With its major trading partner struggling, domestic economy soft and with government officials threatening to intervene to support the yen on an almost daily basis, Japan’s Nikkei 225 appears susceptible to downside having surged to fresh multi-decade highs earlier this year.

Nikkei 225 fundamentals starting to turn

From a fundamental perspective, we know China’s economy is struggling relative to periods of the past, creating stiffening headwinds for exporters given it’s Japan’s largest trading partner. In July alone, exports to China slumped 13.4%, the eighth consecutive monthly decline reported.

Domestically, Japan’s household sector is also weak, demonstrated by Friday’s Q2 GDP update which revealed private consumption, which accounts for more than half of the economy, slumped 0.6% between April and June, adding to even more pronounced weakness in household spending data for July. With real, inflation-adjusted wages falling for an 16th consecutive month, according to separate data released on Friday, there’s little optimism for a turnaround in spending anytime soon.

The rapidly weakening Japanese yen, which has been a positive for exporters as it makes their goods more competitive relative to offshore rivals, may also be nearing it’s end with Japanese policymakers becoming increasingly agitated by relentless decline against the US dollar. Japan’s Finance Minister Shunichi Suzuki was the latest to issue a warning on Friday, telling markets he wouldn't rule out any options to limit fluctuations in the yen, mirroring a similar warning from his deputy Masato Kanda on Wednesday.

Even though the USD/JPY move largely reflects fundamentals such as widening yield differentials between the two nations, the consistent threat of market intervention suggests any further upside is likely to be hard won from here.

That’s important on the outlook for Japanese export earnings. Combined with softness in the domestic economy, downside risks for Japanese equities are not difficult to see.

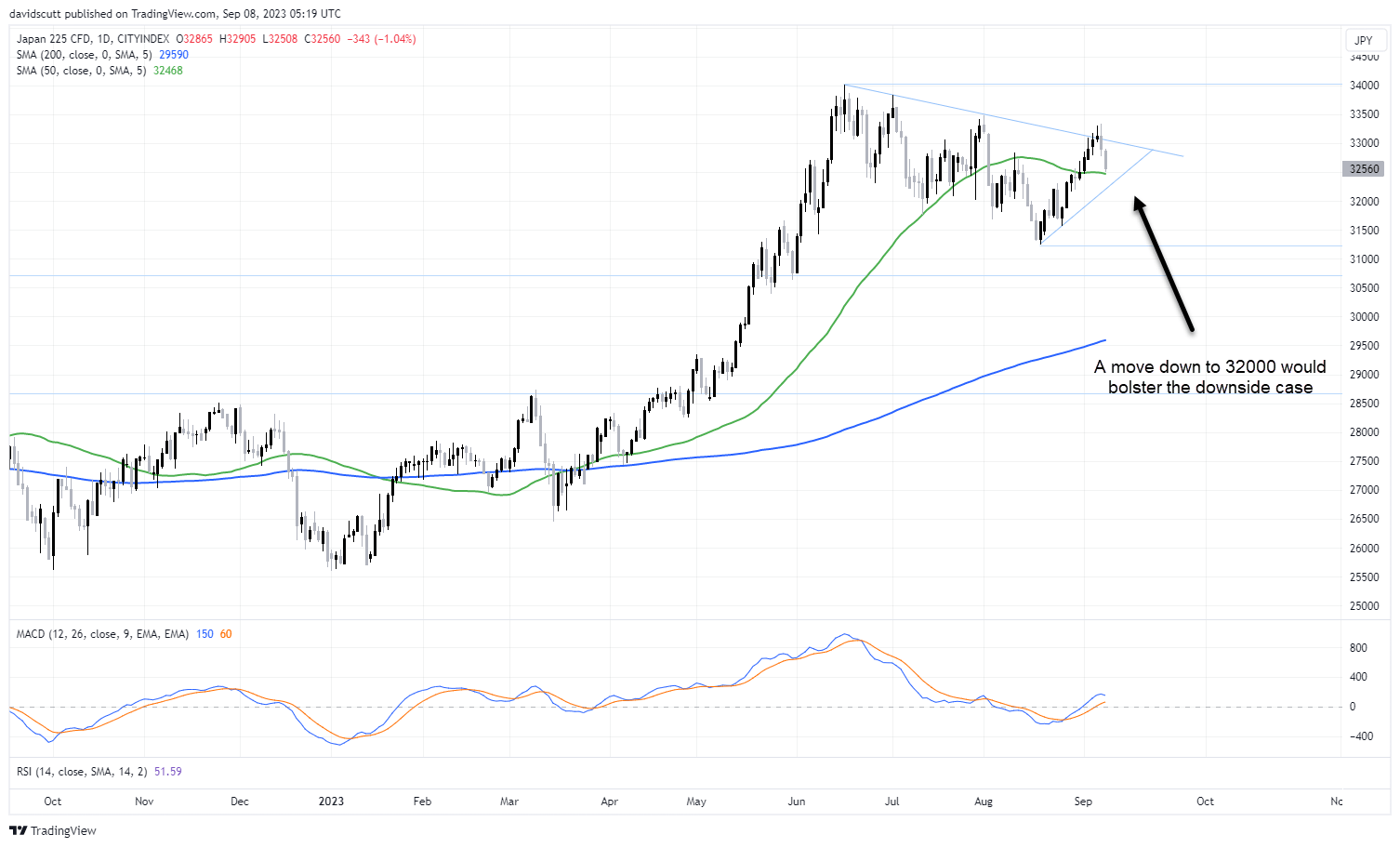

Nikkei 225 price action has not been convincing

Recent price action on the charts is also not convincing. A break of the downtrend that began in June failed earlier this week, completing the fourth lower-high in succession. It is currently resting on it’s 50-day moving average, an indicator the index has respected on numerous occasions over the past few years.

As things stand, there’s still no compelling signal on where the directional risks lie. But should the index fall to around 32,000, the case for further downside will become more convincing, potentially opening the door to a move to 31250, 30700 or lower.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade