Bullish factors

- The contraction of the Brazilian GDP in Q3 is expected to reduce the attractiveness of Brazilian assets and reinforce the need to cut the basic interest rate (SELIC), which could decrease foreign investments in the country and weaken the BRL.

Bearish factors

- Slightly positive data for the American economy can reinforce the perception that the Federal Reserve will not raise interest rates further and contribute to the global weakening of the USD.

- Disclosure of data for the Chinese economy can reinforce the perception of a faster rebound, favoring currencies' performance from commodity-exporting countries like Brazil.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

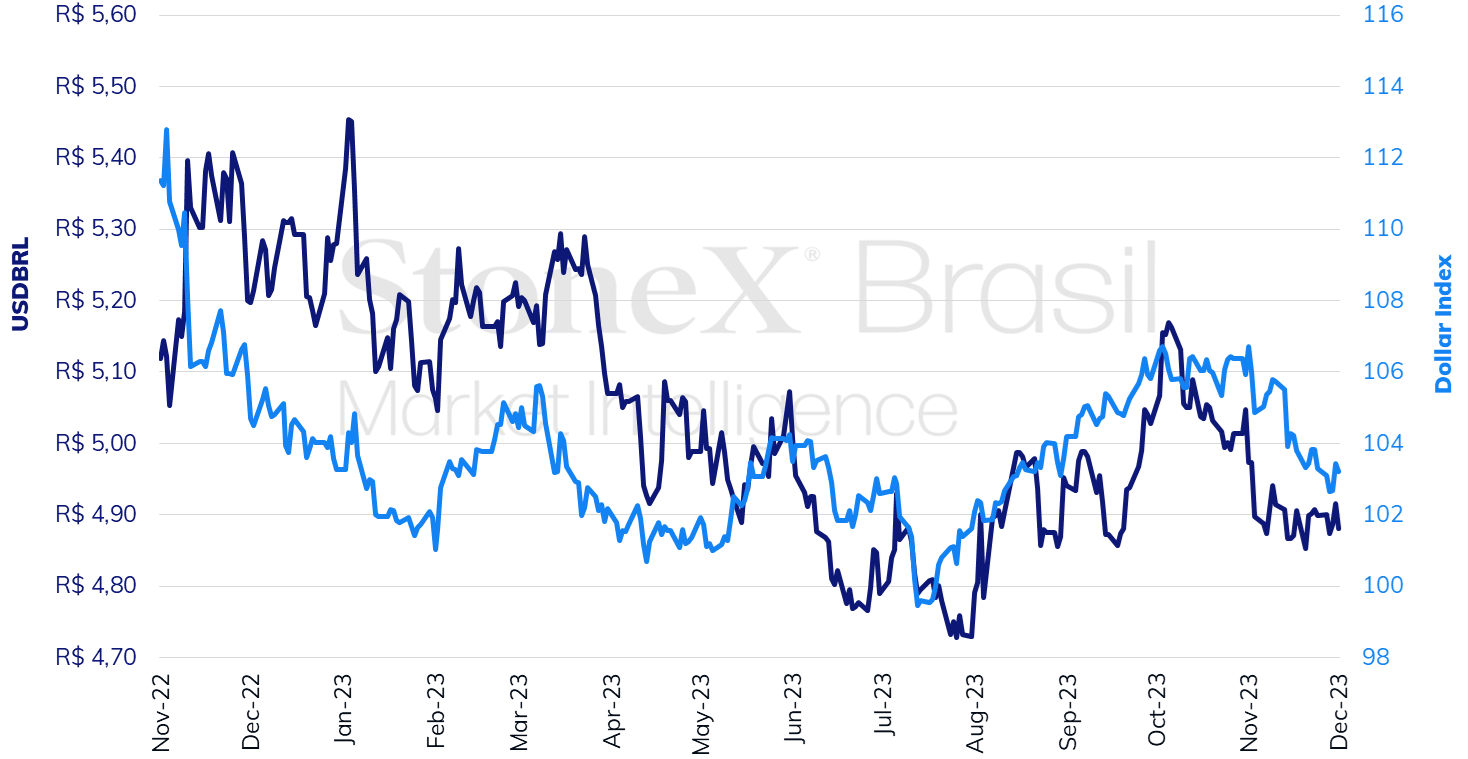

The week was marked by an increase in bets on cuts in the US basic interest rate at the beginning of 2024 after statements by Federal Reserve officials, the formation of the end-of-month PTAX rate, and the processing of the government's economic agenda in the Federal Congress.

The USDBRL ended the week lower on Friday (01) at BRL 4.881, a weekly decrease of 0.4%, a monthly decrease of 3.3%, and an annual decrease of 7.5%. The dollar index closed Friday's session at 103.2 points, a change of -0.1% for the week, -2.6% for the month, and -0.1% for the year.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

THE MOST IMPORTANT EVENT: Data on the American economy

Expected impact on USDBRL: bearish

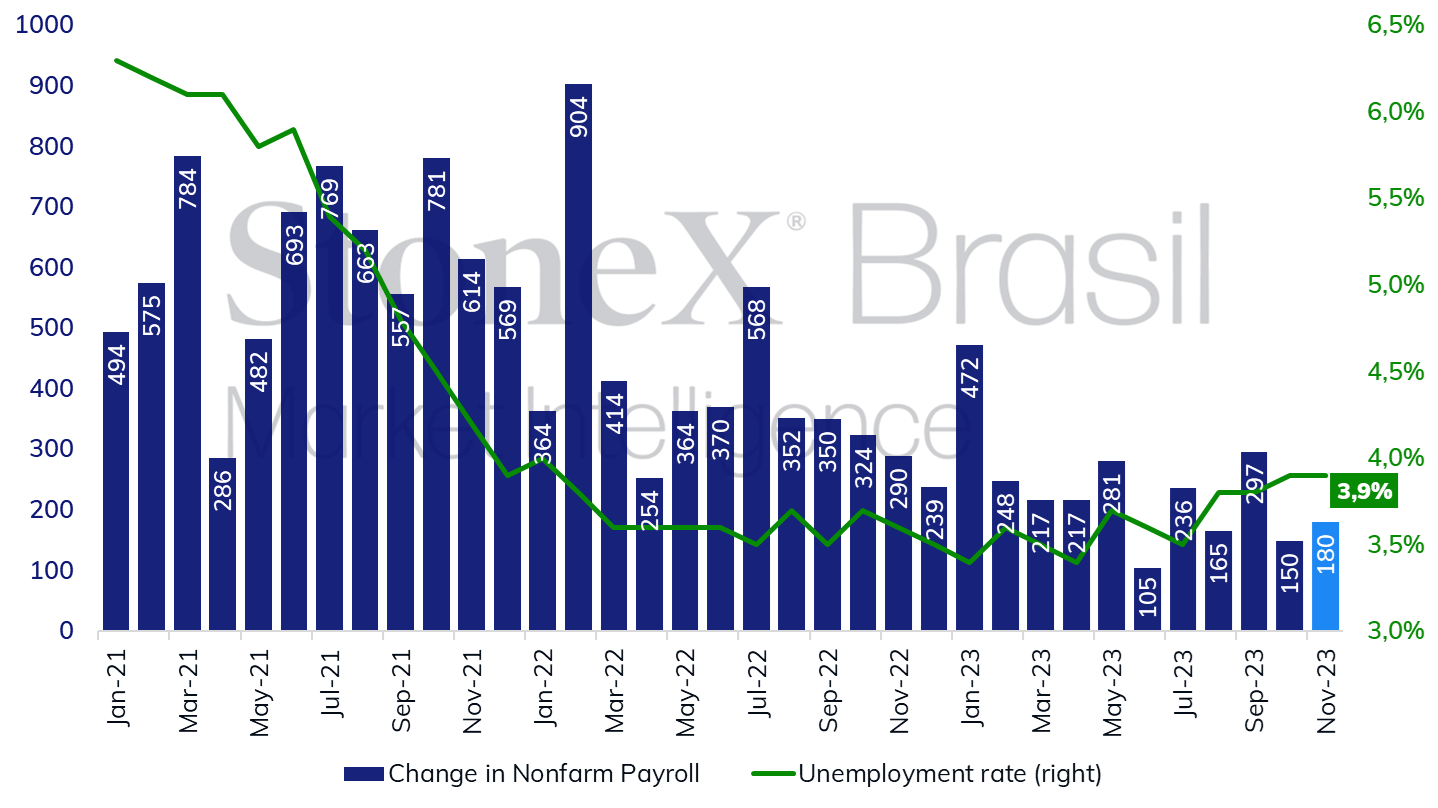

This week's focus of investors' attention should be the release of indicators for the American economy, especially the Purchasing Managers' Index (PMI) for services calculated by the ISM Institute and the Employment Situation Report published by the US Department of Labor Statistics. After a lower-than-expected reading in October, the median estimate for urban job creation in the United States points to a slight rebound for November, with 180 thousand new occupations. The data would be in tandem with an interpretation of a resilient labor market that decelerates subtly, consistent with an interpretation of a "soft landing" of the economy. The PMI for services is expected to increase slightly, from 51.8 points in October to 52.0 points in November. A reading above 50 points indicates expansion, and the growth of the services sector has remained stable despite the long process of monetary tightening.

Variation in total urban employment in the United States (thousand people) and unemployment rate (%)

Source: Federal Reserve Bank of St. Louis. Design: StoneX.

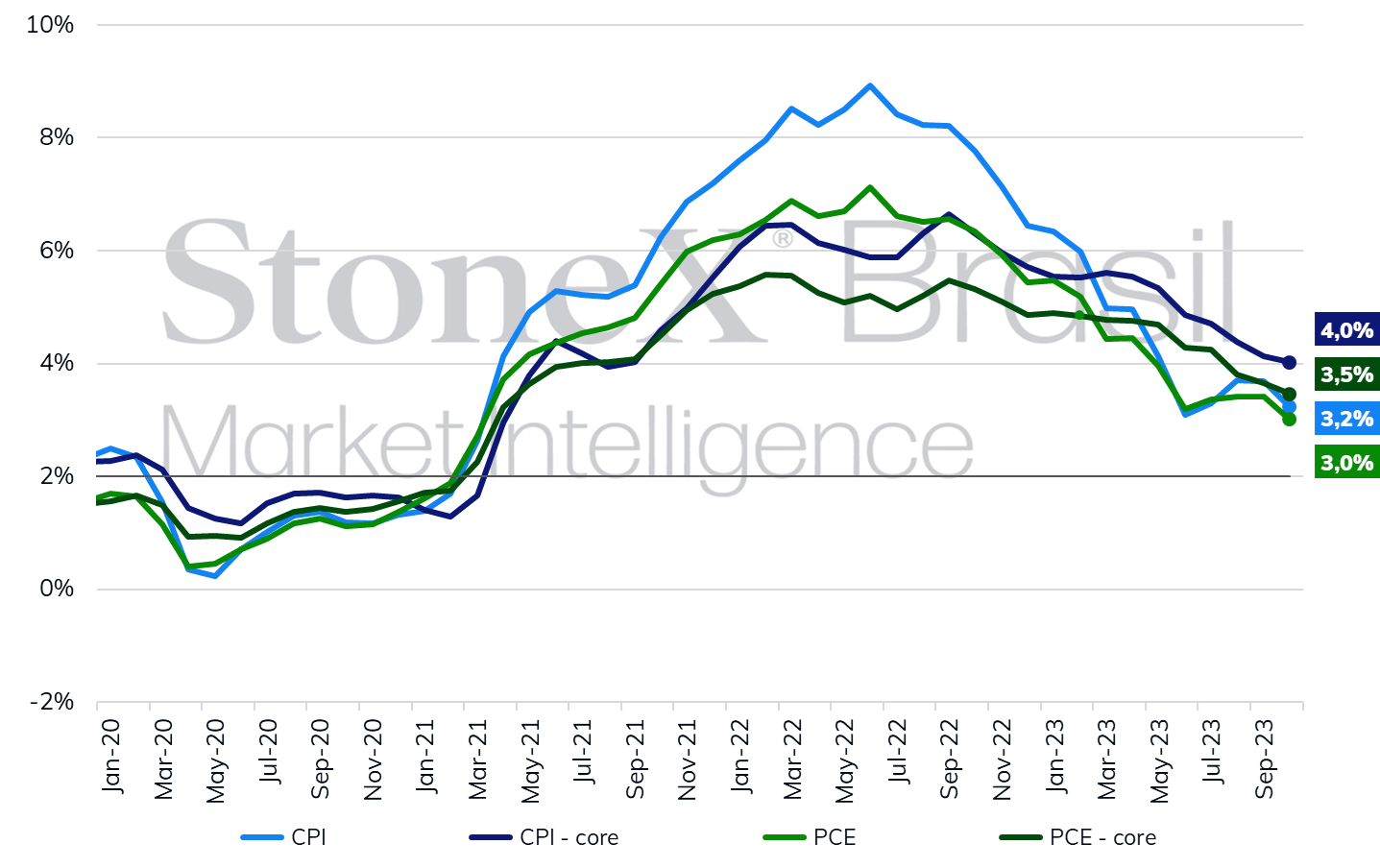

Last week, several Federal Reserve (Fed) authorities spoke about the American scenario and the picture for the country's basic interest rates. Although the assessments have been balanced, considering that the next steps of the Fed largely depend on the evolution of inflation in the coming months, investors reacted more sharply to the new part of the statements from some of these members, such as the member of the Board of Governors, Christopher Waller, stating that they would consider an interest rate cut as a possibility if inflation continued tempering in its upcoming readings. Until then, no agency member even mentioned the possibility, stating that it was premature to discuss monetary easing due to the current price indices.

If, on the one hand, it may seem that financial market agents are selectively reacting to the information provided by Federal Reserve officials, on the other hand, it is worth remembering that inflation data has fallen below expectations in recent months, boosting bets that American interest rates should start to narrow in a few months. For example, in the Summarized Economic Projections released by the Fed on September 20, the median of the estimates from its members pointed to a Personal Consumption Expenditures (PCE) Price Index accumulated at 3.3% in December, with the core at 3.7%. However, in October, the overall index reached 3.0% in the 12-month accumulation, and the core reached 3.5%. Thus, investors began to bet mostly that the first interest rate reduction by the American central bank would occur in March and that a total of 1.25 percentage points would be narrowed throughout 2023.

Inflation measures for the United States (accumulated in 12 months)

Source: Federal Reserve Bank of St. Louis. Design: StoneX.

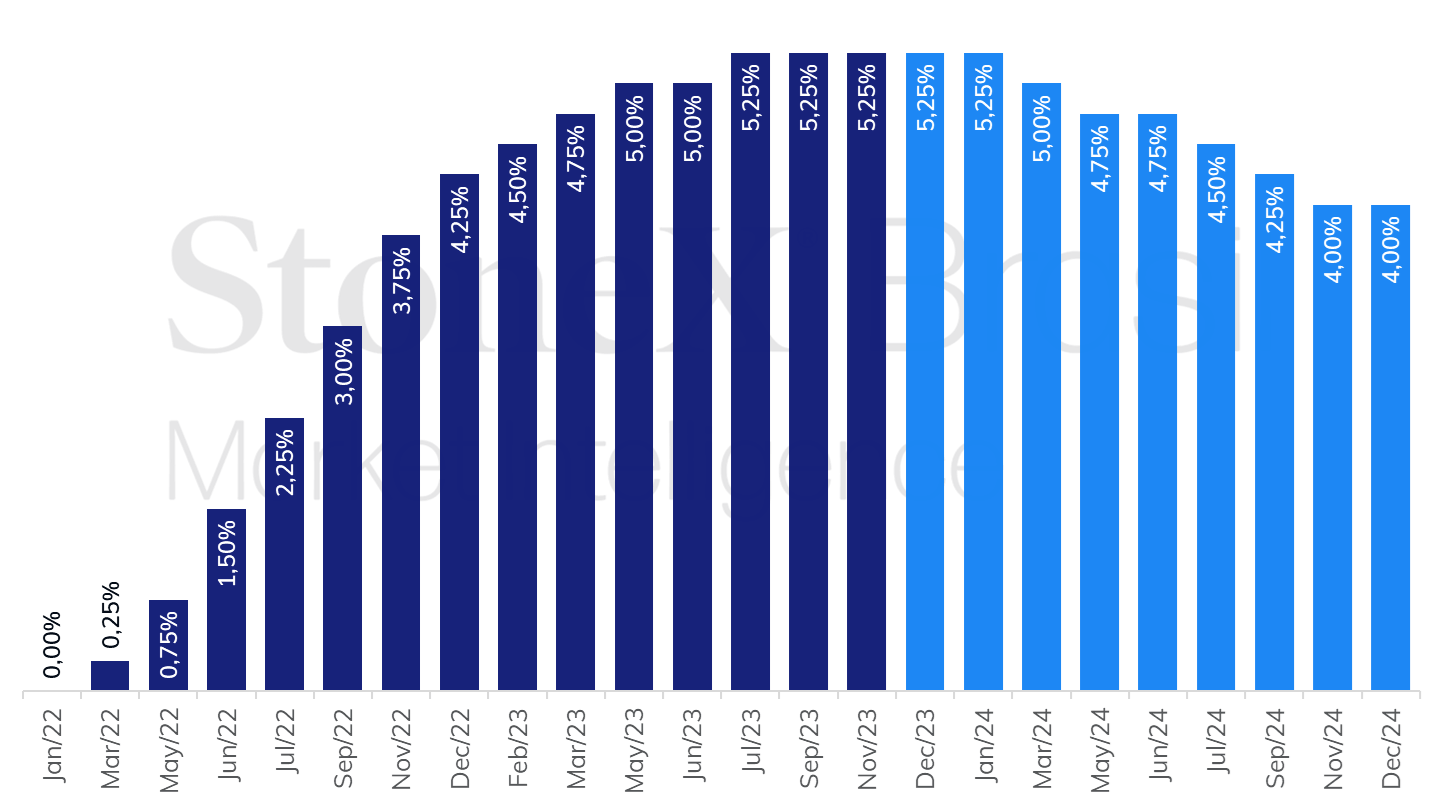

History of the American interest rate and bet with the highest likelihood in the future interest market.

Source: CME FedWatch Tool. Design: StoneX.

Brazilian Q3 GDP

Expected impact on USDBRL: bullish

Also expected to be highlighted this week is the release of the Gross Domestic Product (GDP) for the third quarter in Brazil, with a median expectation of a 0.2% contraction compared to the second quarter. The data should confirm that the positive surprises for the Brazilian GDP were concentrated in the first semester and that the unfavorable macroeconomic environment of high interest rates and a slowdown in credit impacted the country's growth. It is likely that factors that previously contributed to a higher expansion, such as the normalization of post-pandemic activity, have already been exhausted, and the boost from agriculture will not be strong enough to offset the lack of dynamism in industry and services. With slower growth, Brazilian assets become less attractive to foreign investors, which can weaken the BRL.

China economic data

Expected impact on USDBRL: bearish

This week, data on service activity, trade balance, and price index for China will be released, all referring to November. Although the economic indicators so far show a mixed performance and point to a slower economic recovery than expected, a better reading is expected for this week's data compared to October's performance, which can magnify the appetite for risky assets from international investors and contribute to the strengthening of currencies from primary product exporting countries, such as the BRL.

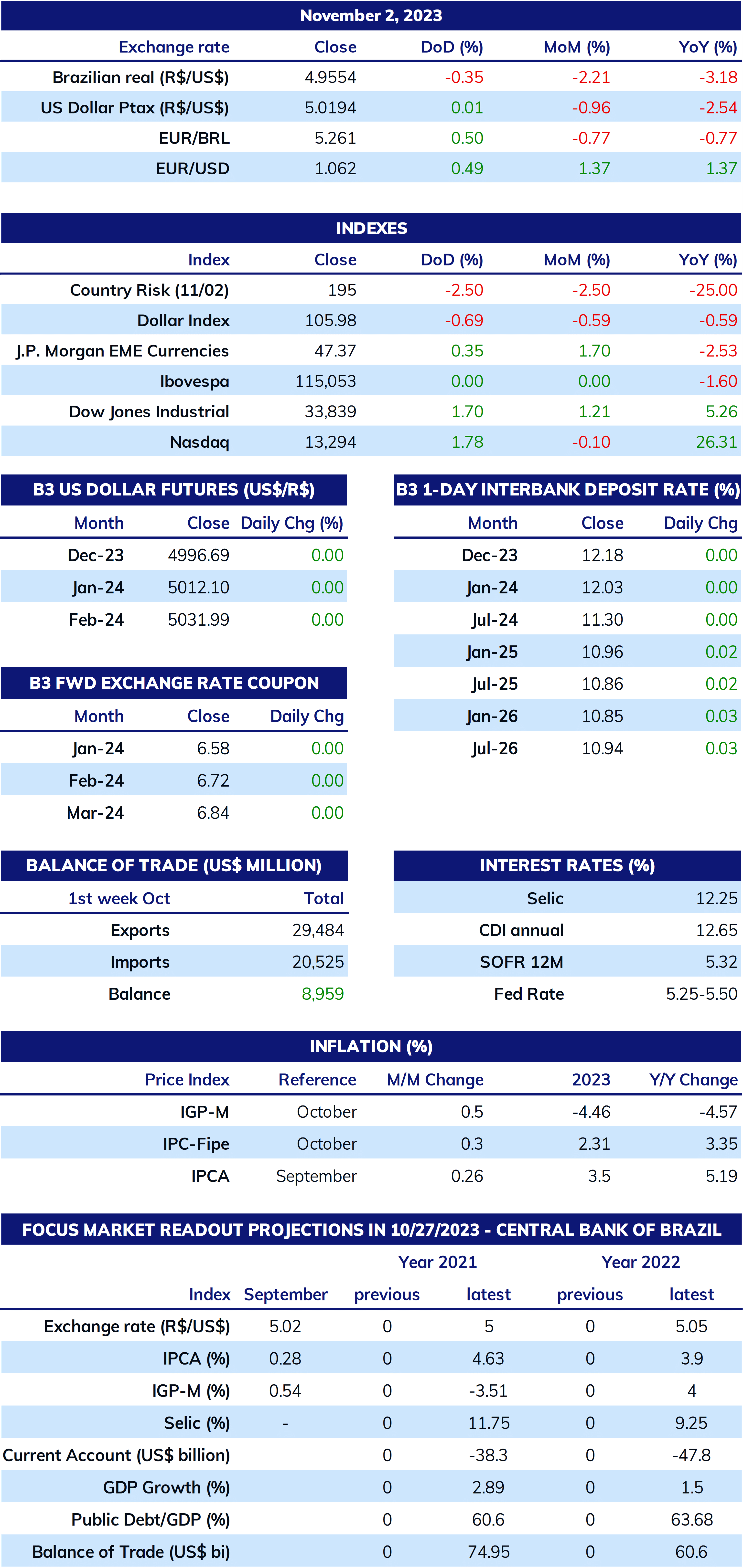

Key Indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos (leonel.mattos@stonex.com), Alan Lima (alan.lima@stonex.com), and Vitor Andrioli (vitor.andrioli@stonex.com).

Translation by Rodolfo Abachi (rodolfo.abachi@stonex.com).

Financial editor: Paul Walton (paul.walton@stonex.com).