Today’s 4% rebound in the oil price, reversing some part of a twenty-point fall, was the main talking point on Wall Street. As discussed below, falling oil prices have led to declining bond yields. Fears of oil over-supply are diminishing as the outlook for the world economy improves, leading to the oil price rebound. Equity markets were quiet, with the cyclical Russell 2000 again leading. The dollar was generally weaker.

TODAY’S MAJOR NEWS

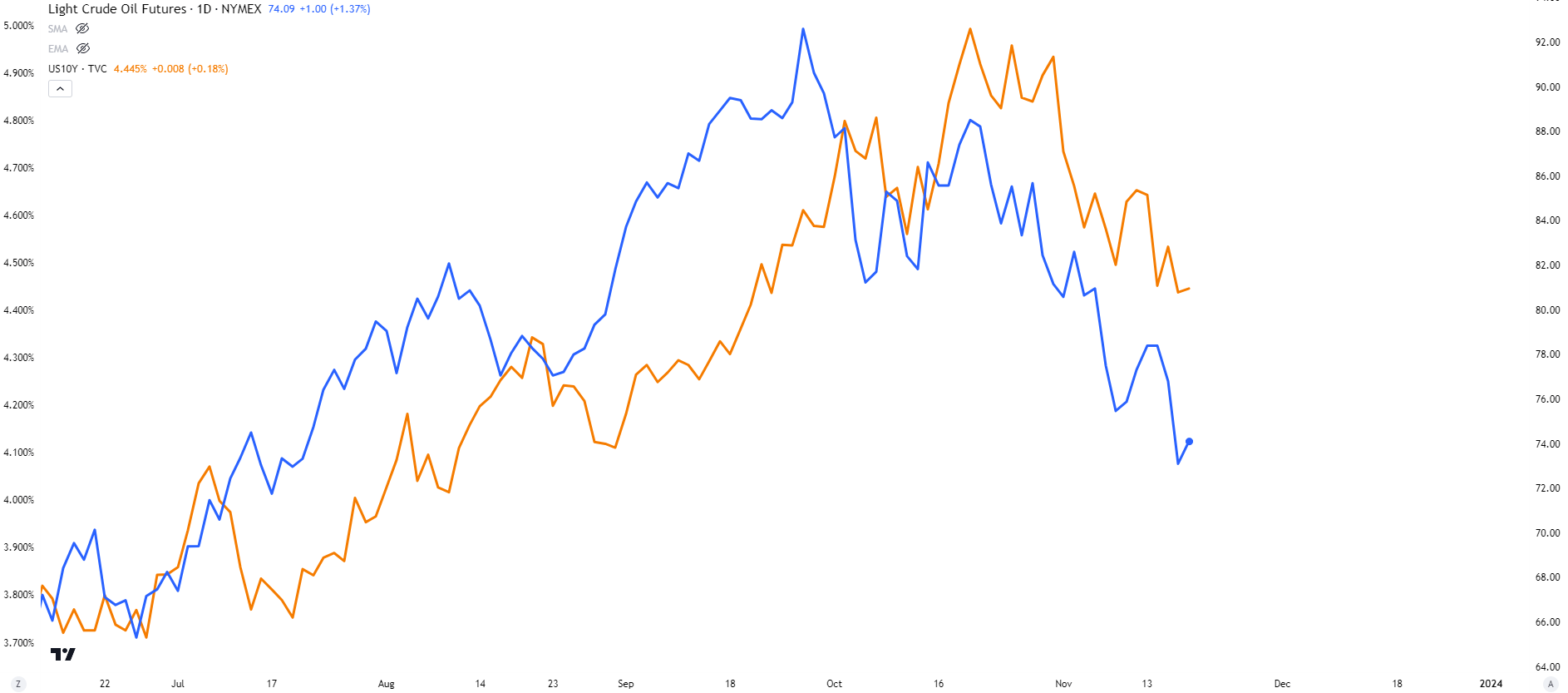

Are oil prices driving bond yields?

An interesting relationship with broader market implications is between the oil price and 10-year bond yields. While not likely to be causal, since commodity prices have a marginal impact on inflation and the interest rate outlook, the sharp price sell-off proceeded to the peak in bond yields by several weeks. Falling oil prices are more likely to be taken as an indicator of weaker global economic growth prospects and, as such, a contributor to the interest rate outlook. If the oil price rebounds, it might signal resumed economic growth and represent a negative factor for interest rate reductions.

WTI Crude Oil price veris US 10-year bond yield

Source: StoneX, TradingView.

Oil prices fell on oversupply fears, sell-off overdone?

Oil prices have fallen by 20% from the late September peak of $93.7 per barrel to a recent low of $73. Restricted supply from Saudi Arabia and Russia pushed oil to its high point. Still, the sell-off was driven by weaker demand fundamentals from China, the US, and Europe and increasing production from Venezuela and the US domestic market. Traders believe that the recent sell-off has gone too far. Crude oil prices are nearly 4% higher today on bargain hunting following a collapse in the market on Thursday.

Oil traders seem to believe that oil is in plentiful supply compared to demand, and that has been advanced as an argument to explain falling prices. However, Harry Altham, StoneX oil analyst, believes the oil market is closer to balance. If so, OPEC+ production quotas for 2024 should remain unchanged at its early December meeting, being neither bearish nor bullish for oil prices.

Venezuela rejoined the global oil market after US sanctions were eased in October. National oil company PDVSA was recently in the market offering a million barrels of Corocoro oil for the first time in two years, and the country is reportedly negotiating with international oilfield services providers to ramp up production. Between 500,000 and 600,000 barrels per day (90% of the total output) had flowed to China before sanctions lifted, but US demand will now consume some of that oil.

Saudi Arabian refinery crude throughput also rose by 336,000 barrels per day in September, with 41% of that rise taken from crude inventories amid depressed production figures due to Saudi Arabia’s one million barrels per day voluntary production cut. To some extent, this offset the production cuts.

US oil production has been strong. Yesterday’s EIA report saw a 3.6 million barrels per day increase in onshore US commercial crude inventories, beating analyst expectations of a 1.8 million barrels per day rise and supported by strong US oil production figures, which held at 13.2 million barrels per day despite pressures on shale output.

US housing starts rise unexpectedly

The US continues to see a housing shortage, with demand popping whenever consumer confidence jumps. Housing starts, a good lead indicator for the broader real estate market, rose by an unexpected two percent in October.

- Housing starts rose to an annualized rate of 1.372 million units in October, beating analyst expectations of 1.350 million and up from 1.346 million in September

- Permits for new housing starts rose to an annualized rate of 1.487 million last month, beating analyst expectations of 1.463 million

Chinese house prices see the sharpest decline in nine years

Chinese property prices don’t seem the most apparent lead financial indicator, but they have broader significance as a gauge of consumer confidence in the world’s second-largest economy. According to data released this week, home prices in major Chinese cities saw their steepest decline in nearly nine years, dropping for the fourth month in October. The property sector makes up more than one-fifth of China’s gross domestic product, and taxes on property sales provide the needed revenues to finance local government services. Numerous stimulus programs and speeches by government leaders have thus far failed to win the consumer's confidence sufficiently to bring them back to the property market.

- Home prices in 70 surveyed cities fell 0.4% month-on-month in October, which is their worst performance since a 0.5% decline in February 2015

- Property sales by the country’s top 100 developers fell 28% year-on-year in October

TODAY’S MAJOR MARKETS

Russell 2000 rallies in quiet trading

- The Russell 2000 rose 1.3%, while the Nasdaq and S&P 500 were up 0.1%

- Foreign equity markets continued to catch up with yesterday’s US equity market rally, with the FTSE 100 up 1.3%, the Dax 0.8% and the Nikkei 225 up 0.5%

- The VIX, Wall Street’s fear index, fell modestly to 13.8 (the year’s low was 13.0)

Bonds yields edge up, dollar edges down

- 2- and 10-year yields reversed yesterday’s substantial gains, up to 4.90% and 4.43%, respectively

- The dollar index fell 0.4% to 103.9

- Versus the dollar, the Yen was up 0.7%, the Euro was up 0.3%, and Sterling was up 0.3%

Oil rebounds after recent sell-off

- Oil prices rebounded strongly on bargain hunting, up 4% to $75.8 per barrel

- Gold prices were unchanged at $1,985 per ounce, while Silver fell 0.3% to $23.9 per ounce

- The grain and oilseed sector was mainly lower today, with Kansas City wheat setting fresh 2-year lows

- Weak demand is the primary theme in the commodity sector, although soybean supply concerns are a key market concern relative to growing conditions in Center-West Brazil.

Analysis by Arlan Suderman, Chief Commodities Economist: Arlan.Suderman@StoneX.com

Market outlook by Paul Walton, Financial Writer: Paul.Walton@StoneX.com