(Click to enlarge charts)

(Click to enlarge charts)

What happened earlier

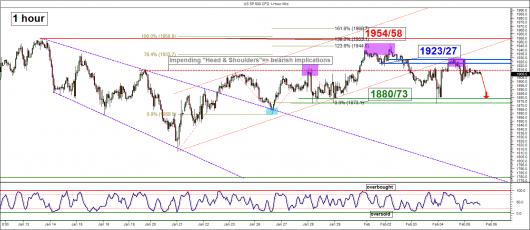

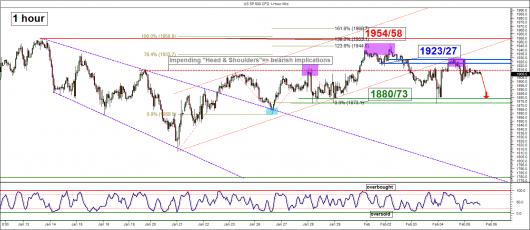

The U.S. SP 500 Index has tested the 1923/27 short-term resistance and staged a retreat to hit our short-term expected downside target at 1880/73. Thereafter, it staged swing back up towards the 1923/27 resistance.

Please click on this link for a recap on our previous daily outlook/strategy.

Key elements

- Even though, the U.S. SP 500 Index is still holding above its 1873 medium-term pivotal support but intermarket analysis does not give credit to see the continuation of similar mean reversion rally that started from the 21 January 2016 low. The Nikkei 225, DAX & Hang Seng has all broken below their respective medium-term pivotal supports as per highlighted in our weekly outlook/strategy at the start of this week.

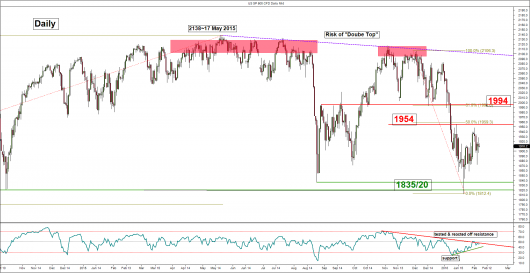

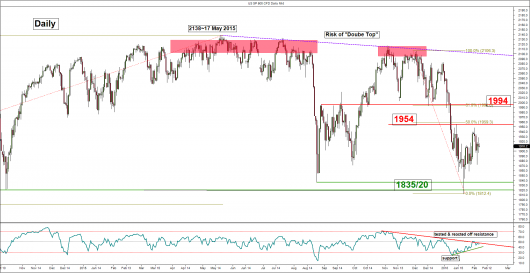

- Right now, the Index has traced out an impending bearish toppish chart configuration called, “Head & Shoulders” (as depicted by the pink boxes) with its neckline support at 1880/73. This type of chart configuration precedes a change in sentiment from positive to negative.

- A break below the neckline support at 1880/73 is likely to open up scope for further downside towards its potential exit target at 1813 (the distance taken from the highest point of the configuration, the “Head” to the neckline support and minus the difference from the neckline support.

- Interestingly, the 1813 exit potential confluences closely with the 21 January 2016 swing low at 1811 which is also the neckline support of a longer-term bearish “Double Top” configuration (see daily chart).

- The advance seen in the daily (medium-term) RSI oscillator has been capped by its trendline resistance.

Key levels (1 to 3 days)

Pivot (key resistance): 1923/27

Support: 1880/73 & 1813

Next resistance: 1954/58

Conclusion

Today’s release of the key Nonfarm Payrolls data for January 2016 should offer some clarity in the price action going forward. Nevertheless from a technical analysis perspective, we are watching closely the 1923/27 short-term pivotal resistance to see a potential swing down move to retest the medium-term pivotal support at 1880/73. Only a clear break below 1880/73 may open up scope for a further decline towards 1813.

However, a clearance above the 1923/27 pivotal resistance is likely to invalidate the bearish scenario for a push up to target the next resistance at 1954/58.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.