Natalie Scott-Gray discusses the importance of Peru’s reopening of key mining corridor after a period of significant political volatility: the countries mines are responsible for 12% of global copper output, or 2.8 million tons in 2023; in addition, Peru produces significant lead, zinc, tin, and silver.

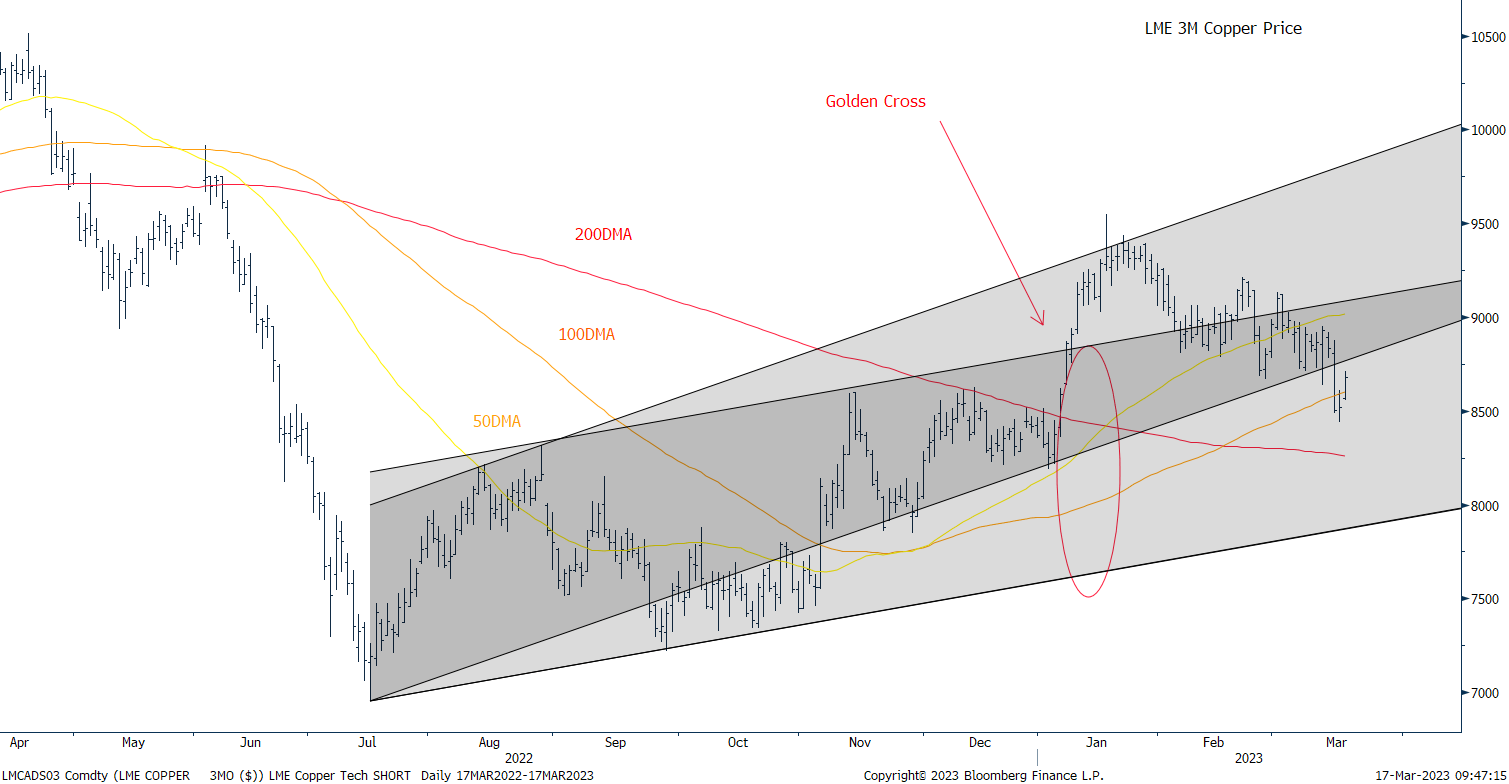

The copper prices is weakening, just as Peru’s significant production comes on line. The copper price bounced at the start of the year but fell back on disappointing demand news from China. While the technical position looks weak, in the chart below, longer term we believe the outlook is bullish.

Copper price

Source: StoneX

Peru declared a 60-day ‘state of emergency’ in seven regions of the country in early February, a response to widespread civilian protests after the removal from office and detention of ex-President Pedro Castillo. Protestors called for Castillo’s release, and early elections to replace new president Dina Boluarte.

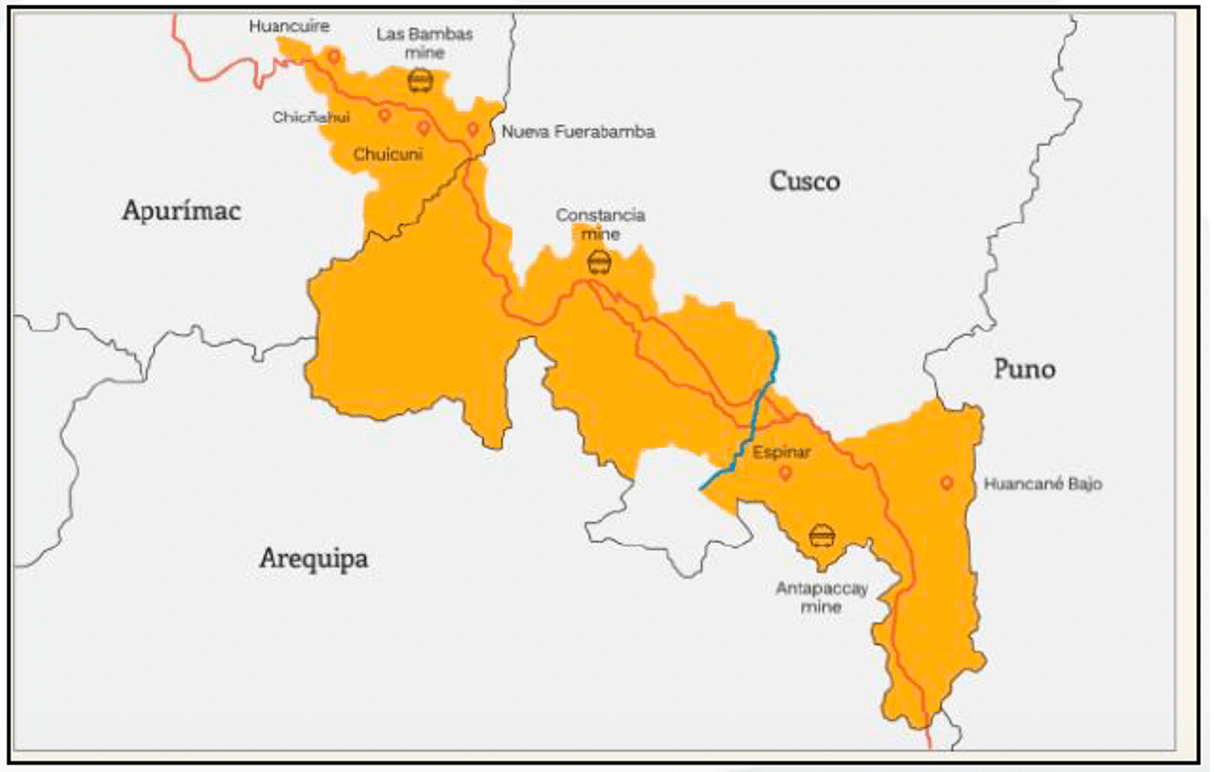

Peru’s Energy and Mines Minister Oscar Vera recently announced that as protests had subsided, “the mining corridor is now open and in the coming days, minerals will begin to be taken out”.

Peru’s Mining Corridor

Source: StoneX.

Closure of the mining corridor hit production hard – output and exports declined:

- Peruvian export revenue fell by 25% year-on-year in January, while output declined by just 0.3% (without Anglo American’s new Quellaveco mine, output would have fallen by 10%)

- Exports were most impacted at Freeport-McMoran’s Cerro Verde mine, MMG’s Las Bambas mine, and Glencore’s Antapaccay mine, with production losses of 32%, 23% and 17% respectively

- MMG’s Las Bambas mine was able to secure critical supplies, enabling production to resume; prior to this, Las Bambas was operating at 20% of its 400,000 tons per annum capacity

- Hudbay Mineral’s Constanciamine reported fire and equipment damage in mid-January, and owner Freeport-McMoRan announced that they can continue to “operate, but have limited” its “mill throughput by about 10% to deal with intermittent supply disruptions”

- Glencore resumed operations ats its Antapaccay mine, following suspensions in January when protesters set fire to buildings and looted employees’ belongings

- Minsur’s San Rafael mine was impacted by protests at the start of the year which lasted 45 days; this is one of the largest tin mines in the world and operations are still a long way off full capacity

- Buenaventura silver mine suspended operations in early February

As production and exports resume, we expect Peru’s participation to reduce supply pressure on key metals, most notably Copper. Today Copper prices are $8,500 per ton having been as high as $9,500 per ton. The StoneX metals team expect Copper prices to rise this year, ending 2023 at $9,800 per ton.

Forecasts are provided by StoneX Financial Ltd. These forecasts represent the views of the StoneX Metals and Energy teams and not necessarily those of FOREX.com or City Index analysts.

Taken from an analysis by Natalie Scott-Gray, Senior Metals Analyst.

Contact: Natalie.Scott-Gray@StoneX.com