(Click to enlarge charts)

(Click to enlarge charts)

What happened earlier

The Japan 225 (proxy for the Nikkei 225) has staged the expected “relief rebound” and hit the upside target at 17770/17820 on 23 September 2015 @3pm.

Thereafter, it has tumbled towards the weekly support at 17160 (printed a low of 17170 on 24 September 2015 @11pm) before staging a recovery in the late U.S. session.

Please click on this link for a recap on our previous daily outlook.

Key elements

- Yesterday’s price decline has managed to hold just above the 17160 weekly pivotal support which is also the “Black Monday”, 24 August 2015 low (click here for more details on our weekly outlook highlights).

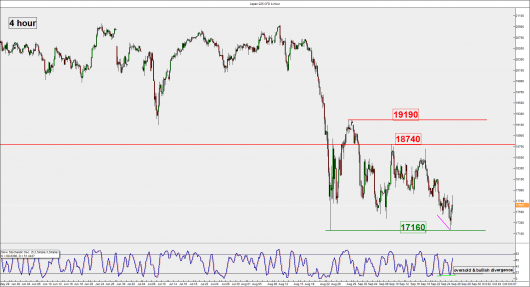

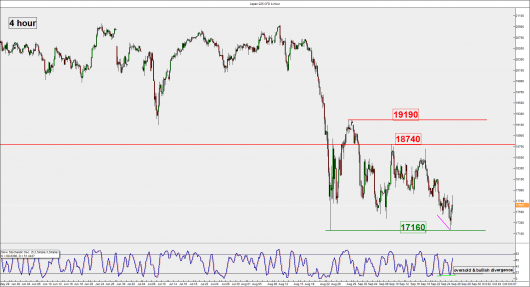

- The 4 hour (short-term) Stochastic oscillator has continued to trace out a bullish divergence signal despite yesterday’s “lower lows” seen in the price action of the Index. This observation suggests that the current downside momentum has abated.

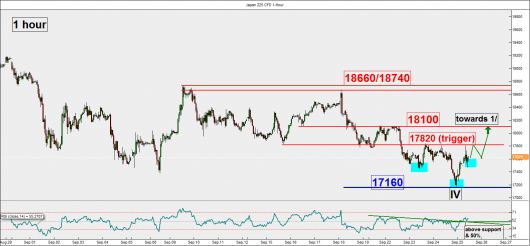

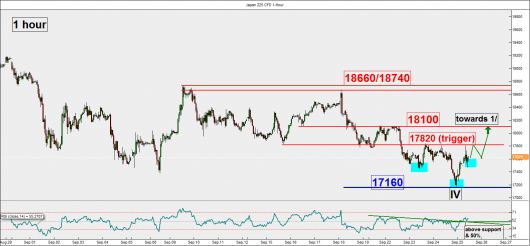

- On the 1 hour chart, the price action has traced out an impending bullish “Inverse Head & Shoulders” chart configuration (as depicted by the shaded light blue boxes) with neckline resistance at 17820.

- The hourly (short-term) RSI oscillator has broken above its former trendline resistance now turns pull-back support and the 50% neutrality level. This observation suggests that short-term upside momentum has resurfaced.

Key levels (1 to 3 days)

Pivot (key support): 17160 (weekly pivot)

Resistance: 17820 & 18100

Next support: 16400

Conclusion

Technical elements have indicated that the downside momentum of the current decline from 09 September 2015 high has abated. The Index now needs to break above the 17820 intermediate resistance (neckline of the “Inverse Head & Shoulders”) to trigger a potential rally towards 18100 in first step.

On the contrary, failure to hold above the 17160 weekly pivotal support is likely to invalidate the expected recovery scenario for a deeper decline towards the next support at 16400.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.