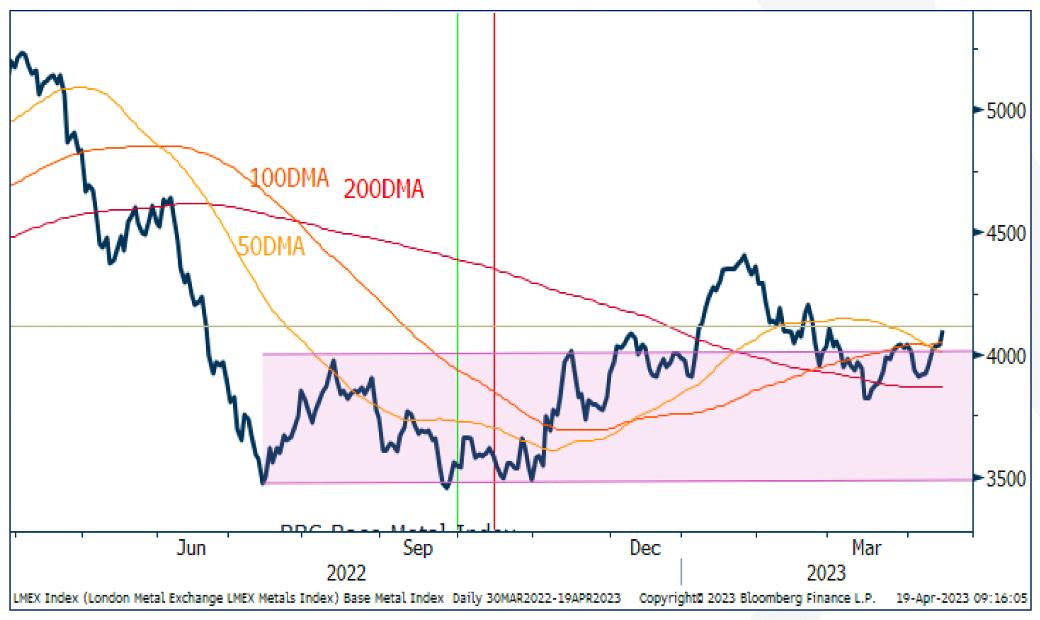

Base metal prices are rallying on South-East Asian demand and China’s economic rebound, coupled with sporadic supply shocks, most notably in Copper and Tin. We expect this price action to continue, exemplified by the performance of the London Metal Exchange (LME) Index, which looks to be on verge of a technical breakout.

Chinese growth is a key driver for metals demand. China’s first quarter gross domestic product grew 2.2% from the previous quarter and 4.5% year-on-year in the first quarter of this year, beating analyst expectations of 4% growth. Our economist expect Chinese GDP growth to reach an annualized rate of growth in 8% in Q2.

London Metal Exchange (LME) Price Index

Source: Bloomberg, StoneX.

Copper and Tin face supply side problems

Copper supply has suffered from Chile’s well publicized production disruptions. Chile is the top copper producer in the world with 29 percent of global copper production. The country’s annual copper output has fallen continuously over the last four years, with 2022 production at its lowest level since 2011, down by 0.9% on a year-to-date annualized basis.

Now copper production costs face political risks. A draft bill to reduce the working week to 40 hours from 45 hours, with the need for overtime payments, was approved in April 2023. Given the need for mines to work continuously, in which workers operate on 12-hour shifts, companies will be forced to pay workers at a higher rate (for the extra hours), raising production costs. Furthermore, Chilean Mining Minister Mario Marcel failed to cap the total tax burden for copper producing companies at 50%, with a final vote being delayed to May.

Tin supply is threatened by Myanmar’s Central Economic Planning Commission ordering a total tin exploration, mining, processing and operations halt, “in order to protect the remining tin resources.” While the country may not follow through with this hardline decision, the country is responsible for 40,500 tonnes of tin ore production, or around 13% of global mine output, returning for growth output in 2022 for the first time since 2017.

The London Metal Exchange’s Tin price jumped 9.2% on this news, to $27,160 per tonne, its highest level since February 2023, but has since fallen back to $27,082. This will hit China, which reportedly imported 62% of its total tin concentrate from Myanmar in 2022. On Monday the tin price hit the Shanghai Futures Exchange 10.5% daily limit on price movements.

Based on analysis by Natalie Scott-Gray, Senior Metals Analyst.

Contact: Natalie.Scott-Gray@StoneX.com