Natalie Scott-Gray discusses risks of Russian growing exclusion from global Aluminium markets, specifically Glencore’s decision to cut ties in 2024, and President Biden’s policy focus: “The Russian aluminium industry is a key part of Russia’s defence industrial base and has played a major role in supplying Russia with weapons and ammunition used in the war,” he said. “In addition, Russia’s war against Ukraine has caused global energy prices to rise, causing direct harm to the United States’ aluminium industry.”

Aluminium markets are growing more bearish, especially given today’s headline that Glencore will cut tires with Rusal in 2024, so the belief is that a surplus of unwanted Russian material that might go on the LME stocks and further depress prices.

The White House acted in late February, announcing a 200% duty to Russian aluminium metal, products, and articles, in addition to doubling existing tariffs to 70% on other Russian exports of copper, nickel, lead, iron, iron ore, stell, ferroalloys and some rare earth metals. These tariffs apply to aluminium and derivates articles from March 10, before being applied to primary aluminium originating from Russia from April 10.

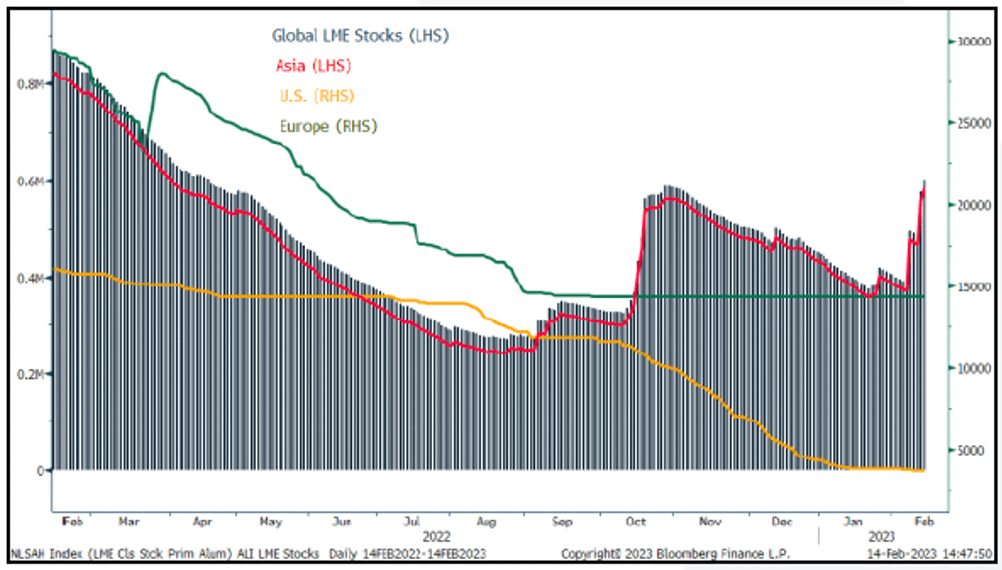

LME Primary Aluminium Stocks

Source: LME, StoneX.

Aluminium prices turned down on the Shanghai Futures Exchange (SHFE) and London Metal Exchange (LME)

Source: SHFE, LME and StoneX.

US tariffs were prompted by concerns that inflows of Russian metal into LME warehouses could distort the global benchmark price. Russian material made up 40% of LME stocks at the end of January, below previous highs over 70% in 2014. However, we believe the impact of sanctions on LME aluminium prices and the US domestic market will be limited, given that Russian imports make up just 3.5% of total imports into the US (its lowest level this decade), and the US can easily increase imports from Canada, China, and Mexico.

LME limits on accepting new primary aluminium copper, lead, nickel, or aluminium alloy in US warehouses will have a limited impact given that there is no Russian primary material held in these warehouses. The largest risk to our forecast would arise from an outright ban from the LME on Russian metal, something we believe to be improbable. News out of Glencore indicate how Russian supply is being squeezed out of the market.

Today Aluminium prices are $2,267 per ton is 5% down year-to-date. We believe that restrictions in Aluminium supply could prompt higher prices, ending the year at $2,600 per ton. Forecasts are provided by StoneX Financial Ltd. These forecasts represent the views of the StoneX Metals and Energy teams and not necessarily those of FOREX.com or City Index analysts.

Taken from an analysis by Natalie Scott-Gray, Senior Metals Analyst.

Contact: Natalie.Scott-Gray@StoneX.com