What is a Knockout Option?

A Knockout Option is a derivative contract that is automatically closed – or ‘knocked out’ – if the underlying price reaches your chosen Knockout level. They’re usually traded over the counter (OTC), directly between you and your provider and can be used to speculate on commodities, currencies and indices markets.

Knockouts are a type of barrier option, which describes any options contract that has a built-in price level that the position cannot move through.

A core feature of a Knockout Option is that they move one-for-one with the underlying market – meaning that for every point the asset’s price moves, the price of the Knockout moves the same amount. This is what makes them a popular speculative tool.

How does a Knockout Option work?

Knockout Options work in much the same way as other options contracts, in that they give you the right to buy or sell an asset at a set price on or before a set expiry date. The difference is that as well as a strike price at which you’ll be in profit, there’s a Knockout level too, which is where your trade is closed out – not unlike a stop loss.

Learn more about options trading.

Knockouts can only be bought to open, unlike other options which can also be sold to open, also known as ‘writing an option’. However, you can still trade rising and falling markets with the different types of Knockout Options available to you.

When you trade Knockouts with City Index, you’ll be opening a CFD position on a Knockout market. So, you’ll never actually take ownership of, or sell, the underlying asset at the end of the position. Instead, your profit and loss will always be settled in cash.

With City Index Knockouts, you won’t need to set a strike price – because you’re simply speculating on whether the price will rise or fall –and your profit or loss is determined by how far the market moves in your favour. However, you will still need to set a barrier level to determine your maximum risk.

Learn more about CFD trading.

Types of Knockout Options

There are two types of Knockout Options: down-and-outs and up-and-outs.

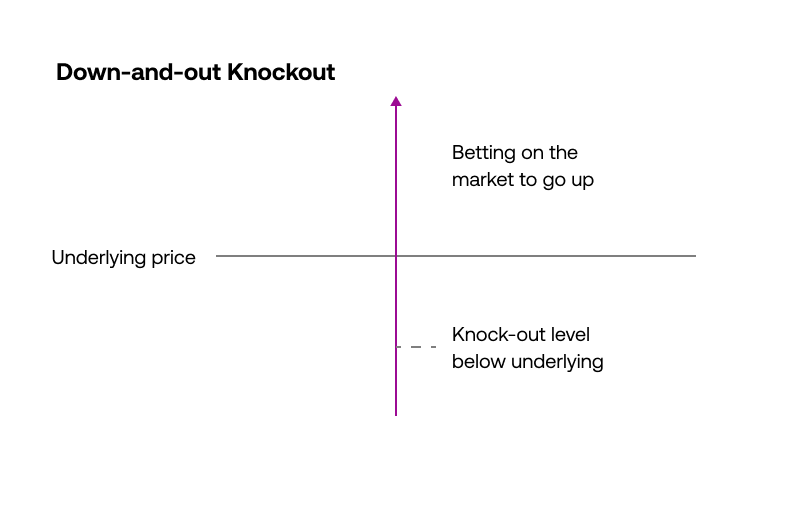

What is a down-and-out option?

A down-and-out option is a type of Knockout that gives you the right to buy or sell the underlying asset, as long as the price doesn’t fall below the barrier price of the contract. If the price does fall below the barrier, the position would automatically close.

You’d buy a down-and-out Knockout if you thought the underlying price would rise, which is why they can also be known as bullish Knockouts. On the City Index platform, these markets are listed as UP KOs.

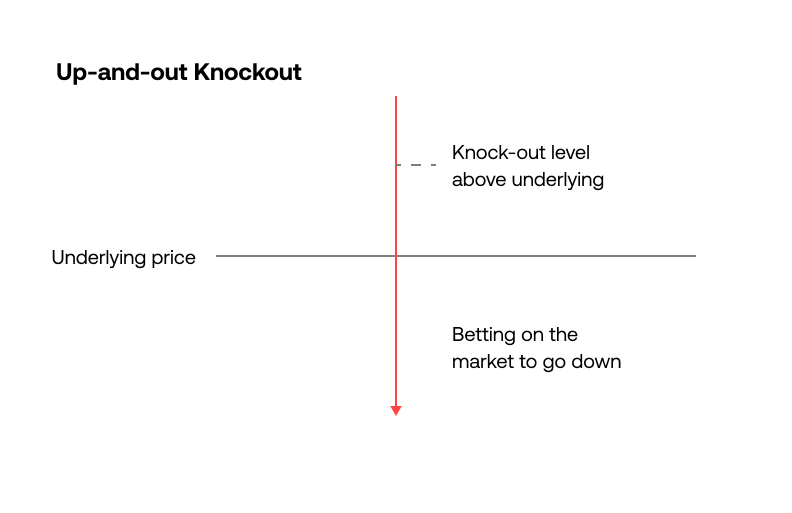

What is an up-and-out option?

An up-and-out option is a type of Knockout that gives you the right to buy or sell the underlying asset, provided the price doesn’t rise above your specified price level. If the price rises above the barrier level, the position would close.

You’d buy an up-and-out if you thought the market price would fall, which is why they can be known as bearish knockouts. In the case of the City Index platform, they’re called DOWN KOs.

Down-and-out options vs up-and-out options summary

Up-and-out Knockout Option |

Down-and-out Knockout Option |

|

|---|---|---|

| Definition | An options contract which expires worthless if the underlying asset falls below a certain level. |

An options contract which expires worthless if the underlying asset rises above a certain level. |

| Expectation | The market price will rise in value | The market price will fall in value |

| Barrier level | Placed below the current market price | Placed above the current market price |

Pros and cons of Knockout Options

Knockout Options are a simple, innovative, limited-risk way to trade forex, indices and commodities. The key benefits of trading Knockout Options are:

1. They have higher leverage* and lower risk

By choosing your own Knockout level and trade size, you determine the margin requirement and maximum risk on the trade. A trade will automatically close, or get ‘knocked out’, if the City Index underlying market price reaches your chosen level.

2. They move one-for-one with the underlying market

Knockout Options have a unique feature whereby the price moves one-for-one with the underlying City Index price. For every point the underlying market moves, the price of the Knockout Option moves by the same amount.

3. You can go long or short

You’ll always buy to open a Knockout Option position, but you can go long on the underlying market by buying an UP KO, or short the underlying market by buying a DOWN KO. If the market moves in your chosen direction, you’ll make a profit; if it moves against you, you’ll make a loss.

4. You can close your trade up until expiry

Knockout Options have an expiry that is stated in the market name – e.g. Wall Street Nov 22 UP KO, which indicates it expires on the last trading day of November 2022. But you have the flexibility to close your position at any time before expiry to lock in any profits. That’s unless your Knockout Level is triggered and the trade closes for a loss.

Risks of Knockout Options

While trading Knockout Options does come with lower risks than other derivatives thanks to its built-in closure level, it’s not without risk completely.

Knockouts do often experience volatility, particularly around major news events, which can cause large price swings. This makes it important to consider how far away from the market price you’ve set a barrier level, as a single move could knock out your trade.

When you trade Knockouts with City Index, you’ll be using CFDs, which are leveraged derivatives. This means that you only have to put down a small initial deposit to get full market exposure. While leverage can magnify your profits, it can also magnify your losses, making it important to manage your trading risk.

See our suite of risk management tools.

Knockout Options FAQs

Can you trade FX Knockout Options?

Yes, you can trade forex with Knockout Options, including EUR/USD, USD/JPY and EUR/GBP, as well as a range of other currency pairs. You can also trade commodities and indices markets with Knockouts.

Take a look at our full range of Knockout markets.

What is a barrier option?

A barrier option is a type of options contract where the final payoff depends on whether or not a predetermined price level or ‘barrier’ is reached. There are two types of barrier options: knockouts and knock-ins.

Discover how to trade Knockout Options.

What is a knock-in option?

A knock-in option is an options contract that only comes into existence if the price of an underlying asset reaches a certain point. It’s the opposite of a knockout, which closes an options contract at a certain price.

Knock-ins are primarily used to hedge against potential risks, because in the event a price level is breached, a position would automatically open that could offset risk to an existing trade.

Learn more about hedging.