Bullish factors

- Minutes from the latest FOMC monetary policy decision should reinforce the interpretation that Federal Reserve authorities want to raise interest rates again in 2023 and pressure US Treasury bond yields, promoting risk aversion among investors and strengthening the USDBRL.

- September CPI for the United States may reinforce the perception that price moderation in the country is not occurring at a pace considered sufficient by the Federal Reserve, which may keep interest rates high for longer and contribute to strengthening the USDBRL.

Bearish factors

- Disclosure of the IPCA for September may reinforce the interpretation that the space for interest rate cuts by the Central Bank of Brazil is reduced, which, in turn, contributes to a more advantageous interest rate differential for Brazil and may contribute to attracting financial investments and strengthening the BRL.

- Inflation data and trade balance in China can reinforce the perception of an improvement in the country's economy in September and increase investors' appetite for risky assets, benefiting the BRL.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

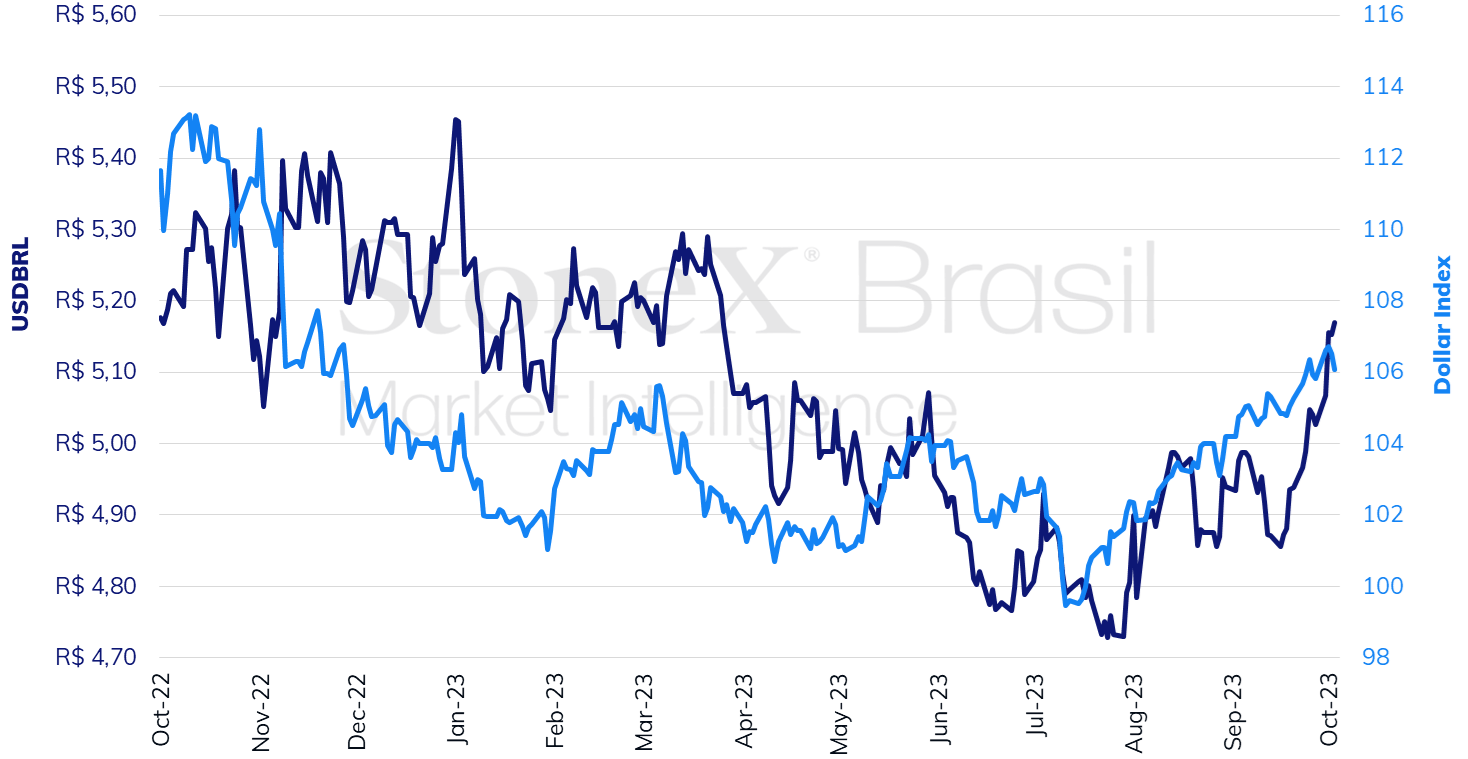

The USDBRL ended the week higher, closing Friday’s session (06) at BRL 5.1621, a variation of +2.7% for the week, +2.7% for the month, and -2.2% for the year. The dollar index closed higher for the twelfth consecutive week on Friday’s session, with a weekly gain of 0.3%, a monthly gain of 0.3%, and an annual gain of 2.7%. The foreign exchange market reacted to the continuous and sustained rise in US Treasury bond yields caused by heated data for productive activity and the labor market in the United States.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

THE MOST IMPORTANT EVENT: Minutes of the FOMC decision

Expected impact on USDBRL: bullish

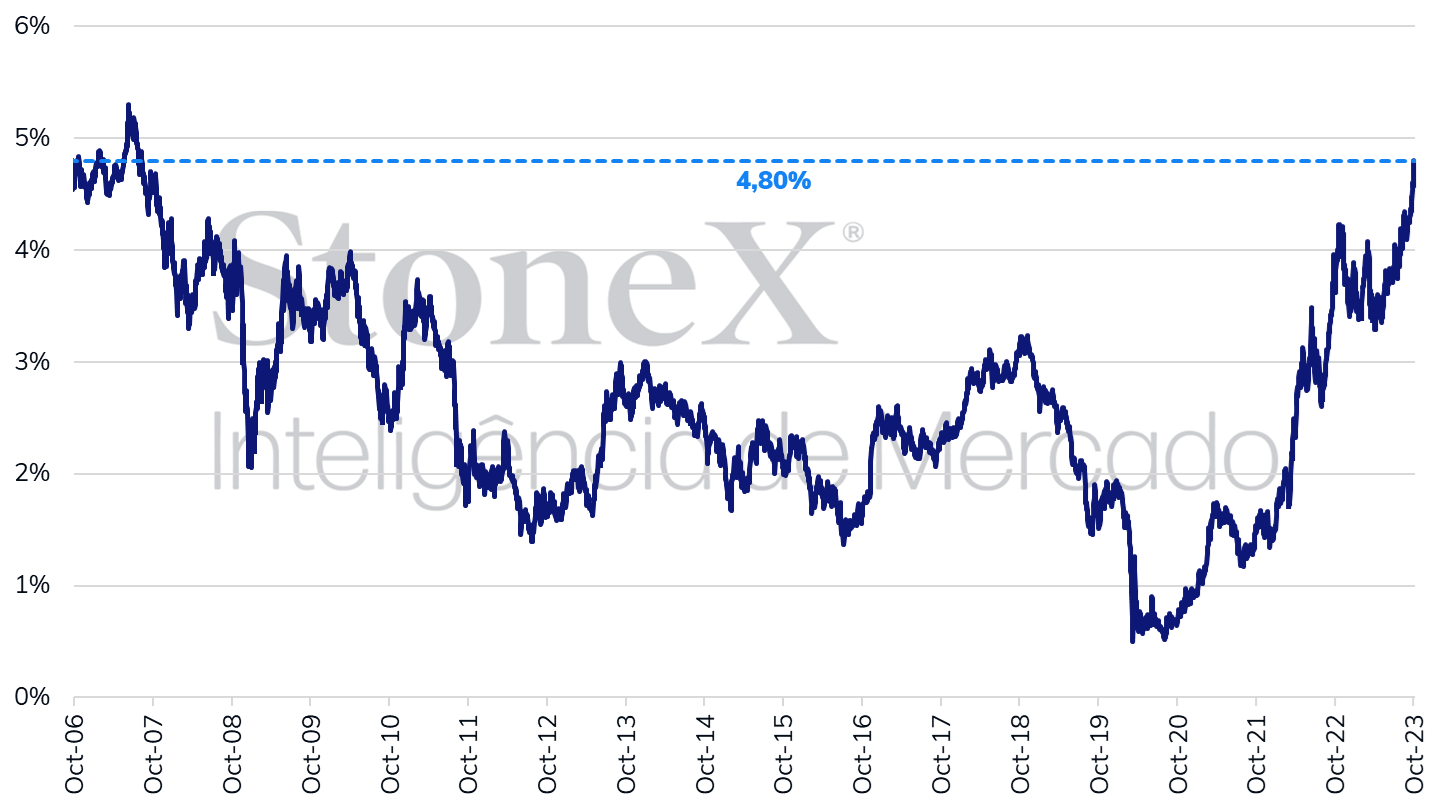

The focus of investors this week should be the release of the minutes from the last monetary policy decision of the Federal Reserve’s Federal Open Market Committee (FOMC). Since the FOMC decision, in which Fed members reaffirmed their more cautious stance towards inflation and the possibility of another interest rate hike in 2023, yields on US Treasury bonds have consistently risen due to the expectation that interest rates will remain higher for a longer period in the US. This expectation was reinforced with more positive data for productive activity and the job market, such as the Purchasing Managers’ Index (PMI) for industry and services in September, urban job creation in September, and the new job openings in August. This increase in interest rates occurs particularly in longer-term securities, such as those maturing in 10 years and 30 years.

This scenario is slowly changing the perspective of economic agents on the American economy. If until a few months ago, there was a perception that the country could have a “soft landing,” that is, stabilize its prices without a sharp slowdown in production or rapid increase in unemployment, the rise in US Treasury bonds to the highest level since 2007, the rapid increase in interest rates on government bonds – and their chain effects on other loan and financing interest rates for individuals and companies – has generated fears among experts that an economic crisis may effectively occur in the short term, either due to the recessive effect of high interest rates or the triggering of some adverse event, such as a financial crisis.

US 10-Year Treasury Yield (% p.a.)

Source: Refinitiv. Design: StoneX.

US September CPI

Expected impact on USDBRL: bullish

Another highlight of the week will be the release of the Consumer Price Index (CPI) for September in the United States. The analysts forecast that there will be a new moderate reading, just like in the last four months, especially in the "core" of the index, which excludes the volatile components of food and energy. However, this is a moment of increased stress in the American scenario, where the perceptions of a "soft landing" among economic agents are being revisited due to the sustained increase in US Treasury yields. The CPI will likely influence the global perception of the American economic conditions next month.

September IPCA

Expected impact on USDBRL: bearish

In Brazil, investors will monitor the release of the National Broad Consumer Price Index (IPCA) for September, with a median expectation of a 0.4% increase for the month and a cumulative increase of 5.3% over 12 months. Amid external stress caused by the increase in US Treasury yields, the rise in international oil prices, and the slowdown in European and Chinese demand, inflation data may have greater relevance than usual in determining the available space for the pace of cuts in the basic interest rate (Selic) by the Central Bank's Monetary Policy Committee (Copom). In just a few weeks, bets in the future interest rate market (DI) have increased the forecast for the basic rate at the end of the reduction cycle from 8.75% p.a. to nearly 10.75% p.a. on Friday (06).

Data on the Chinese economy

Expected impact on USDBRL: bearish

In the early hours of Thursday (12), the National Bureau of Statistics of China (NBS) will release data on the Consumer Price Index (CPI), Producer Price Index (PPI), and the country's trade balance, all referring to September. The data will allow for a more updated reading of the country's internal demand conditions after recent retail sales and industrial production data exceeded analysts' estimates, influencing the performance of risky assets such as commodities, stocks, and currencies of primary product exporting countries like Brazil.

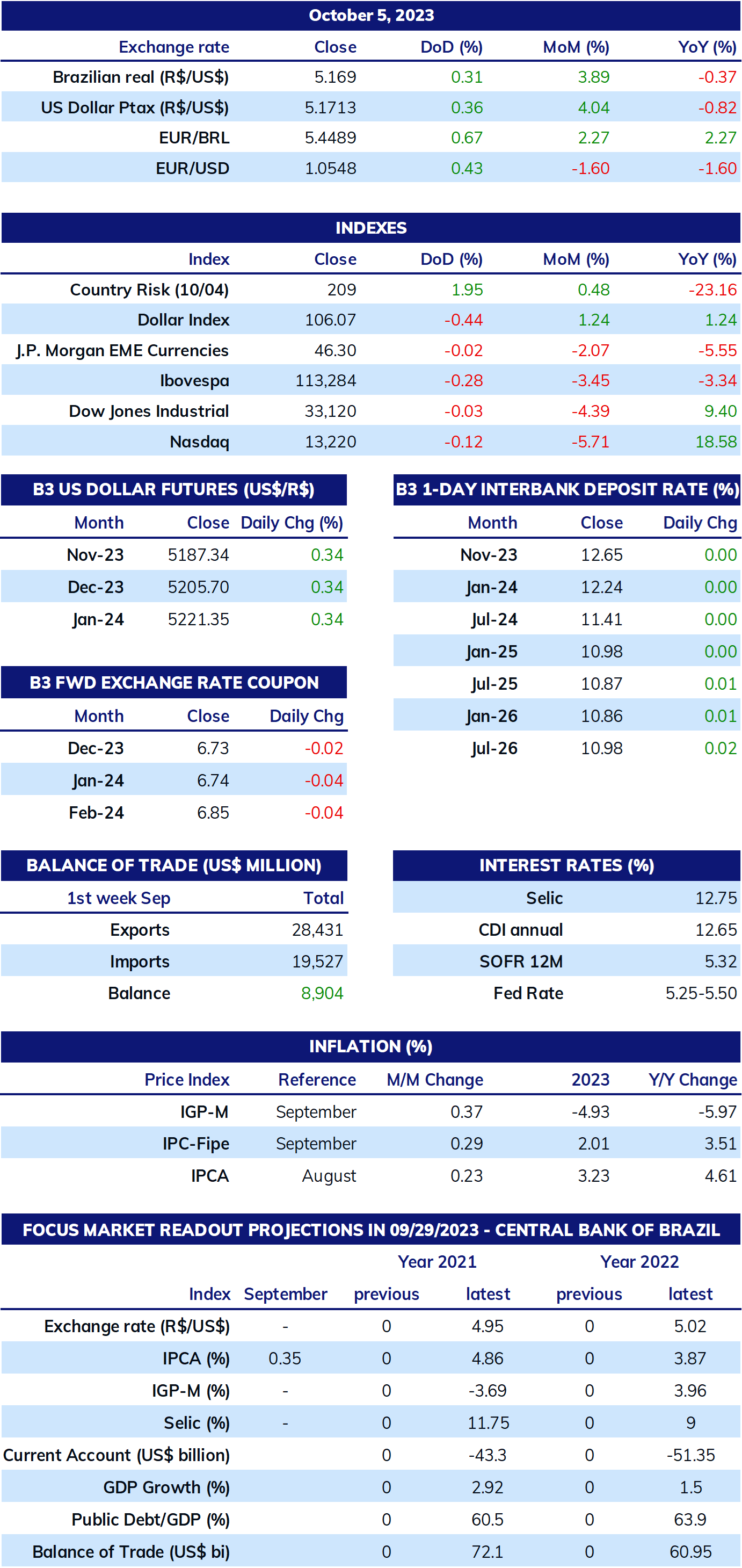

Key Indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos (leonel.mattos@stonex.com), Alan Lima (alan.lima@stonex.com), and Vitor Andrioli (vitor.andrioli@stonex.com).

Translation by Rodolfo Abachi (rodolfo.abachi@stonex.com).

Financial editor: Paul Walton (paul.walton@stonex.com).