Bullish factors

- November IPCA-15 may slightly accelerate versus October, bringing some points of concern regarding inflation dynamics for the upcoming months and potentially weakening the real.

Bearish factors

- The possibility of advancing important economic agendas for the government in the National Congress could reduce the perception of fiscal risks for Brazilian assets and strengthen the real.

- Data for the American economy can reinforce the perception that the Federal Reserve will not raise interest rates further and contribute to the global weakening of the USD.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

The week was marked by reduced liquidity due to holidays in Brazil and the United States. Accordingly, the Brazilian currency fluctuated within narrow margins in a week with few relevant data.

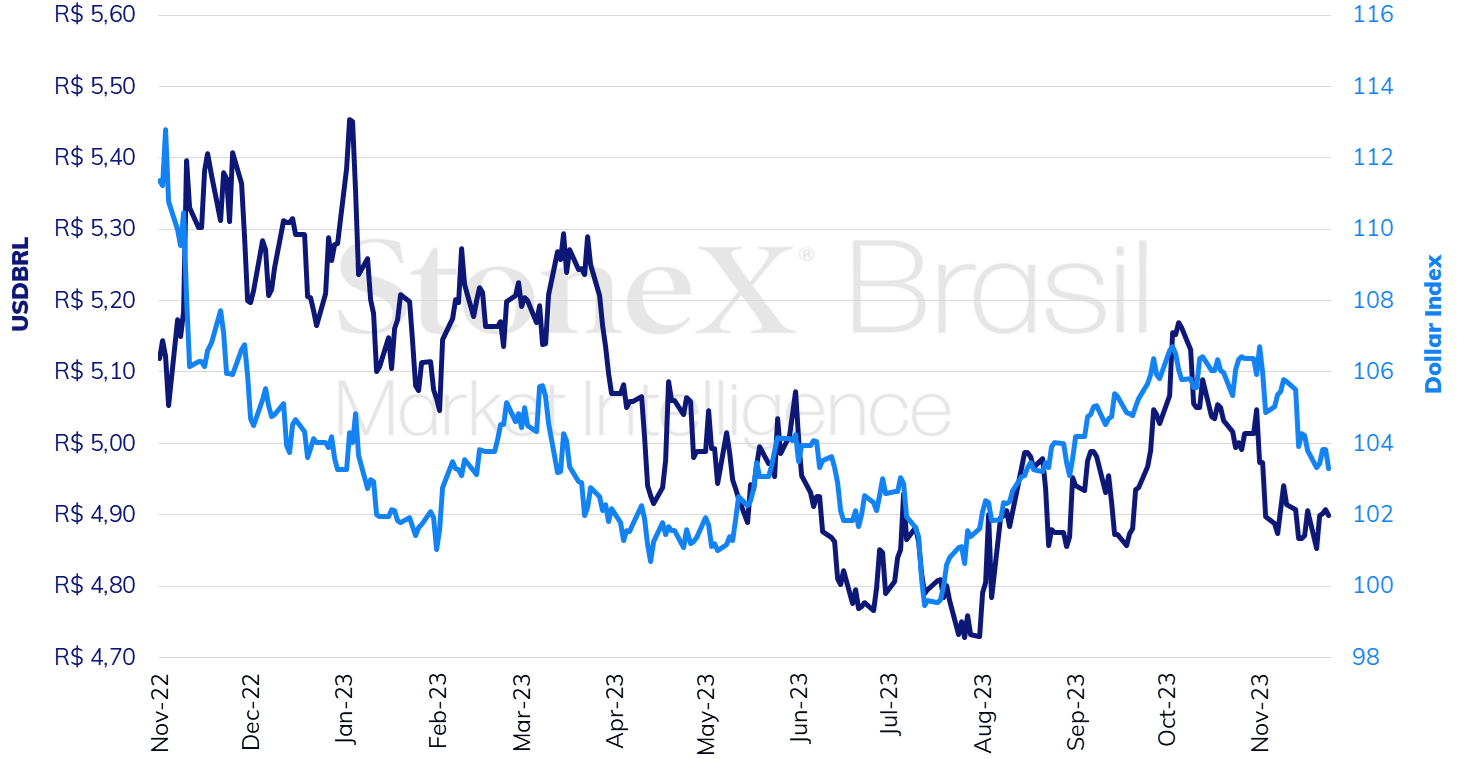

The USDBRL ended the week lower, closing the session this Friday (24) at BRL 4.899, a weekly decrease of 0.1%, a monthly decline of 3.0%, and an annual reduction of 7.2%. The dollar index closed Friday's session at 103.3 points, a change of -0.5% for the week, -2.5% for the month, and 0.0% for the year.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

HIGHLIGHT: Data on the American economy

Expected impact on USDBRL: bearish

The week will be relatively light regarding the data for the United States. It is worth highlighting the release of the Personal Consumption Expenditures (PCE) Price Index for October, concluding this month's round of indicators, with an expected performance very close to the Consumer Price Index (CPI), that is, a 0.1% hike in the overall index and a 0.2% hike in the core index, which excludes the more volatile components of food and energy. The reading should reinforce the perception that American interest rates are at their peak and corroborate a weakening of the American currency. Additionally, the Purchasing Managers' Index (PMI) for the industrial sector in November will be published by the ISM Institute, opening the round of data for November. The expectation is a rebound compared to the performance below expectations last month, going from 46.7 points in October to 47.6 points in November, remaining below the 50-point mark, in contraction territory.

Economic Agenda in Congress

Expected impact on USDBRL: bearish

This week, the progress of the government's economic agenda in the National Congress should also be highlighted. Disagreements over the insertion of a mandatory deadline for the payment of parliamentary amendments prevented the vote on the draft Budget Guidelines Law in the Joint Budget Committee last week, and the Finance Ministry must concentrate its efforts on moving forward with its consideration this week. In addition, there is the expectation of a vote on the bill to tax exclusive and offshore investment funds in the Federal Senate and the bill to review taxation on ICMS subsidies (incentives) in the Chamber of Deputies.

IPCA-15

Expected impact on USDBRL: bullish

The release of IPCA-15 for November is expected to show a slight increase compared to the previous reading, going from 0.21% in October to something close to 0.30% in November. Although fuel prices are slightly falling, food and airfare are expected to pressure the indicator. Additionally, the General Price Index - Market (IGP-M) will be published, allowing for a more updated reading of commodity prices, which experienced deflation between April and August and contributed to the recent stabilization of consumer prices.

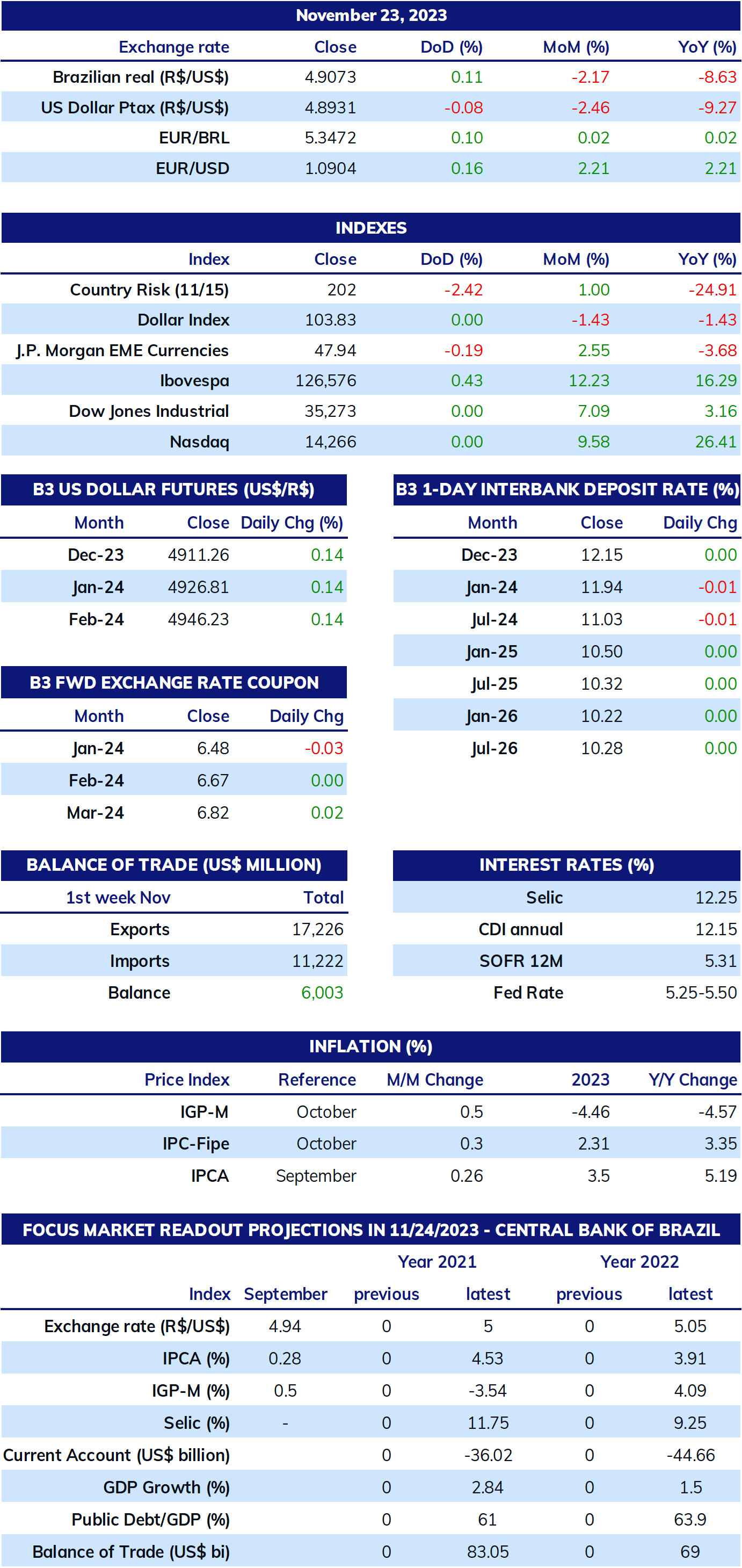

Key Indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos (leonel.mattos@stonex.com), Alan Lima (alan.lima@stonex.com), and Vitor Andrioli (vitor.andrioli@stonex.com).

Translation by Rodolfo Abachi (rodolfo.abachi@stonex.com).

Financial editor: Paul Walton (paul.walton@stonex.com).