(Click to enlarge chart)

(Click to enlarge chart)

What happened yesterday

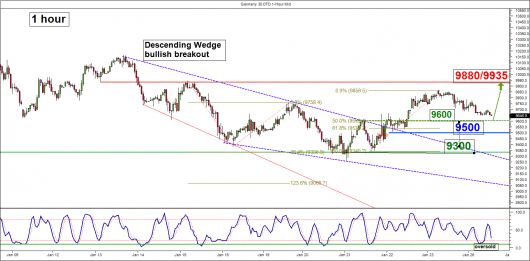

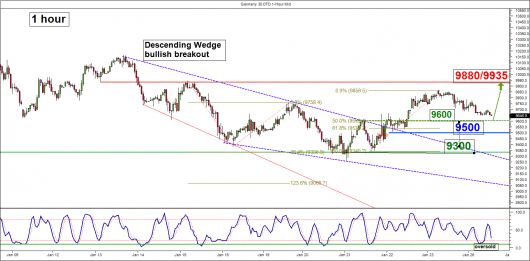

The Germany 30 Index (proxy for the DAX) has started to retrace/pull-back from Monday, 25 January 2016, Asian session high of 9860 (below the intermediate resistance zone of 9880/93335 as per highlighted in our latest weekly outlook/strategy, click here for details) in line with weakness seen in U.S. indices and WTI oil.

Key elements

- Overnight weakness have caused the Index to drift down towards the former minor congestion swing high area of 21 January to 22 January 2016 at 9600 which also confluences with the 50% Fibonacci retracement of the recent up move from 21 January 2016 low to 25 January 2016 high and 1.00 Fibonacci projection from 25 January 2016 high.

- The next significant short-term support rests at 9500 which is defined by the minor swing low area of 22 January 2016 @3am and the 61.8% Fibonacci retracement of the recent up move from 21 January 2016 low to 25 January 2016 high.

- The hourly Stochastic oscillator is now drifting back down towards its oversold region which suggests the current pull-back in price action is reaching a potential turning point for an upturn.

Key levels (1 to 3 days)

Intermediate support: 9600

Pivot (key support): 9500

Resistance: 9880/9935

Next support: 9300

Conclusion

As long as the current pull-back in price action is able to stall at 9600/9500 short-term support zone, the Index is likely to see a reversal to resume its potential mean reversion/ “snap-back rally” to target the 9880/9935 resistance zone in the first step.

On the flipside, failure to hold above the 9500 short-term pivotal support may see a further slide to retest the significant range support of 9300 from the swing lows area of 24 August 2015 and 29 September 2015 and now also the pull-back support of the “Descending Wedge” bullish breakout.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.