(Click to enlarge charts)

(Click to enlarge charts)

What happened yesterday/earlier

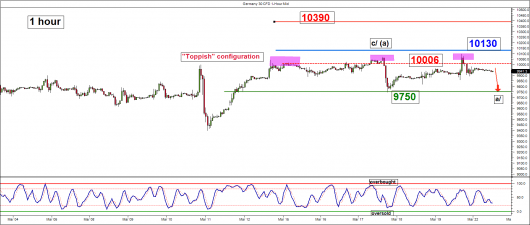

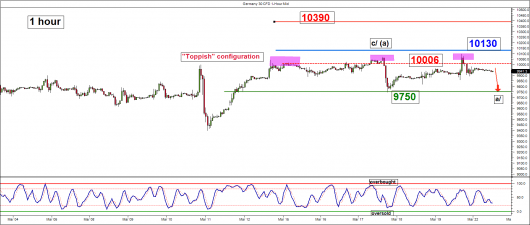

The Germany 30 Index (proxy for the DAX futures) has traded sideways below the 10130 medium-term pivotal resistance. Please click on this link for a recap on our latest medium-term outlook/strategy published yesterday.

Today, 22 March 2016, the DAX is likely to face a volatile trading session as we have a bunch of key economic data out later as follow:

1) IFO Business Climate & Expectations for Mar @0800 GMT

2) Markit Manufacturing & Services PMI for Mar @0830 GMT

3) ZEW Economic Sentiment Survey for Mar @1000 GMT

Key elements

- Yesterday’s initial push up in the Index towards the 10000 handle has fizzled out later as it traded back towards the 9980/9893 range. This latest price action has failed at the third attempt to have a clear bullish breakout above the 9930 rejection zone (in pink ovals) and formed a daily “Doji” candlestick pattern yesterday which indicates a lack of “bullish strength”.

- The Index has continued to evolve within a bearish “Ascending Wedge” configuration in place since the start of the countertrend rally from 11 February 2016 low with the upper boundary at 10130 and the lower boundary at 9750. This typical chart configuration indicates a sign of bullish exhaustion.

Key levels (1 to 3 days)

Intermediate resistance: 9930/10006

Pivot (key resistance): 10130

Supports: 9750

Next resistance: 10390

Conclusion

Technical elements are still toppish which indicates the risk of a further decline. As long as the 10130 medium-term pivotal resistance is not surpassed, the Index is likely to see a potential downleg to target the lower boundary of the “Ascending Wedge” at 9750 in the first step.

However, a clearance above the 10130 medium-term pivotal resistance is likely to invalidate the medium-term bearish view to see an extension of the countertrend rally towards the next resistance at 10390.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.