Reviewed by Patrick Foot, Senior Financial Writer.

- What are stocks and shares?

- Why companies offer shares

- How the stock market works

- Why trade shares?

- Popular stocks

- How to start trading shares

What are shares?

Shares are units that make up the ownership of a business. If you own a share, you technically own a part of the company. This means that if the company increases in value, your shares increase in value too.

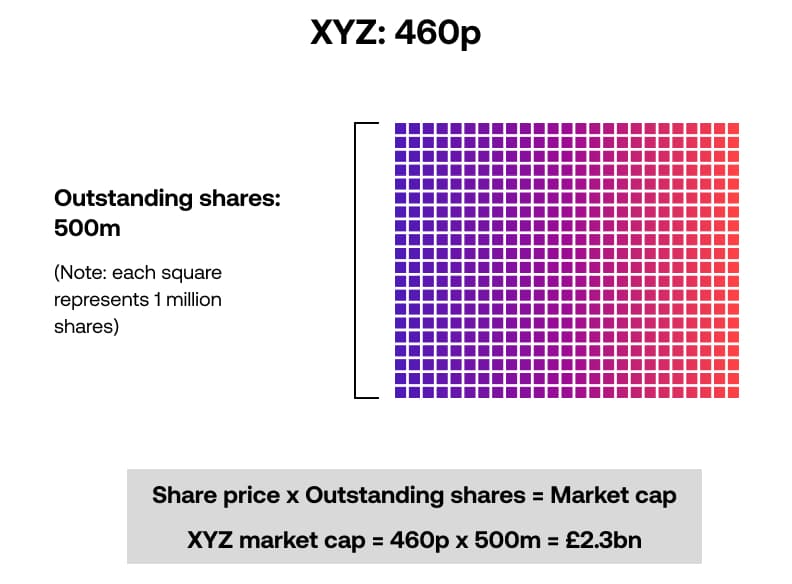

For example, if Company XYZ splits its ownership into 500 million share units and you own 500 shares, then you have a 0.0001% stake in the business.

The value of a listed company is shown in its share price. This tells you how much you’d need to pay to buy a single share in the business today. If you multiply a stock’s share price by the number of shares it has divided its ownership into, you calculate its total value: known as its market capitalisation (or market cap for short).

Let’s say that Company XYZ has a share price of 460p. It has 500 million outstanding shares, giving it a market cap of (460p x 500,000,00) £2.3 billion.

Why companies offer shares

You may wonder why a company would want to give away part of its ownership. Generally speaking, it is so that they can raise capital.

Companies need capital to grow. Now, offering shares isn’t the only way of raising capital. They could, for example, borrow cash from a bank or by offering corporate bonds. Or, they could sell a large stake in the business to one or more investors.

But both of these methods come with drawbacks:

- Loans need to be paid back and incur interest that eats into your bottom line

- Selling a large chunk of your ownership at once increases the risk that someone else could end up controlling your company

By breaking down their ownership into lots of tiny shares, companies can raise a huge amount of capital that they never have to pay back – and keep control of their business in the process.

However, listing shares comes with drawbacks too, so lots of companies choose to remain private. Household names like Aldi, Lidl and IKEA are all privately owned.

How the stock market works

We’ve covered what stocks are and why companies offer them, but how does the buying and selling of shares work? You trade shares via the stock market – a network of exchanges around the world that are home to some of the world’s biggest businesses.

Let’s examine three key aspects of stock markets: exchanges, IPOs and brokers. For an in-depth look, head to our guide on how the stock market works.

Stock exchanges

Stock exchanges are where shares are bought and sold, and where companies are listed. Notable examples include the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE) and Frankfurt Stock Exchange (FSE).

Companies tend to have a primary listing on a single exchange. Apple, for example, is listed on the NASDAQ. Volkswagen, on the other hand, is listed on the Frankfurt Stock Exchange. Sometimes, a stock will also have a secondary listing on another exchange – such as Unilever, which is present on both the LSE and the Euronext Amsterdam exchange.

IPOs

The process to list on an exchange is called an initial public offering (IPO).

IPOs can be a long, arduous process for a company, as many exchanges have strict rules for which businesses can join them. Once the firm is ready to list, shares will be offered to investors ahead of its first day of trading. Then, traders get to find how much the markets think a new stock is worth.

Find out more about IPOs here.

Stockbrokers

Exchanges aren’t just strict about who can list on them; they also have rules about who can trade on their order books. Because of this, most retail investors will buy and sell shares using a stockbroker.

Stockbrokers execute orders on your behalf. There are several different types, depending on how much control you want over your investments. Discretionary brokers, for instance, choose your stocks for you. Execution-only brokers, on the other hand, will only act under your specific instructions.

You don’t have to trade via a stockbroker. With derivatives like CFDs and spread betting, you never own the shares you're trading, so you don’t need a broker. We’ll cover them in more detail on the how to trade shares page.

Why are shares popular?

In most cases, investors choose to buy shares because they believe a company’s value will go up.

For instance, if you think that Company XYZ has a superior business model, a unique product or an advantage over its competition, you might want to buy shares in it. Then, if the business starts to make money, its value will rise – which means its share price will rise too.

When its share price has risen, you can sell your stock and collect the difference as profit.

That’s not the only way to earn from shares, though. You might also be eligible for a dividend: a portion of a company’s profits that they pay back to investors. Not every stock pays a dividend, but high-dividend shares are highly prized for the regular return they generate.

You can also trade shares using CFDs which allows you to benefit from falling prices as well as rising prices.

What are the most popular shares and top companies?

The most popular shares differ around the world. In the UK, Lloyds Bank, Vodafone and Barclays were the most-traded stocks in 2020 by volume. BP and Rolls Royce completed the top five.

Top 5 UK shares in 2020 (by volume)

- Lloyds Bank

- Vodafone

- Barclays

- BP

- Rolls Royce

In the US, Amazon, Apple and Tesla have been hugely popular in recent years.

There can be many reasons why certain shares are more popular than others. The proactive nature of their business, the frequency of dividend payments and specific market and macroeconomic events can all play a part.

To see our analyst’s insight on some of the most popular shares, read our market commentary.

Types of shares

In this guide, we’ve mostly stuck to standard shares. There are, however, a few other types you might hear about. These can include:

- Preference shares. Also known as preferred stock, these come with special dividend rights that ordinary shareholders don’t access

- Share options. Instead of giving you shares directly, these give you the right to buy stock at a fixed price – up until the option expires

- Advisory shares. Stock that is given to company advisors, usually instead of giving them cash

- Bearer shares. This type of stock isn’t registered to any person or business. Whoever holds the share certificate owns the shares

- Class A shares. Some companies split their stock into Class A and Class B shares. Class A typically have more voting rights, but aren’t sold to the public

- Fractional shares. Portions of one share, typically created by a stock split

How do you start share trading?

You can start share trading today by opening a City Index trading account. Or if you want to test out trading risk free, you can start out with a demo.

Either option gives you access to 1000s of shares in the US, UK, Europe and beyond. The only difference is that you add your own funds to a live account, so you’ll collect any profits and pay any losses.

With a demo, the funds are virtual – so you can’t make or lose any money.

For a step-by-step guide to open your first position, take a look at our how to trade shares guide.