(Click to enlarge charts)

(Click to enlarge charts)

What happened yesterday

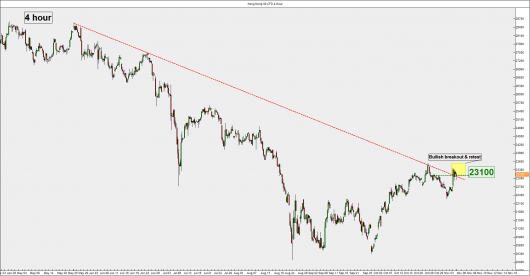

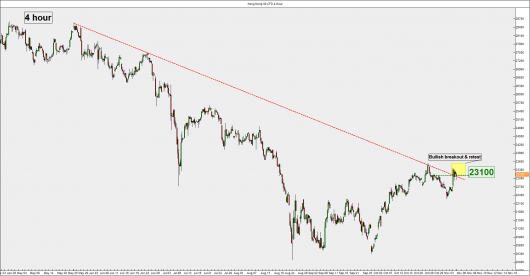

The Hong Kong 40 Index (proxy for the Hang Seng Index) has shaped the expected minor pull-pack towards the key short-term support zone at 23100/22880 before a rebound took place in this morning session, 05 November 2015

Please click on this link for a recap on our previous daily outlook/strategy.

Key elements

- Current price action has managed to hold above the pull-back support of the short-term ascending channel bullish breakout and formed an hourly bullish “Hammer” candlestick pattern which indicates a potential bullish reversal in price action.

- The hourly (short-term) Stochastic oscillator that gauges momentum has just exited from its oversold region which suggests a revival in upside momentum.

- The next intermediate resistance stands at 23530 which is defined by the swing high of 23 October 2015 and the 3.61.8 Fibonacci projection from 02 Nov 2015 low @9am to 02 Nov 2015 high @11am projected from the 02 Nov 2015 low @3pm.

Key levels (1 to 3 days)

Pivot (key support): 22880

Resistance: 23530

Next support: 22530 & 22260/22180 (weekly pivot)

Conclusion

Short-term technical elements are still positive and as long as the 22880 daily pivotal support holds, the Index is likely to shape a further push up to target the 23530 resistance in the first step.

On the other hand, a break below the 22880 pivotal support is likely to see a “bull-trap” (failure bullish breakout) for another round of decline to test the next support at 22530 before the key 22260/22180 zone (pull-back support of the ‘Double Bottom” bullish breakout).

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.