S&P 500 at risk in ‘gathering storm’

We believe that the S&P 500 will experience a correction of at least 10% in the next six months for the following reasons, discussed in this article by our global strategist Vincent Deluard. In a hotter-for-longer economy, rates should stay high for longer, which would be bearish for stocks. The only justification for the fact that S&P 500 index trades for a near-record 20 times forward earnings is that rates will soon fall to zero again. If rate cuts do not come in the second half, we expect multiples to fall to 15 – bring on a more sizable correction.

Bearish indicators

- Market breadth is a risk – eight tech mega-caps have accounted for all of the market’s gain this year

- Earnings may have beaten expectations, but they were still down for a second consecutive quarter in Q1

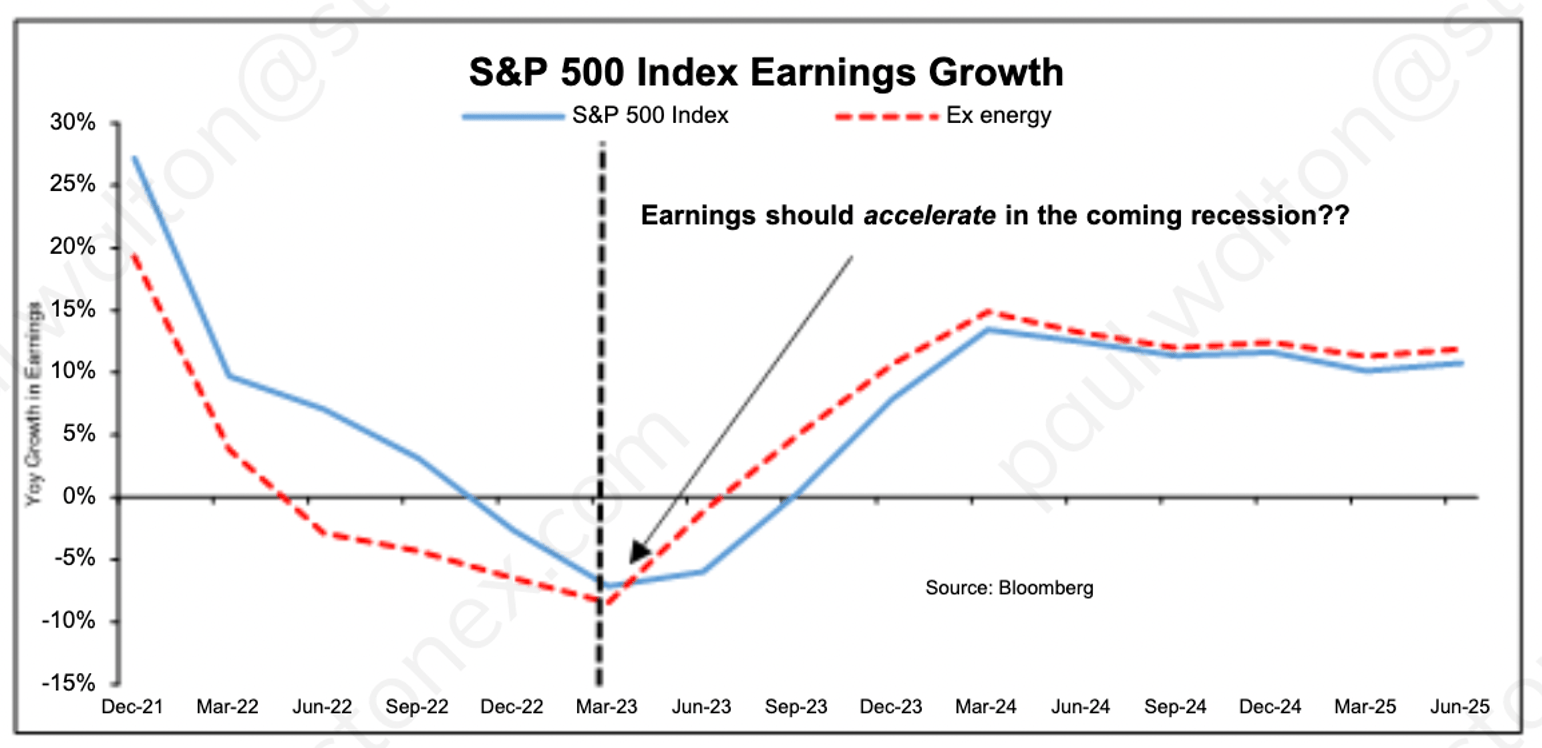

- The bond market expects a second-half recession, but equity analysts expect earnings growth top accelerate to 10% -- someone’s growth numbers don’t add up

- Investors are already bracing for market volatility by buying tech monopolies, European luxury goods makers, and Staples, Healthcare, Utilities and Telecom sectors (the SHUT’s)

- Other potential hedges include energy stocks, the Nikkei, Gold, Latin American bonds and the Nikkei index

Shrinking earnings

First quarter earnings may have beaten low expectations, but earnings have been shrinking for two straight quarters. Investors have reacted negatively to most earnings “beats”, but often because guidance was negative and earnings quality was low. There is a glaring contradiction between the bond market’s forecast for a Q2 recession and analysts’ expectations that EPS growth will rebound to 10% by the end of the year. Q1 earnings looked a lot less encouraging than headline numbers suggested. Granted, 68% of companies beat EPS expectations and the average surprise was an impressive 7%, ending a seven quarters streak of smaller beats. Four ominous trends emerged

- Earnings of Russell 3,000 index still shrank by 2.3%, their second consecutive quarterly decline.

- Top line surprises were rarer, and their magnitude kept declining.

- The market’s reaction to positive earnings surprise tended to be negative, which suggests that companies used accounting tricks to engineer earnings beats or issued negative guidance.

- Analysts expect earnings to accelerate next quarter and should pickup to 11% by the end of the year. These very same analysts believe that that the Fed will deliver almost 100 basis points of cuts because the economy will be in a recession!

How will earnings accelerate in a coming recession? Earnings bottomed before economic growth only once, in the shallow recession which accompanied the first Iraq war, but profits dipped back during the ensuing recovery. The historical odds are not with bullish EPS forecasts.

Forecast Earnings for the S&P 500 Index

Source: Bloomberg, StoneX.

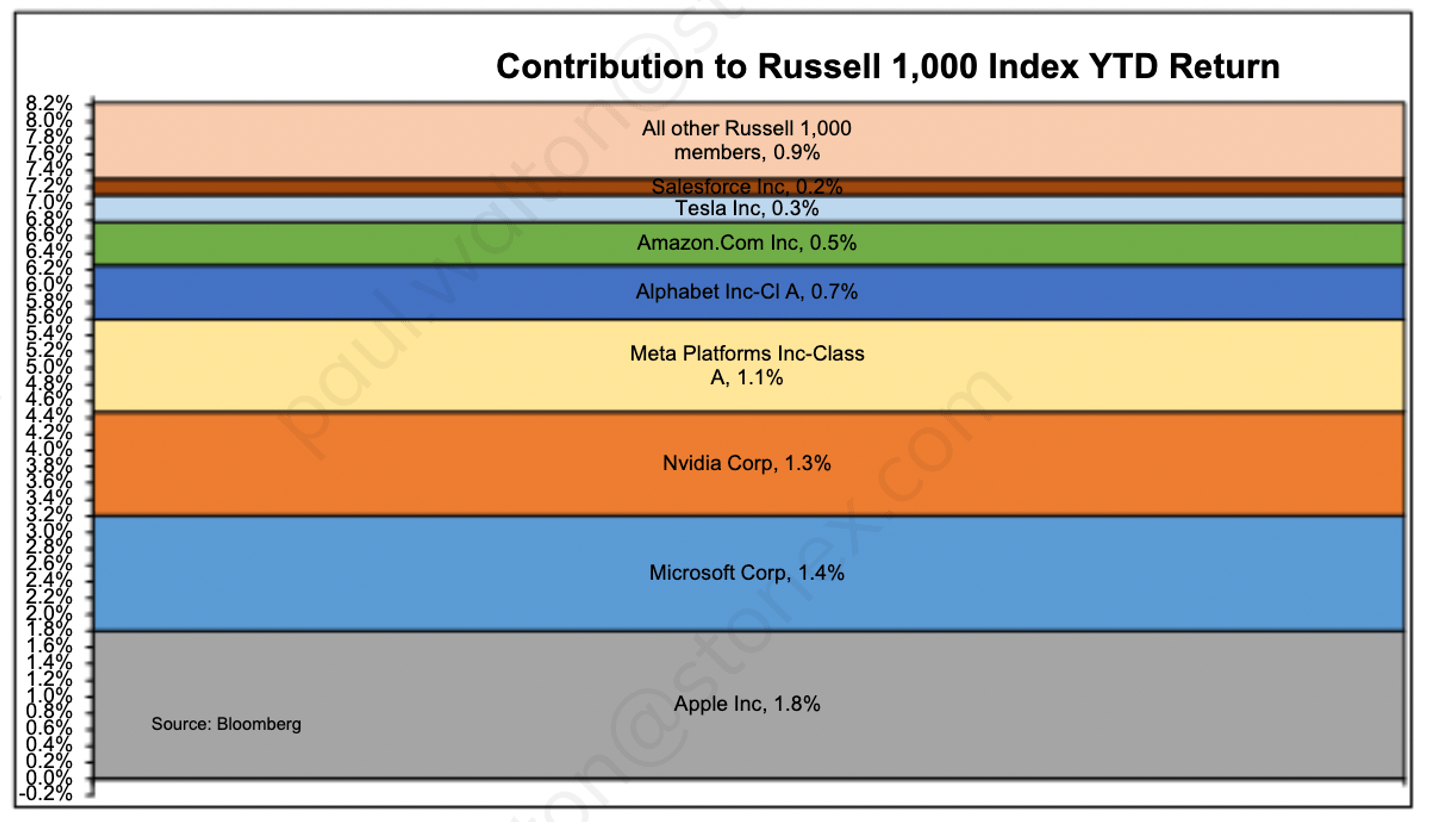

Market moves driven by mega-caps

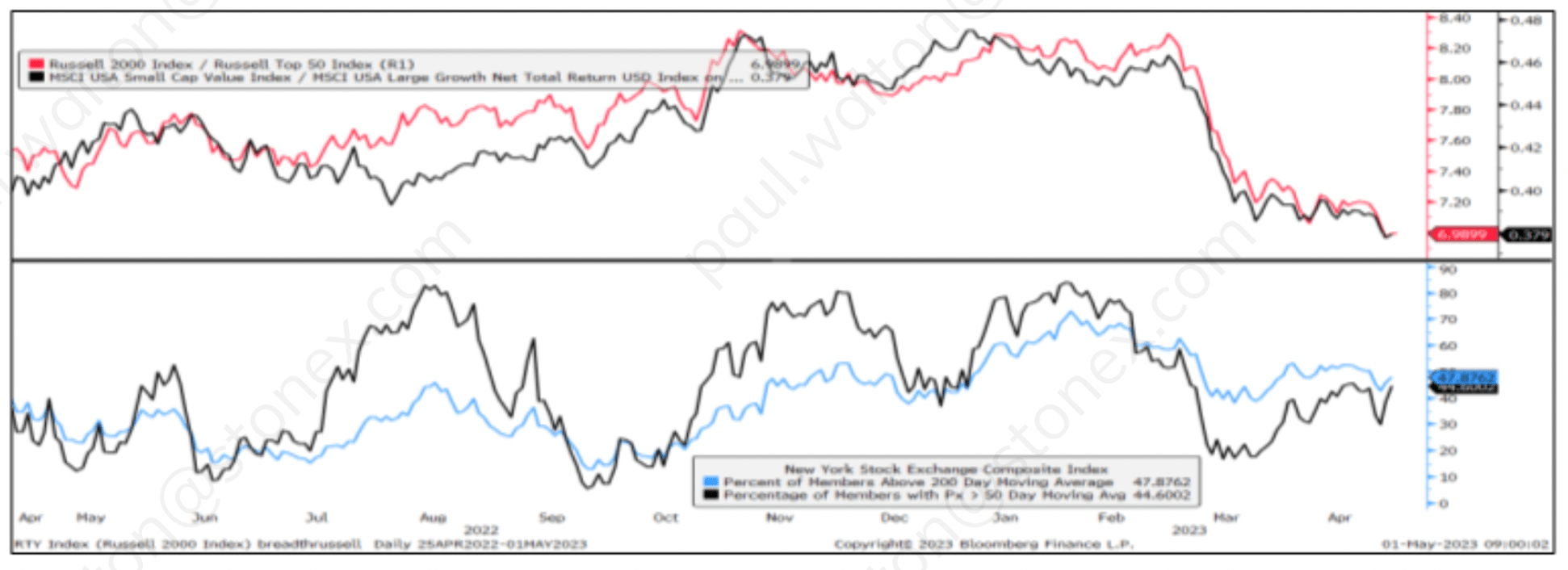

Breadth of price performance in the equity market is awful, with just eight stocks accounting for all the market’s gain this year. Market breadth is one of the most reliable market indicators. The divergence between soaring mega-caps and a stalling rest of the market has never been that extreme. Meta and Nvidia almost doubled so far this year. Apple, Microsoft, Amazon, and Tesla are up about 30%. And yet the Russell 2,000 index is flat for the year. Almost all of the gains of the Russell 1,000 index this year came from the magnificent eight platforms: Apple, Microsoft, Meta, Nvidia, Amazon, Alphabet, Tesla, and Salesforce. Small cap value stocks have underperformed large growth stocks, as the chart below illustrates. Less than half of NYSE stocks trade above their 200 and 50-day moving averages. This is not a good indicator for a sustained bull market

Eight mega-caps YTD Return versus Russell 1000 Index

Source: Bloomberg, StoneX.

Performance of Small Caps / Large caps and Small Value / Large Cap Growth Stocks

Note: Broad Russell 200 index versus larger cap Russell 50 index and MSCI US Small Cap Value versus Large Cap Growth stocks. Source: StoneX.

Defensive portfolios favored

Investors have reflexively chased recession plays in the consumer staples and utilities sectors even though their growth-adjusted relative valuations have rarely been so expensive; they have prepared for the expected recession by embracing the safety of tech monopolies’ margins and their fortress balance sheets, bidding up their valuations to their 2021 peaks. Since Europe missed the tech revolution, investors have inflated luxury consumer goods stock valuations: for example, LVMH’s market capitalization is now higher the value of the Italian stock market.

Energy stocks, the worst performing sector this year, are probably the best hedge against the greatest macro risk of the second half: a pickup in inflation due to a spike in oil prices. Japanese stocks could protect against a brutal repatriation of Japan’s massive foreign investments when the BoJ finally acknowledges the return of inflation. Gold and short-term Latin American bonds should do well in the decade of financial repression.

Investors have viewed big tech firms’ resilient margins, monopoly power, and strong cash balances as recession hedges. The capitalization of the big tech platforms is approaching $9 trillion, while that of the Russell 2,000 index is just $2.6 trillion. Microsoft and Apple trade for eleven and seven times their revenues, respectively, a 70% premium to their post-2010 average valuations. (We suspect that some of this premium reflects our collective angst over artificial intelligence.)

Europeans don’t have tech stocks to choose from, so Luxury Goods are a defensive stand-in. LVMH is now worth more than the entire Italian index and is approaching the capitalization of the MSCI Brazil Index. The stock trades for 5.6 times sales, a 76% premium to its post-2010 valuation.

Energy has been the worst-performing sector this year, but the sector has maintained its valuable risk-off characteristics this year, outperforming by 40 basis point on average on the 14 days during which the S&P 500 lost 1% or more.

Japanese equities should be one of the most interested assets to watch and, perhaps, to own, in 2023. The Yen against the US dollar is 30% lower than it was at the time of the Plaza accord 38 years ago.

Gold should benefit if the Fed caves to the bond market’s obsession with a dovish pivot despite persistent inflation, effectively signaling its embrace of financial repression

Western economies are entering a decade of structural inflation while most emerging markets are experiencing steady disinflation (China, Southeast Asia) or stable inflation (India, most of Latin America).

Fixed income investors will be better rewarded in local currency emerging markets debt, especially in Brazil and Mexico, where real yields are high and positive, and where a dovish pivot is much more likely than in the US.

Analysis by Vincent Deluard, Global Strategist

vincent.deluard@stonex.com