US futures

Dow futures -1.7% at 31820

S&P futures -2.2% at 4085

Nasdaq futures -2.4% at 12380

In Europe

FTSE -1% at 7450

Dax -1.12% at 13325

Euro Stoxx -1.3% at 3870

Rally built on false hopes reverses

US stocks are set to open sharply lower after US inflation was hotter than expected. CPI rose 8.3% YoY, down from 8.5% in July but short of the 8.1% forecast.

Core CPI, which strips out more volatile items such as food and fuel rose to 6.3%, up from 5.9% in July.

The market, which had been rallying over recent sessions on hopes of inflation cooling significantly, has had a reality check. With core inflation rising strongly, there seems little chance of the Fed taking its foot off the gas anytime soon.

The data will be a concern for the Fed, which is due to announce its interest rate decision next week. While the market was getting carried away that there was a possibility of a 50 basis point hike, the data is suggesting that a 100 basis point hike is more likely than 50!

The data is showing that the cooling in inflation is going to be a long slow process. This is the second time that the market has gotten ahead of itself in hope that the Fed could be arriving at a crossroads where a less hawkish approach was called for. This probably won’t be the last time, either.

Reflecting the hotter-than-expected inflation print and higher for longer rate expectations, US stocks are falling, Gold has tumbled, and the USD has reversed the 5-day selloff, charging back towards 109.00. We could expect the US stocks to reverse the last 4-day rally, which it appears was constructed on false pretences.

Corporate news:

Oracle rises after reporting solid Q1 revenues thanks to robust demand for its cloud services and as it starts to reap the benefits of buying IT firm Cerner.

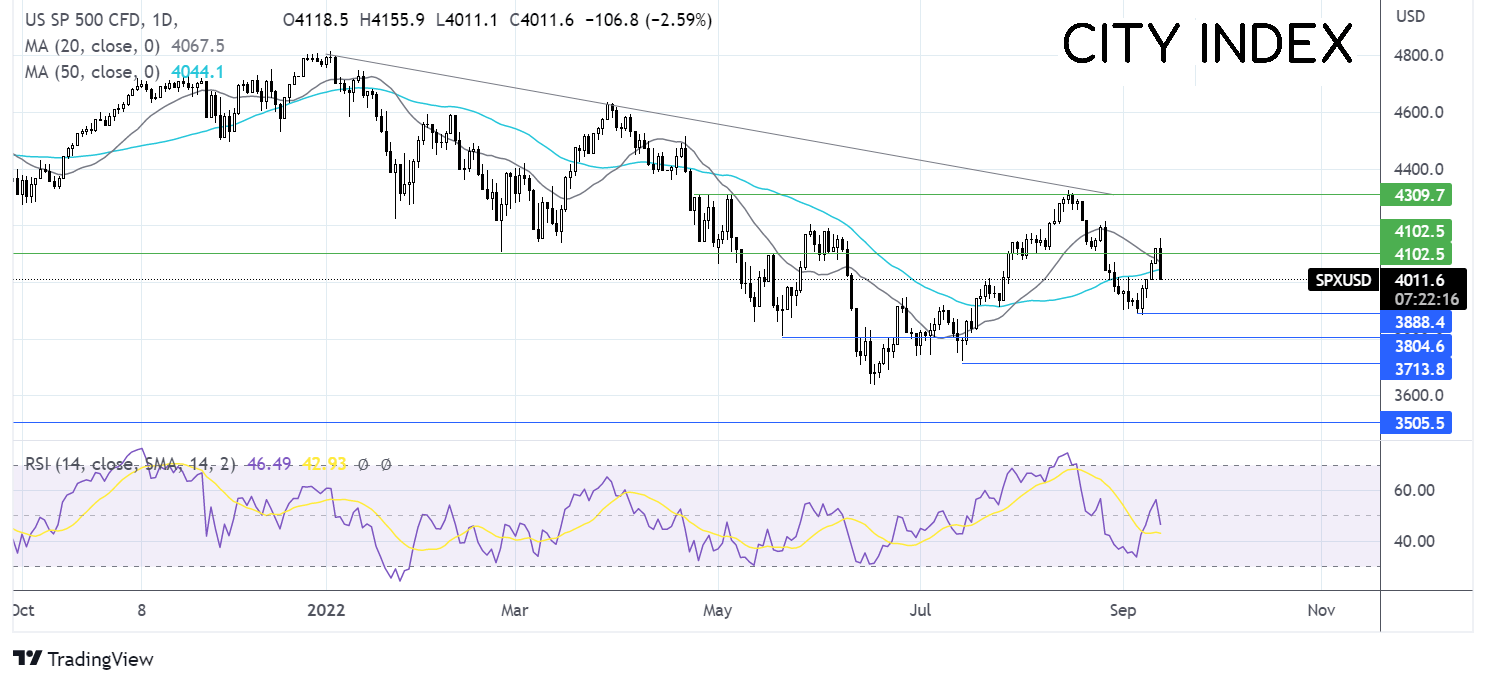

Where next for the S&P500?

FX markets – USD rallies, EUR falls

The USD is rising after the hotter than forecast inflation. Expectations of more rate hikes are lifting the greenback.

EUR/USD is falling on US strength and after dire German economic sentiment data. The ZEW German economic sentiment fell to -61.9 in September, showing that investors are more pessimistic regarding the outlook of the German economy. This was down from -55.3 in August.

GBP/USD is falling after a mixed bag from the labour report. The UK unemployment rate fell to 3.6%, its lowest level since 1974, as more people left the workforce. However, signs of weakness are also emerging, with vacancies falling by the most since the summer 2020 and employment rising by just 40,000, below the 120,00. Wages also rose to 5.2%

Oil edges higher

Oil prices are rising for a fourth straight day as the market struggles to shake off tight supply fears which are overshadowing concerns over the demand outlook. China continues with its strict zero-COVID rules and as central banks across the globe continue hiking interest rates.

In the US SPR emergency reserves fell by 8.4 million to 434.1 million barrels, marking the lowest level since October 1984. The Biden administration pledged to release 1 million barrels a day from the SPR reserves over 6 months in order to bring fuel prices lower.

Elsewhere, the prospect of the revival of the Iran nuclear deal dimed, offering support to oil prices. Germany said it was disappointed by Tehran’s response to the European proposal for the 2015 agreement.

WTI crude trades +0.6% at $87.00

Brent trades +0.7% at $93.20

Learn more about trading oil here.

Looking ahead

21:30 API oil stockpiles