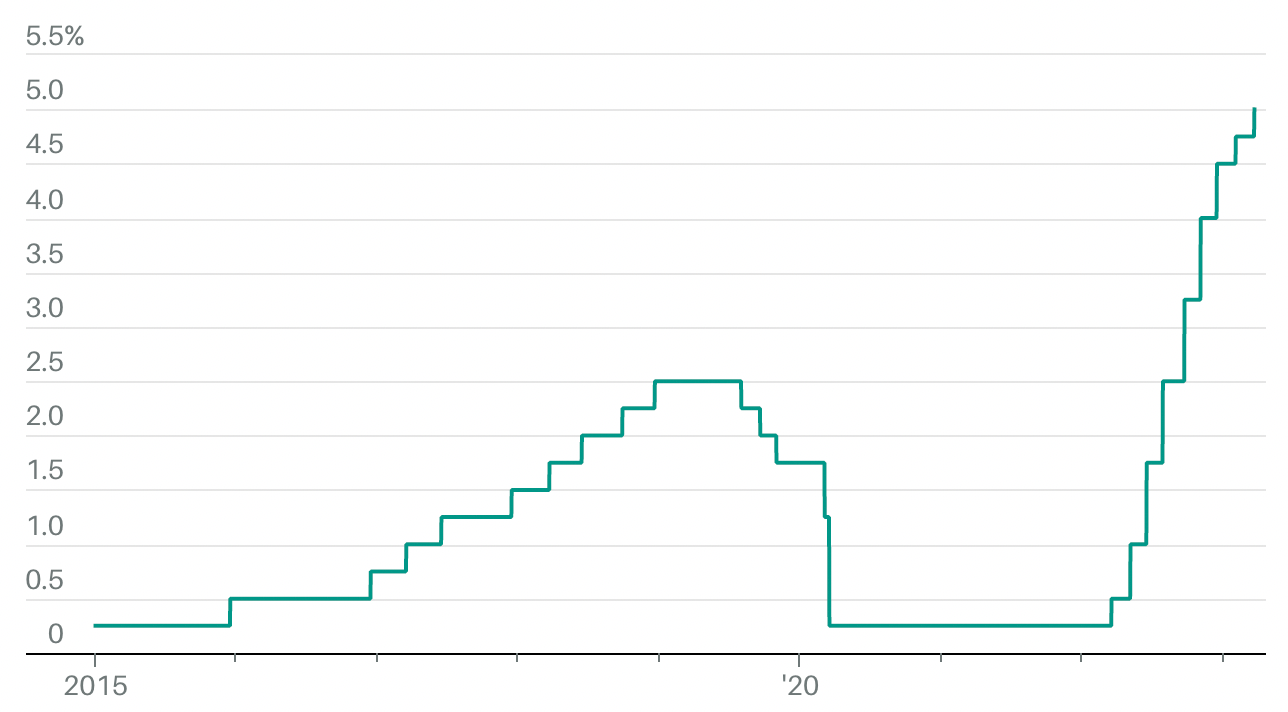

Markets bounced on news of an anticipated 25 basis point rate hike, but the Fed will no doubt be criticized by some market observers for its caution if inflation takes hold. The central bank suggested an end to rate hikes is near by removing a line from its statement about "ongoing increases."

Fed Funds Rate

Source: Federal Reserve, Upper Bound

The median forecast among members of the Federal Open Market Committee is for one more increase this year, perhaps the most bullish news out today. The Fed has certainly made its share of mistakes in the past – most notably clinging to the “transitory inflation” theory for too long, resulting in being too slow to act. Will announcing a peak in rates be a mistake?

We were in unprecedented territory, so it there wasn’t a clear roadmap for unwinding years of easy-money policy to the extent that we saw in the pandemic. One can rightfully debate whether its balance of interest rate hikes and balance sheet reductions was proper. Yet, the Fed now seems to grasp the job before it and it has thus far stayed the course, while trying to also speak with one clear voice in doing so.

The Fed was still pouring money into the economy with monetary stimulus 13 months ago as inflation was getting a foothold, and while its understands that it must stay the course to defeat inflation, but it also knows that it must respect the problem in the regional banking sector. There’s a lot of speculation about the scope of that problem, but the Fed is closest to knowing the extent of the problem. An overly aggressive hawkish stance at this point could create damaging contagion, while pulling back too much likely creates the need to become even more aggressively hawkish down the road.

Markets stabilize

- Equity markets rebounded by around 0.4% at the time of writing, with the tech-heavy NASDAQ up 0.6%

- The VIX, Wall Street’s fear index, fell back to 20.8, about average year-t-date

- The dollar index fell sharply on the rate hike news, back to 102.6

- Yields on 2- and 10-year Treasuries fell back to 4.05% and 3.53%, respectively

Commodities stronger, China a major buyer

- The broader commodity sector remains under a cloud of recession fears which have been around for the past 11 months

- Crude oil prices rallied to $71, ending a recent downtrend

- The grain and oilseed complex was mostly weaker, and soymeal market traded to its lowest level since December this morning as the market now sees Argentina's crop woes as "old" news

- Corn prices are holding the best, as fundamentals continue to tighten, although they're still not strong enough to sustain a rally in the midst of strong outside headwinds at this point

China and Russia strengthen ties

- China’s President Xi Jinping completed his three-day visit to Moscow with the signing of a series of bilateral agreements that will strengthen the tie between China and Russia

- Trade volumes are expected to significantly increase in the months ahead, with China now replacing Europe as the largest importer of energy from Russia

- Growth is expected in crude oil, liquified natural gas, and coal movement from Russia to China

- Russia is expected to increase its purchases of Chinese electronics, cars, and other durable goods

- A pipeline will be developed for grain movement to China

- Steps were outlined to increase use of the yuan as the currency of trade between the two and other countries, displacing the dollar

- China will increase investments in Russia under its Belt and Road Initiative, with a likely focus on Russia’s oil and gas industry, and its infrastructure

- Ironically, there was little if any public mention of the Ukraine war in the discussions

Analysis by Arlan Suderman, Chief Commodities Economist

Contact: Arlan.Suderman@StoneX.com