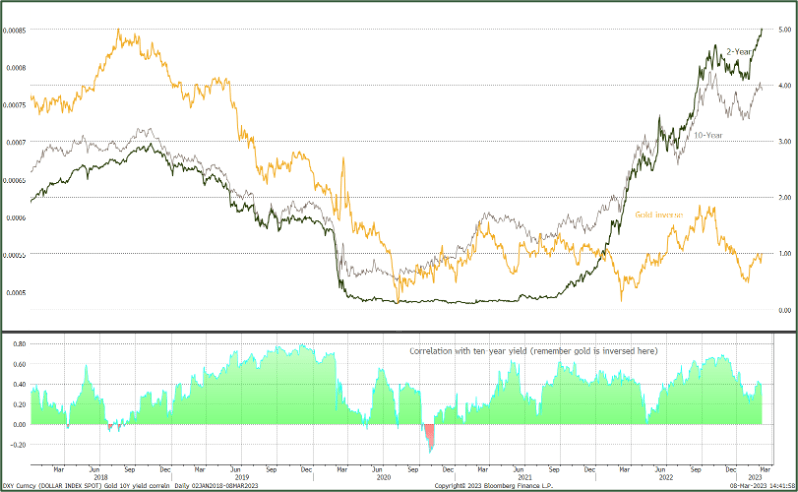

Interest rate fears hit the gold price, with Fed Chairman Powell ramping up rate hike expectations. It’s commonly believed that gold prices have an inverse relationship with interest rates, as the chart below highlights.

On the other hand, continuing geopolitical tensions with respect to Russia and China are supportive of the gold price, a haven in uncertain times.

The gold price has faltered after recouping losses that were posted in February – the gold price fell back under $1,820 an ounce after briefly touching $1,850, but still 9% off last year’s $1,998 high.

Testimony by Federal Reserve Chairman Jerome Powell drove interest rate expectations back to the “higher for longer” phrase that he had used in 2022, with federal funds futures expectations now peaking at 5.75% to 6.00% and staying high into next year.

Powell indicated that it may be necessary to ratchet the pace and scale of rate hikes as economic data has generally come in stronger than expected since the latest meeting of the Federal Open Meeting Committee. The Fed is prepared to increase the pace of rate hikes "if the totality of the data were to indicate that faster tightening is warranted”.

Policymakers will watch Friday's jobs report, and updated inflation data ahead of that next Fed meeting. Fed fund futures are pricing in a 25- to 50-basis point rate hike at the next meeting. The Fed's next policy meeting is scheduled for March 21-22.

Rate hike expectations have become gloomier around the world. In Europe, Olli Rehn, a member of the Governing Council of the European Central Bank, said recently that the Bank is expecting to implement “a fairly significant interest-rate increase” in order not only to slow inflation but also to anchor inflationary expectations.

The Bank for International Settlements argued its March Quarterly Review that central banks around the world need to beat inflation, also pointing up the increased risk of stagflation because of higher commodity prices and an appreciating dollar.

We believe gold will continue to be driven by interest rate expectations.

Gold (inversed) vs the two- and ten-year yield, five-year view *

Source: Bloomberg, StoneX

* There is a positive correlation between ten-year US bond yields and the inverse gold price.

Taken from analysis by Rhona O’Connell, Head of Commodity Market Analysis for EMEA & Asia, StoneX Financial Ltd.

Contact: Rhona.Oconnell@stonex.com