Asian Indices:

- Australia's ASX 200 index fell by -14.5 points (-0.2%) and currently trades at 7,300.50

- Japan's Nikkei 225 index has risen by 94.15 points (0.33%) and currently trades at 28,692.86

- Hong Kong's Hang Seng index has fallen by -163.27 points (-0.58%) and currently trades at 27,980.23

UK and Europe:

- UK's FTSE 100 futures are currently down -5 points (-0.07%), the cash market is currently estimated to open at 7,159.91

- Euro STOXX 50 futures are currently up 1.5 points (0.04%), the cash market is currently estimated to open at 4,088.87

- Germany's DAX futures are currently up 12 points (0.08%), the cash market is currently estimated to open at 15,673.97

US Futures:

- DJI futures are currently up 152.85 points (0.44%)

- S&P 500 futures are currently down -25.5 points (-0.17%)

- Nasdaq 100 futures are currently down -0.25 points (-0.01%)

Learn how to trade indices

Indices

European futures have opened a touch lower, with the FTSE currently down -8.5 points (-0.12%) and Dax futures are trading -5 points (-0.03%) lower. There’s a slight divergence on Wall Street futures, with DJI and Russell 2000 opening slightly higher and the S&P 500 and Nasdaq futures trading slightly lower, essentially going against Friday’s moves. With traders returning to their desks following Independence Day, we should hopefully see a pickup in volatility and trading volumes today (especially if we see a surprise in the ISM services report in the US session).

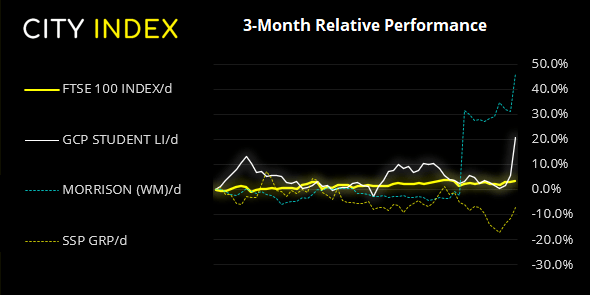

He FTSE 100 hasn’t really looked back since rebounding above 7,000 and shows the potential to trade higher now the UK are once again close to reopening. Our bias remains bullish above the 7100 area, as this houses the weekly pivot point and POC (most actively traded area) over Wednesday and Thursday. However, 7186 may cap as resistance initially as the weekly and monthly R1 pivot are overlapping here.

FTSE 350: Market Internals

FTSE 350: 4110.72 (0.58%) 05 July 2021

- 278 (79.20%) stocks advanced and 61 (17.38%) declined

- 36 stocks rose to a new 52-week high, 1 fell to new lows

- 86.32% of stocks closed above their 200-day average

- 61.82% of stocks closed above their 50-day average

- 23.65% of stocks closed above their 20-day average

Outperformers:

- + 14.30% - GCP Student Living PLC (DIGS.L)

- + 11.55% - Wm Morrison Supermarkets P L C (MRW.L)

- + 5.00% - SSP Group PLC (SSPG.L)

Underperformers:

- -2.83% - Spire Healthcare Group PLC (SPI.L)

- -1.93% - Fidelity China Special Situations PLC (FCSS.L)

- -1.61% - Chrysalis Investments Ltd (CHRY.L)

Forex: RBA keep policy unchanged

GBP/USD extended its gains to a three-day high overnight and is trading just shy of its 100-day eMA. The pound remains firmer on the back of Boris Johnson’s latest plans to remove lockdown restrictions on July 19th but a weaker dollar also helped support the pound.

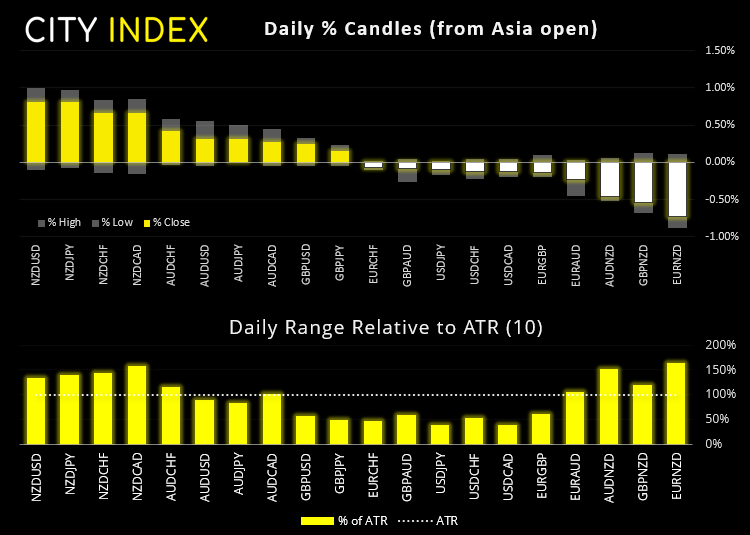

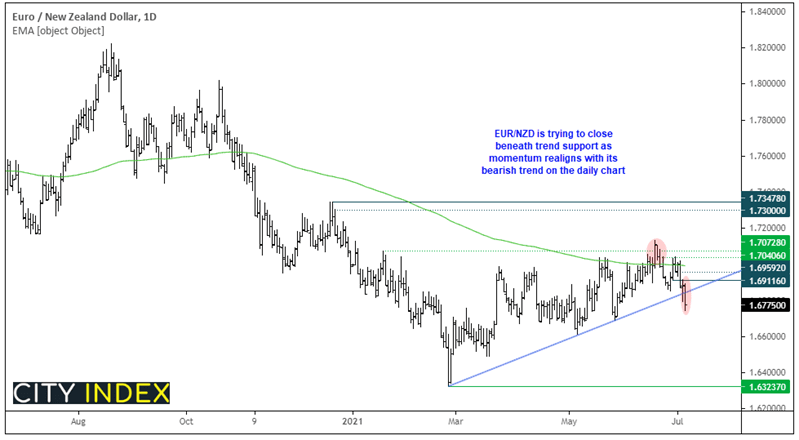

NZD/USD was the strongest major pair overnight and is less than 20 pips away from hitting our initial 0.7100 target and NZD/JPY rose to a 3-week high. AUD/NZD fell to a 24-day low ahead of the RBA meeting and EUR/NZD broke back beneath trend support for a second day in a row.

The New Zealand dollar was broadly higher after a strong business outlook report prompted two local banks to bring forward rate-hike expectations to November this year. The NZIER confidence index rose in Q2 to 7 form -13 in Q1 and is its first positive quarter since June 2017.

If we take a step back on EUR/NZD, we can see it remains in an established downtrend on the daily chart, price action from the end of Feb appears to be corrective, and momentum has turned lower since failing to hold above its 200-day eMA. Barring particularly strong data from Europe today, it appears likely that EUR/NZD could close beneath trend support to strongly suggest momentum had realigned with its bearish trend. German industrial production, output manufacturing output are released at 07:00 and the ZEW economic sentiment report and eurozone retail sales is scheduled for 10:00. If they are weak on aggregate, it could help EUR/NZD extended its downside due to a divergent theme materialising.

The RBA kept their rates at 0.1%, not that they were expected to change anyway. But it does plan on a third round of bond buying which will remain at $4 billion per week until at least November. There was certainly no hawkish surprise in today’s meeting, yet neither was it dovish relative to its usual standards of late. AUD/USD had risen to a five-day high on the back of a stronger NZD earlier in the session, yet has so far held onto gains since the meeting. However, RBA’s Governor Dr Philip Lower is set to speak at 07:00 and that may prove to be the more volatile event as the RBA has generally kept forward guidance for public speaking events.

Learn how to trade forex

Commodities:

Gold rose to 1800 overnight thanks to a weaker US dollar. Momentum leading into the level is relatively strong, although several technical levels await ahead between 1804 and 1812 including the 200-day eMA, monthly pivot and weekly R1. So we would take note of any bearish reversal patterns around such levels. Silver is in a similar situation to gold, and its respective resistance levels are between 26.73 and 71.04.

Copper futures rose to a near-three-week high, although we are waiting to see if it will now break above 4.4350 to suggest a resumption of its long-term bull trend or form a reversal pattern at or around that level. Also take note of trend resistance from the May high which could cap as resistance.

Oil prices continued to trade higher after OPEC+ members were unable to agree on the level of output. WTI rose over 2% and is on the cusp of testing its October 2018 peak, brent is up 0.95%.

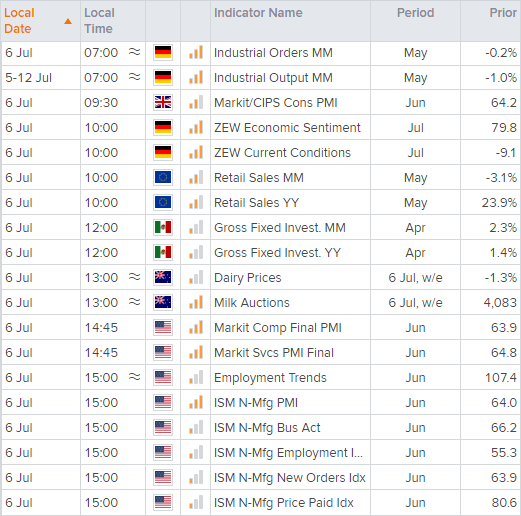

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.