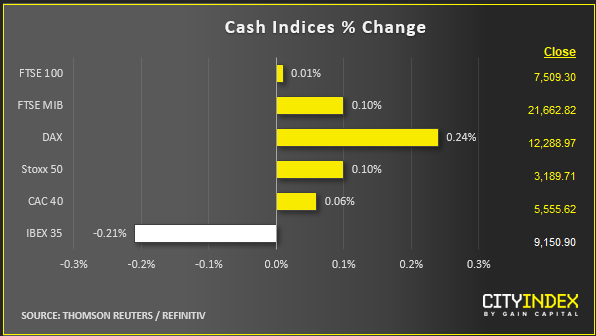

Stock market snapshot as of [22/7/2019 3:51 PM]

- A trickle of buying in Europe and U.S. stock gauges has turned into a stream for Nasdaq indices which are pulling clear of major markets on both sides of the Atlantic partly on the absence of fresh negative news. This has allowed the impact of brokerage upgrades on the semiconductor sector to lift peers and in turn underpin the market

- Stabilizing monetary policy expectations are also helping: In between reversals precipitated by decreasing chances of a 50 basis points cut and complete disappointment is the middle ground of a 25bp cut. The market implied odds that the central bank will ease by 0.25% could be as high as 75% according to some methodologies. Whilst the Fed has entered it’s ‘quiet period’ ahead of next week’s FOMC meeting, these expectations are still critical for the days ahead

- If Europe’s central bank is to also loosen policy, as economists now almost unanimously expect, the tenor and ‘velocity’ of Fed easing will help decide how much and how soon. The ECB will have the opportunity to signal confirmation of a 10-basis point reduction into record-low negative territory of -0.5%, when it meets on Thursday

- On the other hand, a remarkably busy slate of political, economic and geopolitical watch points plus ramped earnings release activity on top of fever-pitch rate speculation could rekindle volatility

- Other points to watch: Italy – a possible snap election may be called by Deputy PM Mateo Salvini; Spain – Podemos and the socialist government near a coalition ahead of a confidence vote scheduled for today; U.S.-China Trade – possible in-person talks after Treasury Secretary Mnuchin comments; Hong Kong protests – in case of escalation; Debt Ceiling – small Treasury pricing dislocations are appearing, as a low risk of default in September looms

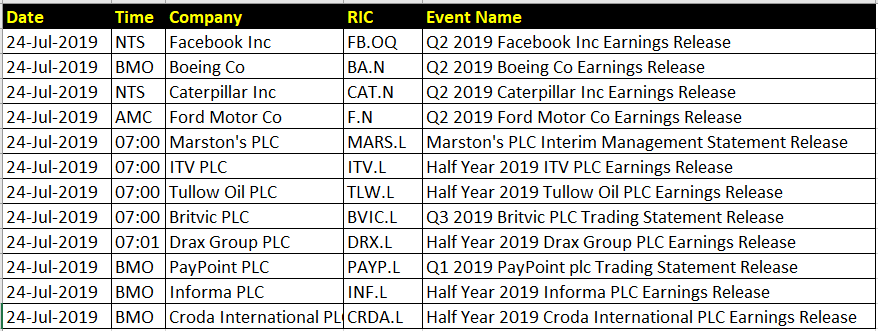

Corporate News

- Oil, and more specifically Iran is among that melee of focus points, as traders wait for the UK’s definitive response to ship seizures and the U.S. formulates a mode of operations to deal with increasingly frequent incursions on tankers in the Strait of Hormuz

- Defensively tinged consumer discretionary and health sector indices are among the largest STOXX industrial gauges to outperform so far

- Steel and commodity metals shares have kept Europe’s Materials sector index in leading position all session; a possible reference to clearer prospects about trade talks

- Halliburton and Applied Materials are S&P 500 top heavy-weight risers. HAL rises 7% and is on pace for its best one-day gain since late 2016 after higher than forecast underlying earnings, though the group still reported a huge drop to $75m vs. $511m in Q2 2018. Applied Materials is around 4% higher after Goldman Sachs said it upgraded its recommendation on the stock to Buy from Neutral

Upcoming corporate highlights

BMO: before market open AMC: after market close NTS: no time specified

Upcoming economic highlights

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM