Strategies and risk

Position and swing trading

Position trading and swing trading are mid- to long-term styles. In this lesson, we’ll explore the characteristics of each and how you’ll know if one is for you.

What is position trading?

Position trading is a style that seeks to identify an ongoing trend and benefit from the majority of that movement. Position traders ignore short-term volatility and focus on the longer-term price action.

They wait for a trend to reach its peak before closing their trade. Whether this happens after weeks, months or years depends on the trend in question. Normally the style only involves opening a few positions each quarter.

Sound similar to investing? It can be. There’s nothing to say a position trader can’t utilise investment vehicles as part of their strategy.

The main difference is that position traders don’t just buy and hold. They can also go short, believing there will be a prolonged downturn in a market price. This is why most position traders tend to use spread bets or CFDs to give them this flexibility.

Holding positions open longer opens traders up to more risk of adverse movements, but also the potential for larger gains.

Position trading might be the right style for you if you’re:

- Patient and less excitable

- Capable of taking on higher risks

- Not able to spend all day monitoring markets

- Interested in larger trends, not volatility

What is swing trading?

Swing trading is a style that involves taking advantage of price moves that last from a couple of days to weeks. It covers most medium-term, active trading strategies.

It’s based on the assumption that market prices don’t move in a single straight line, and so rather than avoiding volatility, traders can find opportunities in the smaller movements within a larger trend. This can involve holding positions from one day to a couple of weeks – the idea being to make smaller profits more regularly and cut losses quickly.

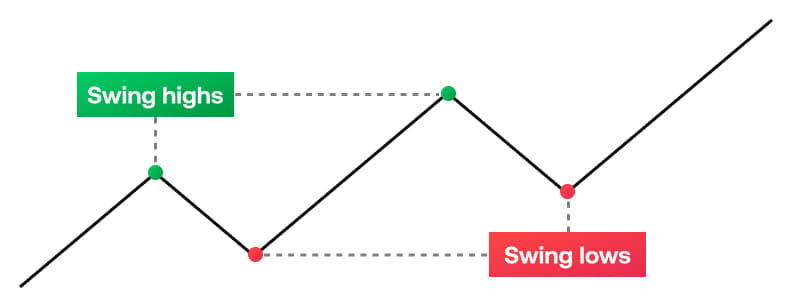

A swing trader won’t necessarily look to enter and exit the market at the start and end of the movement but capture the bulk of a price ‘swing’ from low to high or high to low.

To do this, swing traders use technical analysis to identify points of support and resistance – levels where the market price has either failed to break above or below. The theory goes that once a level has been passed, the price will continue in that direction until it finds new support or resistance.

The most common indicators used for finding swings include Fibonacci retracements and candlestick patterns.

The key difference between swing trading and the other styles we’ll look at is that traders can hold positions open overnight.

While giving them more opportunity to profit, this does open them up to gap risk. This is when the price of a market moves dramatically while closed, resulting in a ‘gap’ between the previous close and the market open price.

Swing trading might be the right style for you if you’re:

- Active and looking for excitement

- Interested in smaller, more frequent gains

- Able to monitor markets throughout the day

- Interested in both short and long-term movements