Bullish factors

- Statements from Federal Reserve officials may want to realign expectations of an interest rate cut by the American central bank after Powell's comments this week triggered a sharp global rally for risky assets, strengthening the American currency.

- Minutes of the COPOM and Quarterly Inflation Report (RTI, an acronym in Portuguese) should show a more benign external scenario for the Central Bank, maintaining expectations of cuts to the basic interest rate (SELIC), which in turn reduces the attractiveness of Brazilian assets and weakens the real.

Bearish factors

- PCE index should maintain a trend of gradual price moderation in the US and suggest that the Fed has room for monetary easing, increasing bets on interest rate cuts by investors and weakening the American currency.

- The possibility of advancing important economic agendas for the government in the National Congress can ratchet down the perception of fiscal jeopardy for Brazilian assets and contribute to strengthening the BRL.

- Due to Christmas and the New Year, the Weekly Exchange Overview will not be published on December 22 and 29, returning on January 5, 2024. Happy Holidays!!!

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

The week was marked by the sharp rally of risky assets caused by the monetary policy decision of the Federal Open Market Committee (FOMC), which showed that 17 out of the 19 authorities that make up the Committee project lower interest rates in 2024 and was accompanied by statements from its Chairman, Jerome Powell, signaling the possibility that interest rate cuts could begin soon, surprising investors.

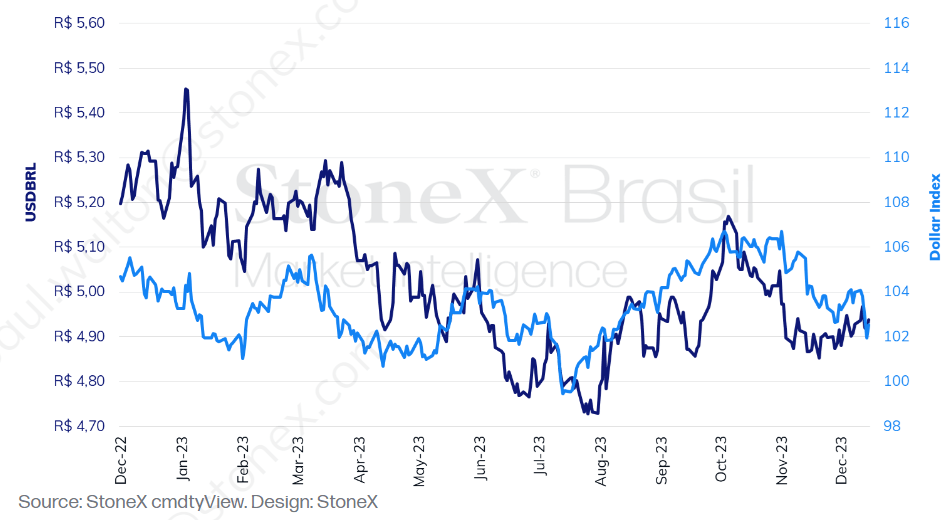

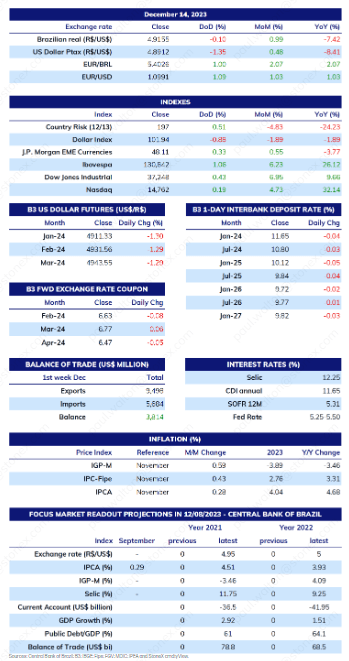

The USDBRL ended the week slightly higher, closing Friday's session (15) at BRL 4.938, a variation of +0.2% for the week, +0.5% for the month, and -6.5% for the year. The dollar index closed Friday's session at 102.5 points, a weekly decline of 1.4%, a monthly decline of 0.9%, and an annual decline of 0.7%.

USDBRL and Dollar Index (points)

THE MOST IMPORTANT EVENT: "Fed Pivot" and PCE

Expected impact on USDBRL: bearish

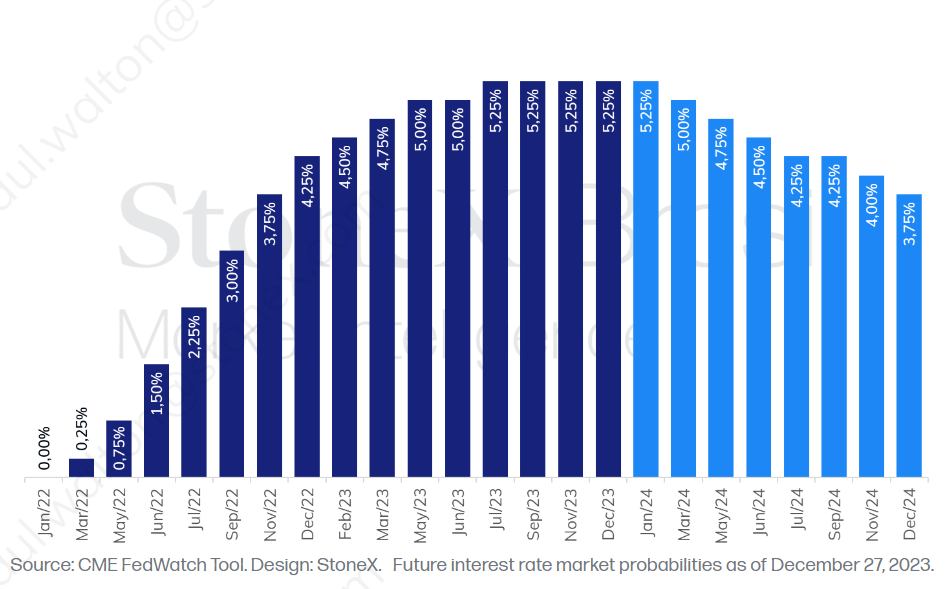

Last week, risk appetite globally surged, driven by a perception among financial market participants that the Federal Reserve made a "reversal" in its stance in its latest monetary policy decision. The decision did not bring surprises, with interest rates being maintained between 5.25% and 5.50% p.a. for the third consecutive meeting. Nonetheless, it was surprising the projection of lower interest rates in 2024 by FOMC members in the summarized economic projections and, especially, the comments of Federal Reserve (Fed) President Jerome Powell, who made little effort to curb the expectations of traders regarding the possibility that such interest rate reductions may occur in the short term. Two weeks ago, Powell stated it was "too early to speculate on interest rate cuts" and "premature to conclude that interest rate increases have wrapped up." However, yesterday, he declared that "[interest rate cuts] are starting to come into view; it's a topic of discussion around the world, and it was also a topic of discussion at our meeting today." Analysts perceive that Powell did not seem concerned about potential inflationary jeopardies in the current situation and chose not to convey a more cautious message, for example, avoiding warning about potential difficulties in the final stretch of disinflation.

History of the American interest rate and bet with the highest likelihood in the future interest market

In this sense, disclosing the Personal Consumption Expenditures (PCE) Price Index for November, the Fed's preferred indicator for tracking consumer prices should reinforce the view that the Fed has room for monetary easing. The PCE must maintain the trend of gradual moderation and increase by 0.1% in the headline index and 0.2% in its core, which excludes volatile food and energy components. Such results should reduce the 12-month accumulated of each metric by 0.1 p.p., from 3.0% to 2.9% in the full index and from 3.5% to 3.4% in the core.

However, given the breadth and strength with which investors reacted to the FOMC decision, it is likely that Federal Reserve officials will seek to "correct the course" and curb agents' expectations to avoid further loosening of financial conditions. Last Friday, the president of the Federal Reserve Bank of New York, John Williams, stated that "we aren’t talking about rate cuts" and that thinking about cuts for March is "premature".

Copom minutes and RTI

Expected impact on USDBRL: bullish

The statement from the Monetary Policy Committee (COPOM) took a backseat on a day when the Federal Reserve dominated the attention of global financial markets. Still, there is the impression that the document was not adjusted for the unexpected change in the position of the American central bank, which is preparing for a monetary reprieve. Likewise, some analysts believe that the Central Bank of Brazil (BC) will have more room to reduce the basic interest rate (SELIC) in this new context. Thus, the Central Bank may adjust its position in the minutes of the decision, published on Tuesday (19), a document that allows for a more detailed exploration of the economic situation and the discussions held by COPOM. Nonetheless, interest rate reductions by Brazil reduced the interest rate differential offered by the country, which can reduce the flow of financial investments and weaken the real.

It is also worth noting the release of the Quarterly Inflation Report on Thursday (21), an extremely detailed report that brings the analysis of internal and external economic conjuncture, accompanied by the Central Bank's economic projections for the main macroeconomic variables, followed by a press conference by the president of the monetary authority, Roberto Campos Neto, and his director of economic policy, Diogo Guillen.

Economic Agenda in Congress

Expected impact on USDBRL: bearish

After much negotiation and impasse, an agreement between the Administration and the leaders of Congress ended up allowing lawmakers to agree to approve practically the remaining economic agenda of the government in exchange for the overturning of some presidential vetoes. Among the 13 vetoes that were fully or partially overturned are the measure that extended the payroll tax exemption for 17 sectors of the economy until December 2027, with an estimated annual cost of BRL 18.4 billion, and the topic of the fiscal framework that limited the payment of budget amendments by committee. Thus, last Friday (15), the Chamber of Deputies approved the Proposed Constitutional Amendment 1185/23, which changes the federal taxation on ICMS subsidies and restricts the payment of Interest on Equity to shareholders, while the vote on the Tax Reform Constitutional Amendment Proposal (PEC 45/2019) was still pending. For this week, the plenary assessments of the Budget Guidelines Law (LDO) were promised on Tuesday (19) and the Annual Budget Law (LOA) on Thursday (21).

Key indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos (leonel.mattos@stonex.com), Alan Lima (alan.lima@stonex.com), and Vitor Andrioli (vitor.andrioli@stonex.com).

Translation by Rodolfo Abachi (rodolfo.abachi@stonex.com).

Financial editor: Paul Walton (paul.walton@stonex.com).