(Click to enlarge chart)

(Click to enlarge chart)

What happened yesterday/earlier

In our previous short-term daily outlook/strategy published last Friday, 11 March 2016 (click here for a recap), we maintained our bullish bias on the Japan 225 (proxy for the Nikkei 225 futures) for the potential last push up scenario in this second phase of the countertrend rally.

The Index has continued to push up as expected and it surpassed the 05 March and 10March 2016 similar minor swing high area at 17100/17200 (printed a high of 17315 in yesterday’s U.S. session).

The Index is now consolidating its earlier gains as it awaits for the Bank of Japan (BOJ)’s latest monetary policy decision out at later at 11.00am (Singapore time)/0300 GMT. Majority of the market participants are expecting no change in policy after the surprise cut in policy interest rate to -0.1% in the previous meeting. The key emphasis will be on the statement and press conference for any highlights of the next possible cut in the policy interest rate as well as any desire to increase the purchase of government bonds, exchange traded funds and Japanese real estate investment trusts.

Key elements

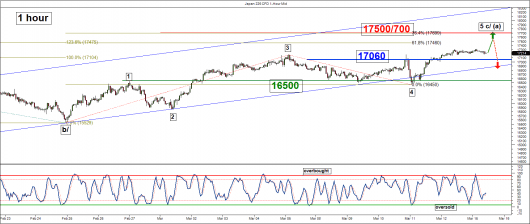

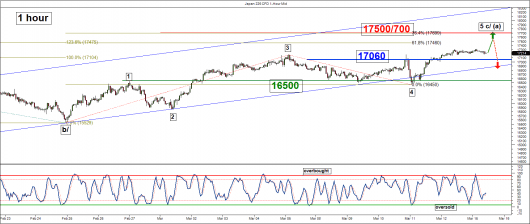

- Based on the Elliot Wave principal and in conjunction with other technical elements, the Index is now likely to be undergoing the final upleg for the wave 5 of c/ to complete a three waves countertrend rally labelled as (a) that started from 12 February 2016 low of 14782 with a potential end target set at 17500/700 as defined by a Fibonacci projection cluster (click here for more details as per highlighted in our latest weekly outlook/strategy published yesterday).

- The hourly (short-term) Stochastic oscillator has just turned up from the oversold region and still has some room left for further potential upside before reaching its extreme overbought level. This observation suggests that upside momentum (short-term) of price action has started to resurface.

Key levels (1 to 3 days)

Pivot (key support): 17060

Resistance: 17500/700

Next support: 16500

Conclusion

We are maintaining our bullish bias for that expected last push up towards the 17500/700 resistance holding above the tightened short-term pivotal support at 17060. Thereafter, the Index faces the risk of a potential steep decline as it completes the countertrend rally cycle, wave (a) that started from 12 February 2016 low of 14782.

However, a break below the 17060 short-term pivotal support is likely to invalidate the last push up scenario to trigger the start of the steep decline towards the 16500 support in the first step.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.