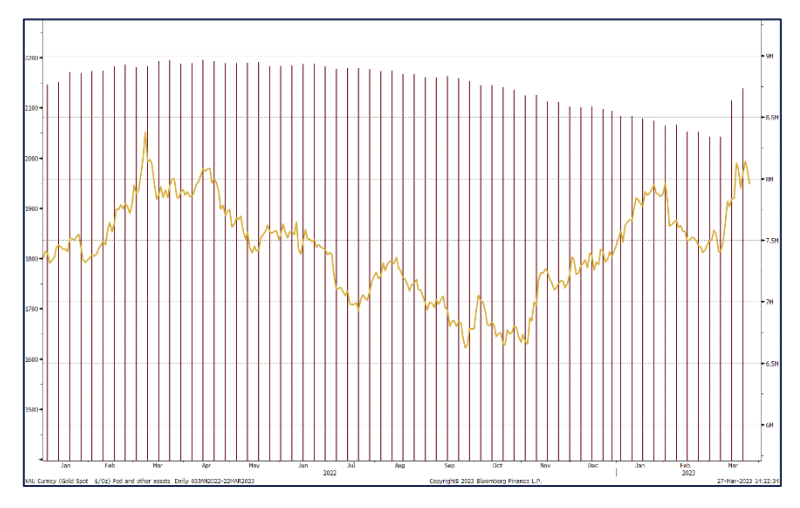

Gold has attempted to breach the $2,000 mark over the past two weeks as bond yields sank and banks failed. Was this a reminder of the Metal’s safe-haven status? While the Federal Reserve will continue to reduce the size of its balance sheet, selling bonds or at least not rolling them over at maturity, it added $394 billion, or 5% of its balance sheet holdings over the past three weeks as a lender of last resort to calm markets given banking failures.

For more detailed market commentary go to StoneX Market Intelligence, https://my.stonex.com/.

Spot Gold and the Fed’s Balance Sheet

Source: Bloomberg, StoneX.

Banks struggle …

Tensions persist in the banking sector: the cost of funding versus the free-floating interest rate has eased but is still historically high. We think that some banks are probably are either struggling, concerned about liquidity, or – most likely scenario – simply taking cover against any further market problems.

… Gold benefits

Market actions of the past couple of weeks have served to remind the financial markets of gold’s role as a hedge against risk and as a source of liquidity. The gold price reflects, among other things, the ebb and flow of risk. As tensions diminish, the gold price dips; as fears increase, it goes up. However, the gold price has a ceiling: gold it is usually liquidated in times of distress (for said liquidity reasons).

Money flowed into Gold

Money flows into gold during March reinforce this story. Major Exchange Traded Funds bought 35 tonnes of gold since the date of the Silicon Valley Bank collapse (an additional 1.2% of total) for a net dollar inflow of $2.27 billion. Prior to that the net outflow year-to-date had been 76 tonnes. These are small changes compared to world mine gold production of around 4,000 tonnes, but the swing in sentiment reflects the perception of gold as a risk hedge.

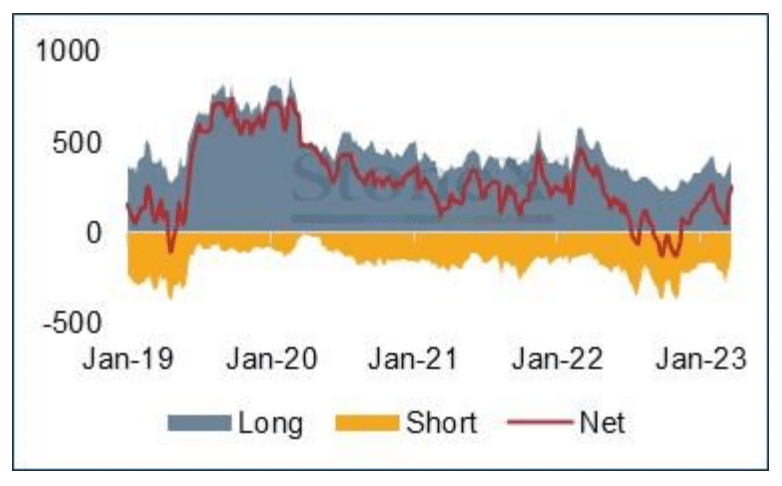

Gold buying Data from the Commodity Futures Trading Commission (CFTC) gold numbers from 7th – 21st March, show major swings. Managed funds gold long positions added 67 tonnes to 389 tonnes, while shorts more than halved from 277 tonnes to 136 tonnes. The net long position, longs less shorts, swung from a small net long of 45 tonnes to one of 253 tonnes, the highest since the end of January and compared to a twelve-month average of 113 tonnes.

Gold: managed positions on COMEX (tonnes)

Source: CTFC, StoneX.

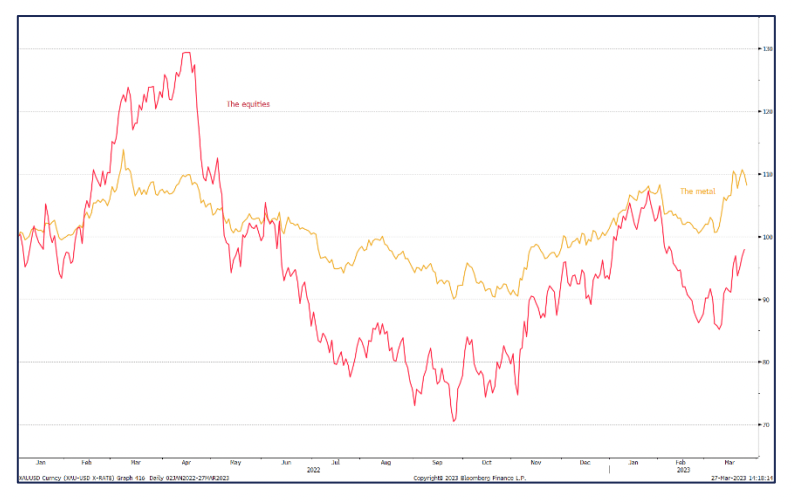

Gold mining equities benefitted …

The Philadelphia Gold and Silver index, an index of thirty precious metal mining companies which are traded on the Philadelphia Stock Exchange, is up 14% from the close of business on March 10th, while gold gained just 4% in the same period. Mining stocks are geared to the price of underlying metal assets.

Gold and the PHLX Gold and Silver mining index

Source: Bloomberg, StoneX

… As did Bullion Coin sales

There has also been a surge in purchases of US Gold Eagle coins during March, also attributable to banking fears. Spending on Gold Eagles is almost three times that in February and over twice the monthly average in 2022.

Taken from analysis by Rhona O’Connell, Head of Commodity Market Analysis for EMEA & Asia, StoneX Financial Ltd.

Contact: Rhona.Oconnell@stonex.com.

For more detailed market commentary go to StoneX Market Intelligence, https://my.stonex.com/.