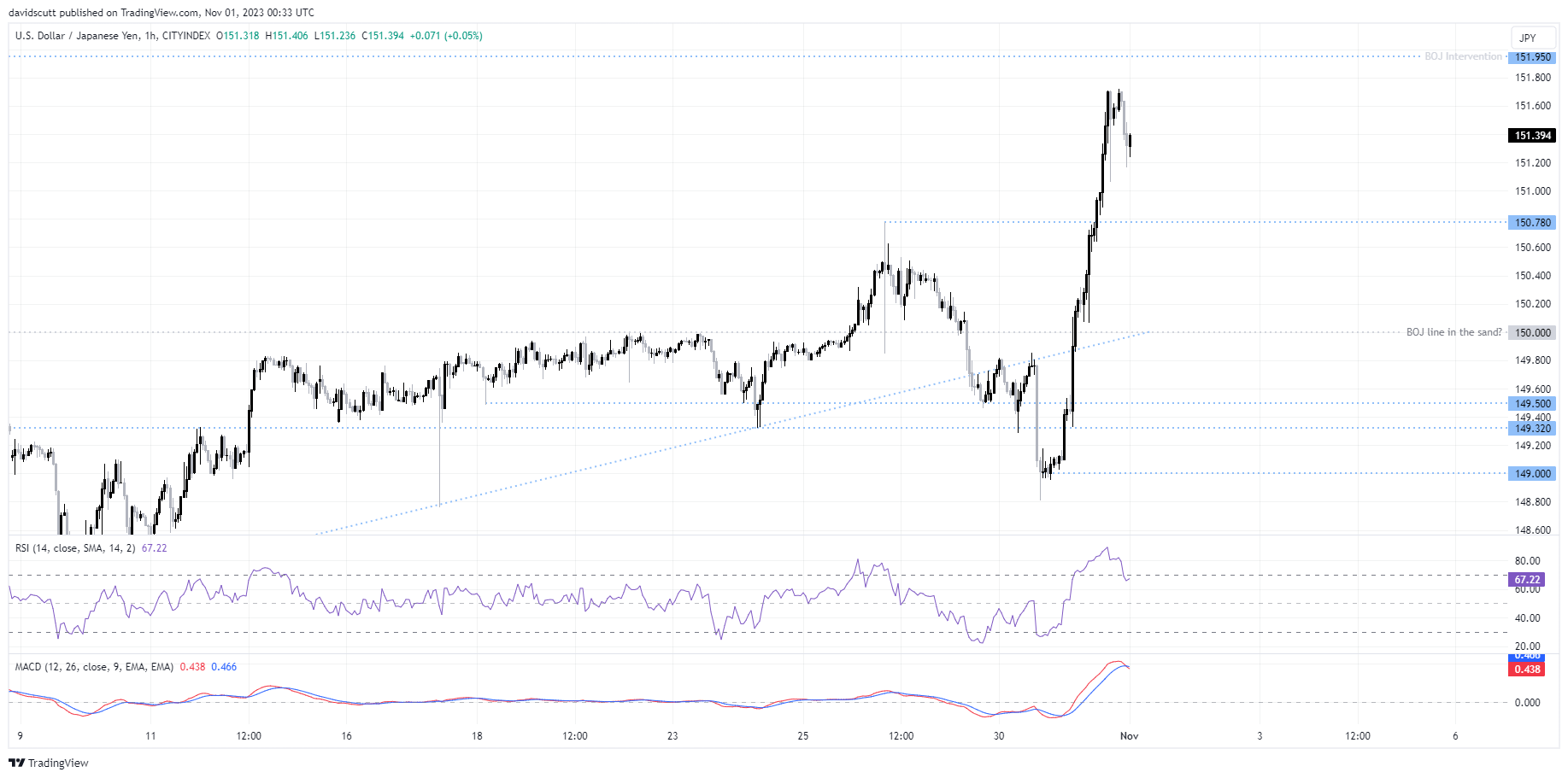

- Both the Nikkei 225 and USD/JPP have surged since the BOJ October monetary policy decision on Tuesday

- Japanese officials have warned there will be little tolerance for market moves deemed to be driven by speculative forces

- Further gains in USD/JPY may trigger a more forceful response from the Japanese government

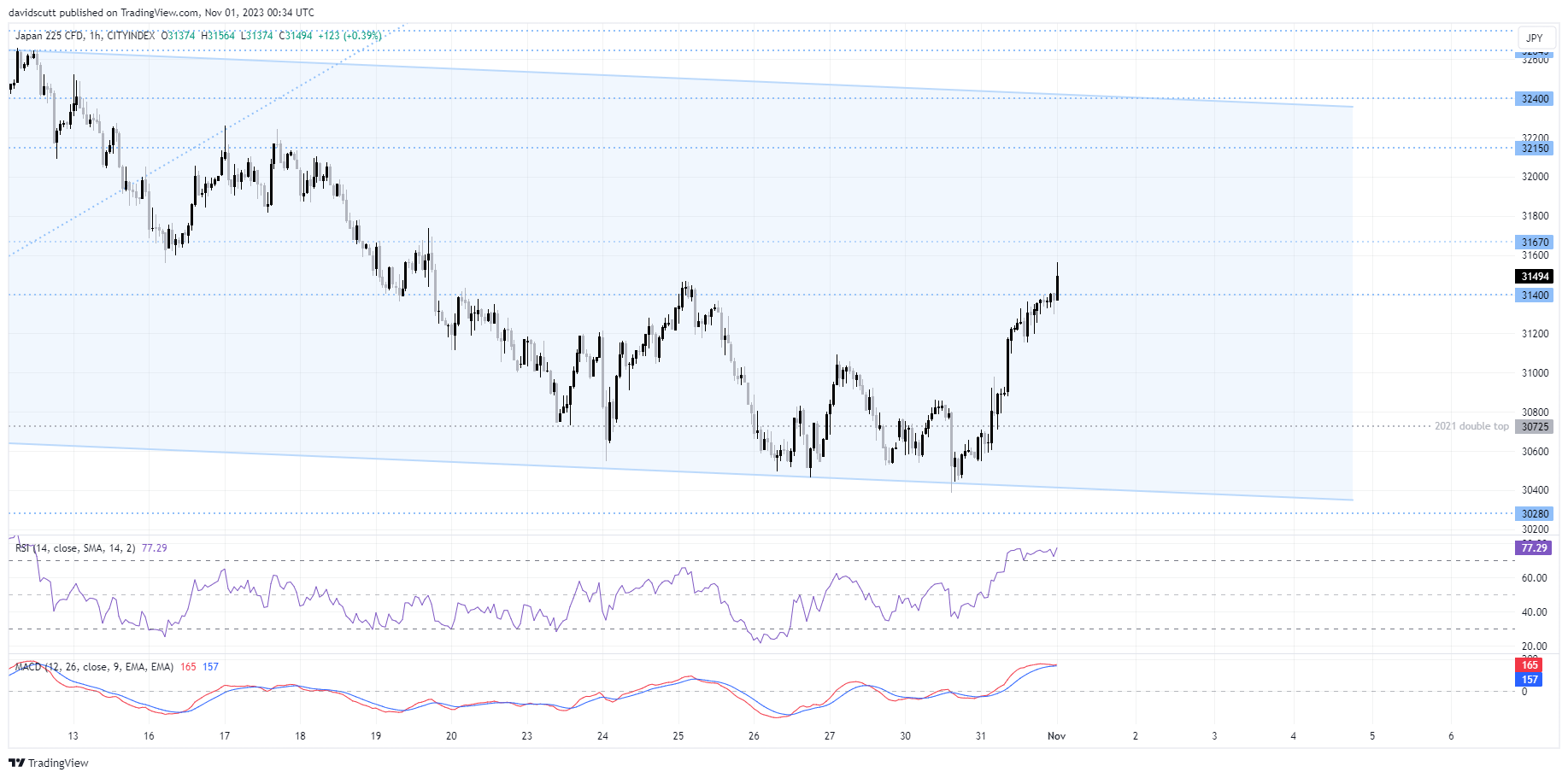

Japan’s Nikkei 225 has endured a whirlwind 24 hours, mirroring the USD/JPY in the wake of the Bank of Japan’s (BPJ) October monetary policy meeting. It’s surged more than 1000 points from the lows hit on Tuesday, largely reflecting stiffening tailwinds for Japanese exporter earnings thanks to the rapid depreciation in the Japanese yen, especially against the US dollar.

BOJ, MOF warn on speculative market moves

However, extrapolating near-term trends may be fraught with danger in this headline-drive market with Japanese officials wasting little time in expressing their displeasure at the speed of the yen’s unravelling. Masato Kanda, Japan’s vice finance minister for international affairs, has been the most vocal critic so far.

"Speculative trading seems to be the biggest factor behind recent currency moves," Kanda told reporters, adding authorities will "respond appropriately without ruling out any options". Ominously, he warned the situation has become “more tense” because of recent moves.

The use of “speculative trading” may have been specific given Bank of Japan (BOJ) Governor Ueda suggested yesterday that policymakers may allow more flexibility for market moves deemed not to be driven by speculative forces.

With Kanda and Ueda using similar terminology, it suggests tolerance for further upside in USD/JPY may be limited beyond that already seen. If that proves to be the case, it may also limit upside in the Nikkei 225.

Nikkei 225 enjoying weaker JPY

Having broken resistance at 31400 on the resumption of physical trade, bulls will be eyeing off a test of 31670. But given the potential risk of FX intervention, buying up here is risky in the near-term, as is the case for USD/JPY. There could be upside, but with one swift move the BOJ could change the picture entirely, depending on what Japan’s Ministry of Finance instructs it to do. Adding to warning signals, RSI is extremely overbought on the hourly chart. MACD is also about to cross the signal line from above.

Those considering shorts could wait to see what happen if the Nikkei 225 reaches 31670. A rejection at that level would allow for a tight stop to be placed above, providing protection against a continuation of the rebound. The obvious initial target would be the bottom of channel, currently found around 30400.

USD/JPY stalls ahead of multi-decade high

It’s a similar trade setup for those who think USD/JPY has run a little too hard too fast, adding to the risk of BOJ intervention. The pair topped out around 151.70 overnight, just 15 pips away from the multi-decade high of 151.95 hit last year. Shorts around the overnight high, with a stop above 152, is one option for a potential short trade with an initial target of 150.78, the highs set last month.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade