US futures

Dow futures -0.9% at 30695

S&P futures -0.85% at 3775

Nasdaq futures -0.9% at 11511

In Europe

FTSE -2% at 7167

Dax -2.6% at 13034

Euro Stoxx -2.22% at 3518

Learn more about trading indices

Stocks tumble after the long weekend

US stocks are pointing to a weaker start on Tuesday, the first day after the long weekend, as recession fears ramp up.

Stubbornly high inflation and fears of aggressive tightening pushing the economy into recession plagued the markets in the previous quarter and showed no signs of easing. PMI data in Europe and rising gas prices have added to the market’s woes.

Investors are once again selling out of everything. In Europe, commodity stocks have been the hardest hit, which could be the case in the US as markets open.

Investors continue to wait for signs that peak inflation has passed, yet with CPI rising to a fresh 40-year high of 8.6% YoY in May, the signs remain elusive, meaning that the Fed has little reason to take its foot off the gas tightening policy.

Recession worries overshadow news that the Biden administration is to hold talks with China aimed at reducing tariffs in an attempt to ease inflation.

Looking ahead, US factory orders are expected to rise 0.5% MoM, up from 0.3%

In corporate news:

Tesla falls after the EV maker delivered 17.9% fewer electric cars in Q2 compared to the previous quarter owing to disruptions from China’s COVID shutdown.

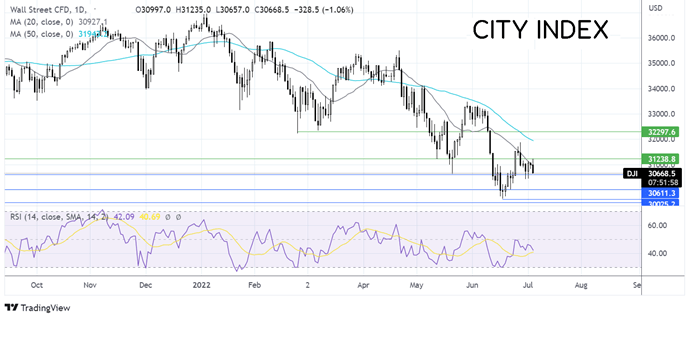

Where next for the Dow Jones?

Failure of the Dow Jones to retake resistance at the 31225, the subsequent fall through the 20 sma, and the RSI in the bearish territory keeps bears hopeful of further losses. Sellers will look for a move below 30600, the May 20 low. A break below here opens the door to 30000 the psychological level. Buyers look to rise over 31225 to expose the 50 sma at 31925, with a move above here creating a higher high.

FX markets – USD rises, EUR tumbles.

USD is surging higher, reaching 1.06, a fresh 20-year high, on a combination of aggressive Fed bets and safe-haven flows. US 10-year treasury yields remain in negative territory.

EURUSD has fallen to its lowest level since 2002. The eurozone economy is not in a good place with rampant inflation and a deteriorating outlook. PMI data today was revised higher but failed to fuel optimism toward the euro. Instead, fears over rising gas prices and the prospect of Russia cutting off gas to Germany are hitting the euro hard, pulling it closer to parity.

GBP/USD is tumbling in risk-off trade despite the services PMI holding up well in June. Still, the economic outlook remains dismal, and BoE’s Governor Andrew Bailey highlighted this, saying that the view has deteriorated materially, bringing the pair below 1.20, the key psychological level.

GBP/USD -1.2% at 1.2030

EUR/USD -1.07% at 1.0374

Oil drops on recession fears

Oil prices are falling as recession fears hurt the demand outlook and pulled prices lower despite ongoing supply concerns.

The latest PMI data across Europe reflected slowing growth and pointed to a slowdown this quarter as costs keep rising. The data, combined with fears that Russia is on the brink of cutting gas supplies to Europe, raise concerns that the eurozone economy is set to deteriorate further.

Supply concerns remain as Norwegian workers begin a stroke that will reduce oil and gas production.

Saudi Arabia also raised its official selling price for August, suggesting that, despite recent weak prices, it expects oil prices to remain high.

Meanwhile, Citigroup has said it sees oil dropping back to $65 per barrel

WTI crude trades -2.6% at $106.22

Brent trades -2% at $110.72

Learn more about trading oil here.

Looking ahead

15:00 US factory orders