US futures

Dow futures -0.42% at 29478

S&P futures -0.3% at 3676

Nasdaq futures -0.3% at 11280

In Europe

FTSE -0.7% at 6950

Dax -0.1% at 12270

Learn more about trading indices

Recession fears rise

US stocks are heading lower after steep losses across the previous week. The Nasdaq fell 5% for a second straight week, and the Dow Jones tumbled 3%, narrowly avoiding joining its peers in a bear market.

The selloff comes as expectations of a more hawkish Federal Reserve rise and the chances of a soft landing are increasingly unlikely. Given the amount of hiking still needed, a recession is looking increasingly harder to avoid.

The Fed raised rates by 75 basis points last week while other central banks such as the Riksbank, SNB and BoE also hiked rates.

The USD’s strength has been a key theme across the markets and doesn’t usually end well. With the USD up 19% this year, risk assets have been sliding. The move in the USD is considered untenable, but with no better alternative, there doesn’t appear to be an end to the king dollar trade either.

Corporate news:

Amazon trades lower pre-market after announcing plans for an early access sale for Prime users to boost holiday revenue and to appeal to shoppers amid the ongoing squeeze on their incomes.

Apple is failing pre-market, in line with the broader market, despite announcing that it will manufacture its latest iPhone 14 in India, away from China.

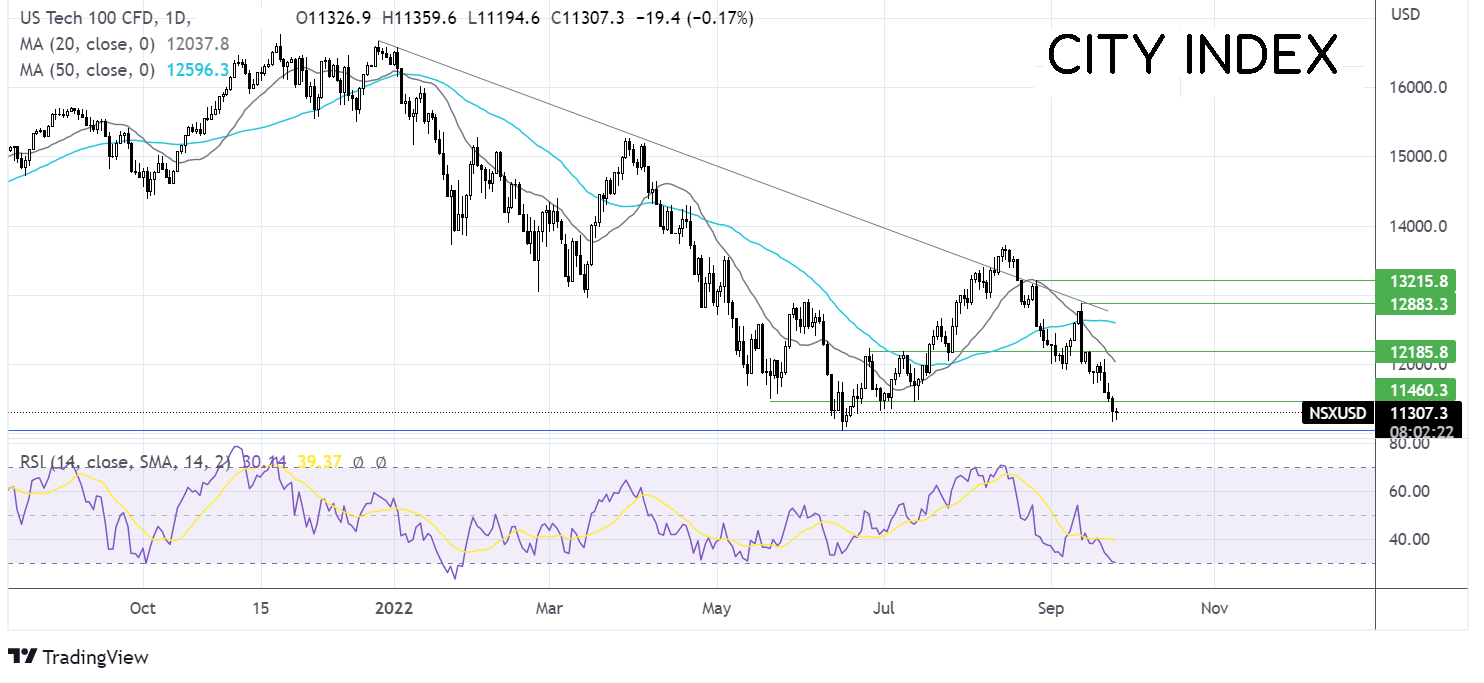

Where next for the Nasdaq?

The Nasdaq has broken below support at 11450 and is powering lower. The 20 sma has crossed below the 50 sma. The RSI also supports further downside while it remains out of the oversold territory. Sellers will look to take out the June low at 11036 to bring 1000 psychological level into target. Buyers would need to rise above 12150 to negate the near-term downtrend.

FX markets – USD rises, GBP tanks

The USD rose to a new 20-year high of 114.50, boosted by the risk-off the environment and last week’s hawkish FOMC decision.

EUR/USD is amid rising fears of a recession. The German IFO business sentiment index dropped to 84.3, a two-year low in September, down from 88.5 in August. Rising energy costs are weighing on business morale, making the recession increasingly likely. The data comes after PMI data on Friday showed that German business activity shrank. The market reaction to the far right winning the Italian election has been minimal.

GBPUSD plunged to a record low on Monday as investors continued digesting the Chancellor’s mini emergency budget and after comments from Kwasi Kwarteng that more tax cuts were coming.

The pound has been hammered by Kwarteng’s radical approach, and the gilt market has been spooked with bonds plunging. The market’s reactions show that investors have lost confidence in the government’s approach, creating a level of volatility that puts the pound on par with some emerging market peers.

Attention is now turning to the BoE to step in to support the pound. So far, the BoE has been more cautious compared to other central banks regarding hiking rates, voting in favour of 50 basis points, while elsewhere, 75 is the new 25. There is a good chance that the BoE will now be forced to hike rates aggressively in the coming November meeting if an emergency intervention isn’t made before. A large hike, potentially around 3%, and a strong message from the BoE could help soothe the pound, which is trapped in a confidence crisis. But given the BoE’s relaxed and tardy approach to inflation so far, this is probably unlikely.

The BoE could also adopt a joint approach with the ECB and BoJ to intervene. This would then shift the blame onto USD strength rather than questionable UK macroeconomic policy.

GBP/USD +0.5% at 1.0910

EUR/USD -0.15% at 0.9677

Oil falls to a 9-month low.

Oil prices are tumbling lower, extending a 7.5% selloff last week, which marked the fourth straight week of losses. Oil has dropped to a nine-month low as the oil demand outlook deteriorates as the likelihood of a global recession rises and as the strong dollar also hits demand.

The US dollar index trades at a 20-year high, making oil more expensive for buyers of other currencies. Furthermore, according to Refintiv Eikon data, the impact of a stronger USD is at its most pronounced in a year.

WTI crude trades -0.67% at $78.10

Brent trades -0.8% at $84.50

Learn more about trading oil here.

Looking ahead

14:00 ECB’s Lagarde

17:00 BoE’s Tenreyo