US futures

Dow futures -0.75% at 39240

S&P futures -0.70% at 5203

Nasdaq futures -0.96% at 18106

In Europe

FTSE -0.11% at 7957

Dax -0.60% at 18376

- Treasury yields rise to a near 4-month high

- US JOLTS jobs openings & Fed speakers in focus

- Insurers fall as margins are expected to remain tight

- Oil rises to a 5-month high

Treasury yields rise to a near 4-month high

US stocks point to a weaker open, extending losses from the previous session after robust manufacturing activity data hurt expectations for the Fed's early interest rate cut.

Yesterday, US ISM manufacturing unexpectedly rose into expansion territory after 16 months of contraction. This hurt the probability of a Fed rate cut in June to 62%, down from 70% a week ago.

Attention will remain on the US economic calendar, with factory orders and jolts job openings due later. The figures are expected to highlight the US economy's ongoing resilience.

Meanwhile, Fed speakers will also be under the spotlight with commentary from New York Fed President John Williams, Cleveland Fed President Loretta Mester, and San Francisco President Mary Daly, who could provide fresh clues over the timing and scale of Fed rate cuts this year.

Their comments come as U.S. treasury yields rise, triggered by stronger PMI data from China and the US and rising oil prices. This highlights expectations that inflation could be challenging to return to the Fed's 2% target and could prevent U.S. stocks from booking further gains.

This week, attention will be on the US nonfarm payroll, which could provide further clarity over whether the Federal Reserve will cut rates in June or may push out rate cut expectations to July.

Corporate news

United Health is set to open over 4% lower, and CVS Health is on track for 5% losses after the Centre for Medicare and Medicaid Services announced unchanged reimbursement rates for Medicare Advantage health plans. This suggests that insurers' margins will stay under pressure next year.

Nio ADR fell 2.2% after Barclays downgraded its stance on the EV manufacturer to underweight from equal weight, citing weaker March sales.

GE slumped 20% as the industrial conglomerate completed its breakup into three companies. Its aerospace and energy businesses started trading on the New York Stock Exchange as separate entities a year after the health business spin-off.

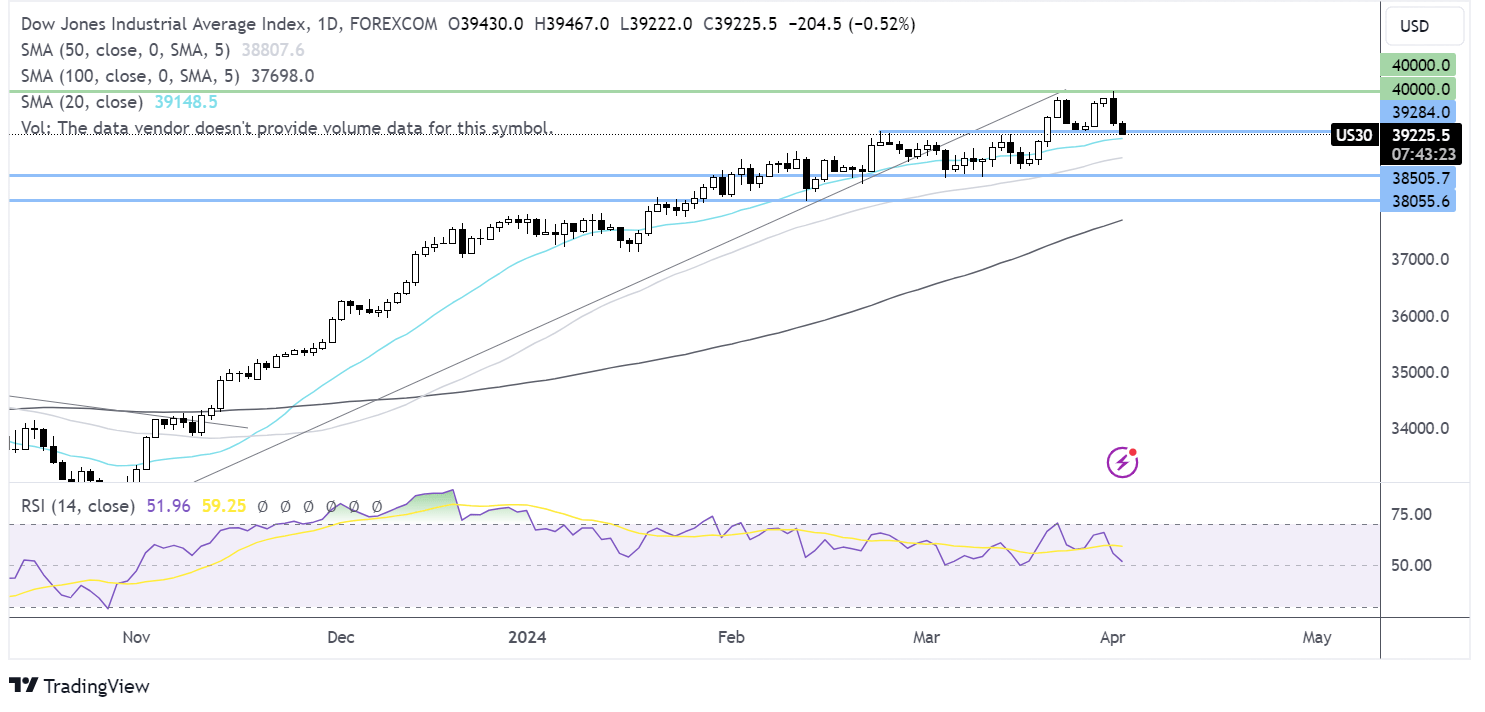

Dow Jones forecast – technical analysis.

After being a whisker away from 40,000, the Dow has fallen sharply and is now testing 39284, the February high, and 39150, the 20 SMA. A break below here opens the door to 38450, the March low. Should buyers successfully defend the 39284 level, buyers could look to push the price back to 40,000.

FX markets – USD rises, EUR/USD falls

The U.S. dollar is easing after spiking above 105.00 in the Asian session, rising to a 4.5-month high after US ISM manufacturing data returned to growth after 16 months of contraction. The stronger data supports the view that the Fed will keep interest rates high for longer.

EUR/USD is inching higher but struggles around a six-week low after the UK's eurozone manufacturing PMI fell to 46.1, down from 46.5, marking the 21st straight month of contraction. Meanwhile, German manufacturing PMI contracted at a faster pace at 41.9 in March, down from 42.5, marking a 5-month low. Factory gate prices also fell by the most in five months. Separately, German inflation cooled to 2.2%, in line with forecasts. Cooling in inflation suggests that the ECB could start cutting interest rates as soon as June.

GBP/USD is inching higher after UK manufacturing PMI rose above 50 for the first time since July 2022, suggesting that the downturn in the UK economy could be short-lived. Business optimism rose to an 11-month high and there were other signs of stabilization in the survey. Meanwhile, according to the BRC, UK shop inflation fell to ease to 1.3%, its lowest level since 2021, raising expectations that the Bank of England could soon cut interest rates.

Oil rises to a 5-month high.

Oil prices rose to a five-month high on optimism that economic growth in the US and China will boost demand while supply remains tight amid OPEC output cuts and ongoing attacks on the Russian refineries.

Chinese manufacturing PMI data yesterday showed a return to growth in the sector, and the US manufacturing sector also grew for the first time in 1 1/2 years, fueling optimism that the world's largest crude oil consumer and importer will support demand.

Meanwhile, on the supply side, oil exporter Saudi Arabia is considering raising its official selling price in May for its Arab light crude. Such a move would indicate strong demand.

Meanwhile, OPEC+ will meet tomorrow, although this is not a full ministerial meeting, so no changes to production output are expected.

Separately, drone attacks from Ukraine on Russian refineries have reduced Russian fuel exports. Almost 1,000,000 barrels per day of Russian crude processing capacity is offline.