US futures

Dow futures -0.2% at 31078

S&P futures +0.4% at 3900

Nasdaq futures -0.07% at 12167

In Europe

FTSE -1% at 73283

Dax -0.6% at 12960

Euro Stoxx -1.7% at 3670

Learn more about trading indices

Fed speaks up next

US stocks are set to open lower, extending losses from the previous session as hawkish Fed bets rise. US stocks ended yesterday lower after the better-than-expected ISM non-manufacturing data paves the way for more aggressive rate hikes. The strong the economy is, the more room the Fed has to act aggressively and still orchestrate a soft landing.

Data from China overnight showing a sharp drop in the trade balance added adding to the risk-off mood in the market. The trade surplus dropped as exports rose just 7.1%, half what they were in July.

The economic calendar is light today, but there are several Fed officials due to speak. Investors will br listening intently for any clues at to whether the Fed plans to hike rates by 50 or 75 basis points in September. Hawkish sounding fed could send stocks lower and see the USD rip higher.

Right now, there is very little in the market for investors to be positive about. Interestingly the S&P500 fear index, the VIX is only mildly higher, just below 27 and well below the 40 level that we would be looking at for capitulation.

Corporate news:

Nio falls after seeing Q2 losses widen. The EV maker reported losses of $409.8 million even though deliveries were ahead of the previous year’s level. Revenue bear forecasts at $1.54 billion, ahead of $1.31 billion.

Apple will be in focus ahead of the Apple event to launch new products later today. The new iPhone 14 is expected to be revealed in addition to other products.

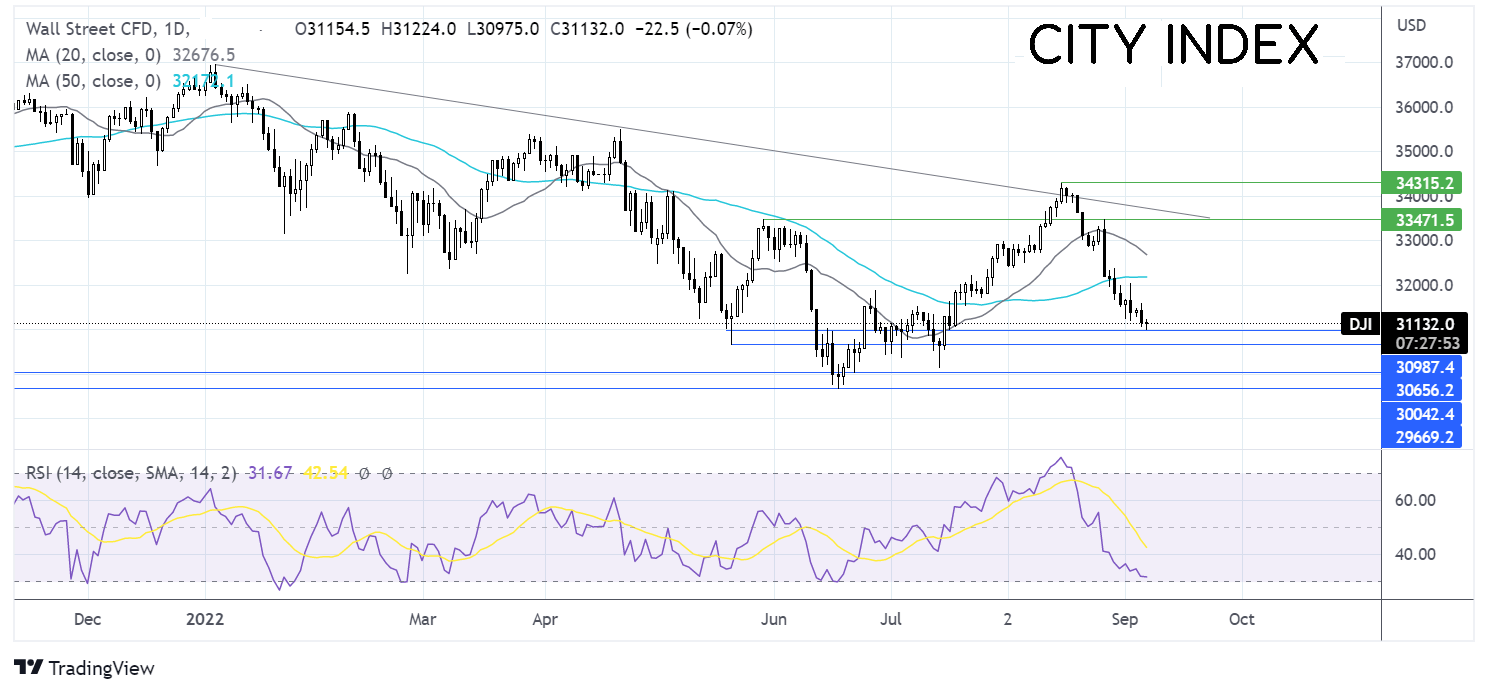

Where next for the Dow Jones?

The Dow Jones has fallen away from the falling trend line resistance, dropping through the 20 & 50 sma. The price is testing support around 3100. The RSI supports further losses while it is out of oversold territory. Sellers will look to break below 31000 to open the door to 30700 the May low before 30000 comes back into focus. Buyers need a move over 32200 the 50 sma to extend gains northwards towards 32750 the 20 sma.

FX markets – USD rises, GBP tumbles

The USD is going from strength to strength on safe-haven flows even as treasury yields ease lower. The USD jumped to fresh 20-year highs over 110.40, USD/JPY appears to be heading for 145.00. The pair trades over 144 at a fresh 24-year high on central bank divergence

EUR/USD is falling on USD strength and amid a souring market mood. German industrial production was stronger than forecast and eurozone GDP was also upwardly revised to 0.8% QoQ. The upbeat data has been shrugged off as investors await tomorrow’s ECB meeting. Even a 75 basis point rate hike may not be enough to help the euro.

GBP/USD is falling and trades close to its March 2020 low of 1.1415 after cautious comments from BoE Governor Andrew Bailey. The market is also awaiting more details from Prime Minister Liz Truss over the energy support package. These are expected by the end of the week. However, the bond market could struggle to swallow the huge borrowing pill that the package could involve.

GBP/USD -0.77% at 1.1433

EUR/USD -0.12% at 0.9893

Oil recovers from earlier losses

Oil fell in early trade as demand concerns dragged the price lower.

Weaker than expected Chinese trade data and rising COVID in China, the world’s largest importer of oil, raised fears over the demand outlook for oil pulling the price lower in early trade. The possibility of higher interest rates and slower global economic growth also fuelled worries over the demand side of the equation.

However, threats from Russian President Putin that Russia will not supply oil and fuel if a price cap is applied to the country’s exports. The prospect of a much tighter market pick oil up from an 8-month low. His comments come after the G7 agreed to back an oil prices cap for global purchases of Russian oil.

Looking ahead, API data is due later.

WTI crude trades -0.4% at $86.26

Brent trades -0.5% at $92.70

Looking ahead

15:00 US Fed Mester

15:00 BoC rate decision

15:35 Fed Brainard