Bullish factors

- Federal Reserve's interest rate decision may reinforce American authorities' concerns about the recent dynamism of the country and the Fed's cautious stance on inflation, supporting the interpretation that interest rates will remain higher for longer and contributing to the strengthening of the USDBRL.

- Disclosure of economic data for the United States may show that the country's economy remains strong even in the face of the Fed's monetary tightening. This supports the interpretation that interest rates will remain high for longer and contribute to strengthening the USDBRL.

- President Lula's statements questioning the feasibility of budget targets 2024 may increase risk premium requirements by investors for Brazilian assets and decrease foreign investments, weakening the BRL.

- Central banks of England and Japan are expected to keep their interest rates unchanged, strengthening the USD.

Bearish factors

- Central Bank of Brazil may recognize a more challenging foreign environment and question its anticipated interest rate cuts in August. This would benefit the domestic interest rate differential and could attract a more significant influx of foreign investments, strengthening the BRL.

- Disclosure of data on the Chinese economy can reinforce the perception of a faster recovery in the country, favoring the performance of currencies from commodity-exporting countries, such as Brazil.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

The USDBRL ended the week lower, closing Friday's session (27) at BRL 5.0132, a weekly decline of 0.4%, a monthly decline of 0.3%, and an annual decline of 5.1%. The dollar index closed Friday's session at 106.4 points, a change of +0.4% for the week, +0.5% for the month, and +3.0% for the year. The foreign exchange market reflected the volatility in US Treasury yields, the US Gross Domestic Product growth in the third quarter, and moderate inflation data in Brazil and the United States.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

THE MOST IMPORTANT EVENT: Federal Reserve interest rate decision

Expected impact on USDBRL: bullish

The focus of investors this week should be the monetary policy decision of the Federal Reserve's Federal Open Market Committee (FOMC). Although there is strong consensus among analysts that the Committee should keep the basic rates unchanged in the range between 5.25% and 5.50% p.a., investors are waiting for the stance that will be adopted in the statement and press conference by its president, Jerome Powell, in the analysis of the risk balance of the conjuncture. The latest readings for economic activity have been particularly strong, such as the strong expansion of the Gross Domestic Product in the third quarter, the significant job creation balance in September, and the recovery of the Purchasing Managers' Index (PMI), which brings a risk of new inflationary pressures in the future due to a demand rebound. Still, several Fed authorities warn of the possibility of a slowdown in the country's economic conditions, either because the interest rate hike cycle has not fully produced its effects or because the recent increases in yields of US Treasury bonds are expected to increase the costs of loans and financing in the country.

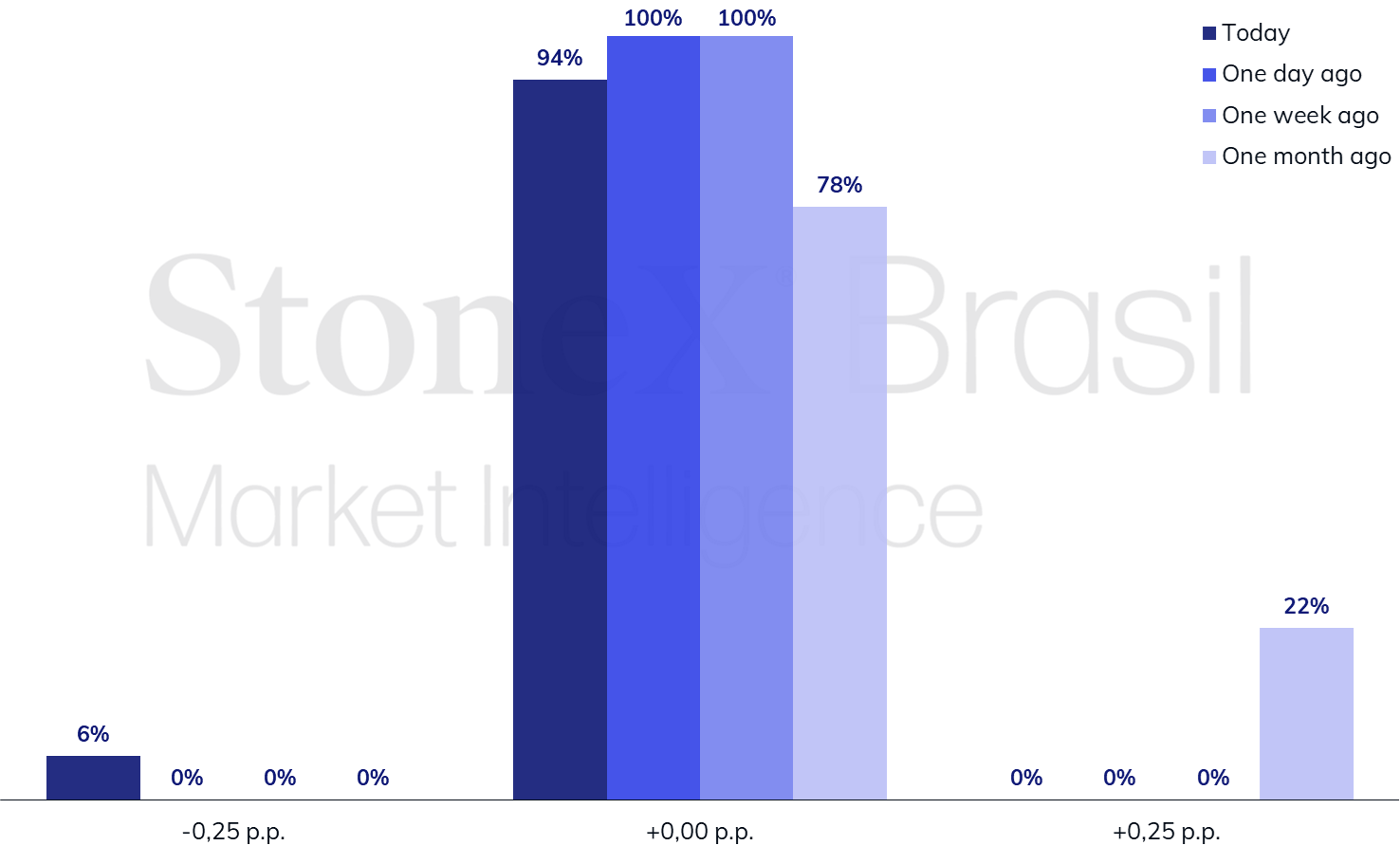

Bets for the Federal Reserve interest rate decision on November 1

Source: CME FedWatch Tool. Design: StoneX. Future interest rate market probabilities as of October 27, 2023.

Source: CME FedWatch Tool. Design: StoneX. Future interest rate market probabilities as of October 27, 2023.

Data on the American economy

Expected impact on USDBRL: bullish

The expectations for data in the United States this week point to the continuation of the country's "soft landing" trajectory, that is, the maintenance of discreetly favorable readings that do not represent risks of inflation reacceleration. Thus, the projections for the Purchasing Managers' Index (PMI) for October calculated by the ISM Institute indicate a performance very close to the September figures, with a reading of 49.0 points for the industrial PMI and 53.0 points for the services PMI. Net job creation is expected to decrease significantly for the job market, from 336 thousand new positions in September to 188 thousand in October. The country's indicators have surpassed analysts' estimates in recent months. New surprises may occur this week, reinforcing the interpretation that the Federal Reserve must keep interest rates higher for an extended period.

Copom interest rate decision

Expected impact on USDBRL: bearish

This week, the decision of the Central Bank of Brazil's Monetary Policy Committee (Copom) should also be highlighted. The Committee must reduce the basic interest rate (Selic) from 12.75% p.a. to 12.25% p.a., as anticipated in the last meeting. Since the decision of September 20, the external environment has become more challenging for implementing the strategy designed by the Brazilian monetary authority, with an increased aversion to international risks, a rise in US Treasury bond yields, and the beginning of the conflict in the Middle East. Therefore, investors will be attentive to the risk assessment carried out by Copom and whether the statement will maintain its signaling that it will maintain its pace of cuts for the Selic rate "in the next meetings."

Doubts about the budget target in 2024

Expected impact on USDBRL: bullish

The week may still reverberate with the words of the President of Brazil, Luiz Inácio Lula da Silva, last Friday (27), that the federal government will "hardly" meet the target proposed by the new fiscal framework for 2024 of a zero primary result, that is, primary revenues identical to expenses. In a press conference with journalists, the president's statements resonated negatively among market agents, as the Budget Guidelines Law (LDO) for 2024 has not even been voted on in the National Congress and already represents resistance from the leader of the Planalto in seeking alternatives to achieve the goals worked on by the economic team. Lula praised Haddad's willingness but stated that he did not want to cut investments and infrastructure projects and referred to the 'market' as 'too greedy.'

BoE and BoJ interest rate decision

Expected impact on USDBRL: bullish

The monetary policy decisions of the central banks of England and Japan will also mark this week. In both cases, the basic interest rates are expected to remain unchanged but in very different contexts. The English central bank must maintain its rate at 5.25% p.a. after a long cycle of monetary tightening, still facing higher inflation rates than desired, although recently falling, admitting that the risks of an economic recession should be its priority at this time. Additionally, the first preview of the eurozone's Gross Domestic Product should reinforce the perception of economic stagnation on the continent. The Japanese monetary authority has not made an interest rate adjustment since 2016, when it reduced its basic rate to -0.10% p.a., and faces questioning from analysts due to a significant weakening of its currency in 2023.

Data on the Chinese economy

Expected impact on USDBRL: bearish

This week, the Purchasing Managers' Index (PMI) for industrial and services sectors in China will be released, with expectations of a slight improvement compared to the September reading. International investors are moderately more optimistic about the country's economic recovery after releasing some recent indicators that were better than anticipated, such as the Gross Domestic Product for the third quarter, the industrial production for September, and the retail sales for the same month. If the most favorable forecasts are confirmed, it should boost the performance of risky assets, such as stocks, commodities, and currencies of countries that export primary products, like Brazil.

Key Indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos (leonel.mattos@stonex.com), Alan Lima (alan.lima@stonex.com), and Vitor Andrioli (vitor.andrioli@stonex.com).

Translation by Rodolfo Abachi (rodolfo.abachi@stonex.com).

Financial editor: Paul Walton (paul.walton@stonex.com).