumbles

The USD rose to another 2-decade high of 114.89 but is now paring earlier gains. The risk averse climate in addition to hawkish comments from Fed speakers overnight means that the USD remains well supported. All eyes will be on Fed Chair Powell for further clues.

EUR/USD is falling amid rising fears over the energy crisis in the Europe after Russia deliberately sabotages a part of the Nord Stream pipeline. Separately German consumer confidence fell to a new record low amid rising concerns over energy security and high inflation.

GBPUSD is tumbling lower once again after the IMF criticized the Chancellor’s mini-budget and the BoE’s response, urging the UK Treasury to re-think its huge, unfunded tax cut measures. Investors continue losing confidence in the UK economic outlook. A policy U-turn is looking increasingly necessary to stabilise the pound. The BoE are expected to hike rates aggressively, which is causing lenders to withdraw mortgage deals from the market, fueling concerns of house prices collapsing. The BoE has said that it will step back into the bod market to restore stability.

Oil rebounds from 9-months.

Oil prices stabilise, pairing earlier losses as USD strength, rising stockpiles and demand concerns are offset by supply worries as production suffers disruption from Hurricane Ian.

In the Gulf of Mexico, around 190k barrels of output per day, which equates to around 11% of the Gulf’s total output, has been shut down while the hurricane passes. This is offering temporary support to oil prices.

Demand concerns remain a worry as recession fears rise and the USD keeps strengthening. A strong USD makes oil more expensive for buyers will other currencies.

API stock piles rose by a higher than 4.2 million barrels, while gasoline inventory fell by 1 million barrels.

EIA stock pile data is due later

API crude oil stockpiles are expected to rise by 300,000 barrels. The data is due later.

WTI crude trades +0.67% at $77.70

Brent trades +0.6% at $84.50

Learn more about trading oil here.

Looking ahead

15:00 US pending home sales

15:15 Fed Chair Powell speaks

15:30 EIA crude oil stock piles