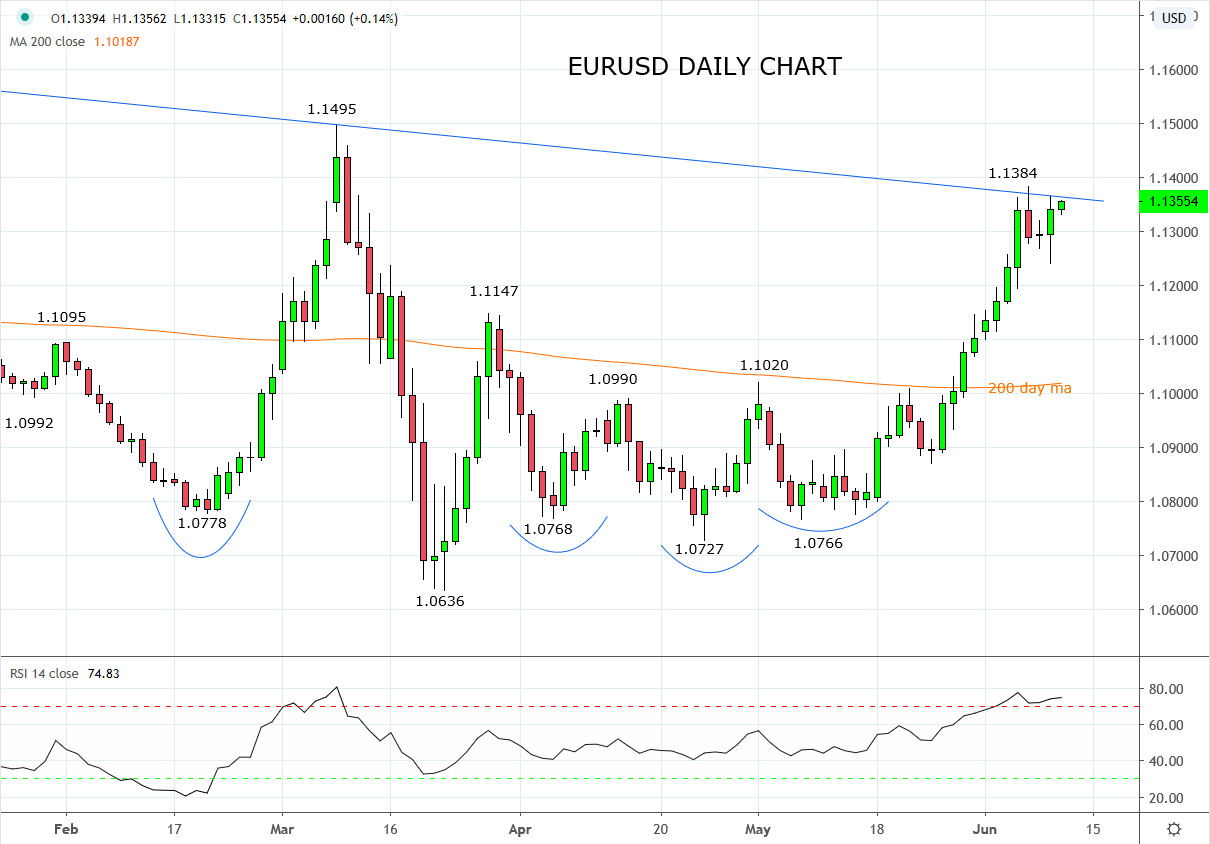

However, such is the strength of the dominant U.S. dollar downtrend, that by the time the Asian market walked in this morning, the EURUSD had rallied back to close near cycle highs. Perhaps aided by upbeat comments on the EU Recovery Fund from the German Finance Minister who said the “everyone has the will to reach an agreement within a short time” following constructive conversations with members of the “frugal four” Austria, Denmark the Netherlands and Sweden.

As noted recently here the EU Recovery Fund if agreed upon is a symbolic first step towards fiscal union, the lack of which is been seen as the EU’s and the Euro's “Achilles heel”. At the same time, the U.S. dollar has fallen dramatically out of favour, much as it did following U.S President Trumps Tax cuts in late 2017 that sparked concerns over the “twin deficits”.

This time around it is a combination of social unrest, mismanagement of the COVID-19 pandemic, ballooning deficits and other political decisions that have sparked fears the U.S. dollars status as the reserve currency of the world is under threat.

This has suited out bullish bias in the EURUSD and the recent break above resistance at 1.1150 was confirmation the next leg higher was underway and the catalyst to re-open longs in the EURUSD.

“To this effect, I am watching for a break and daily close above 1.1150 to confirm the breakout and that the next leg higher is underway towards the year to date highs 1.1500 area. In this instance, consider opening a long EURUSD trade with a stop loss placed 25 pips below the 200 days moving average, currently at 1.1010.”

Presuming the FOMC meeting tomorrow morning (4.00 am Sydney time), does not unveil any surprises we would view a sustained break of the downtrend resistance 1.1360/90 (coming from the February 2018, 1.2555 high) as a signal the next leg higher in the EURUSD towards 1.1500 is underway.

The stop loss on EURUSD longs opened on the break above 1.1150 should be placed just below yesterday's low 1.1235 area, ensuring a small profit on the trade, if the trailing stop is reached.

Source Tradingview. The figures stated areas of the 10th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation