(Click to enlarge charts)

(Click to enlarge charts)

What happened yesterday

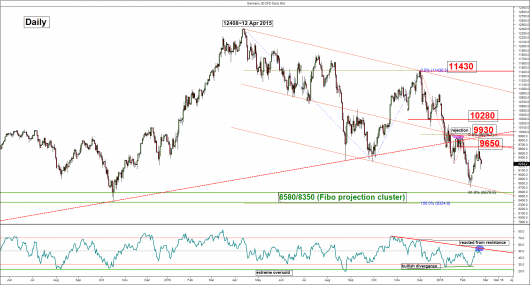

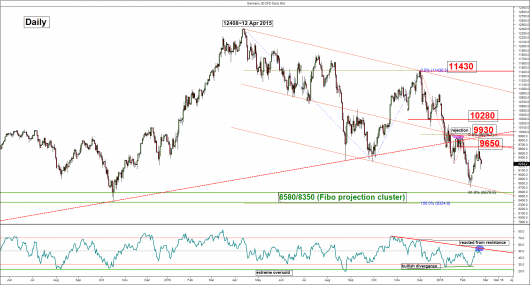

The Germany 30 Index (proxy for the DAX futures) has managed to pull-back as expected and hit the expected 9300 short-term downside target as expected.

Please click on this link for a recap on our previous daily outlook/strategy.

Key elements

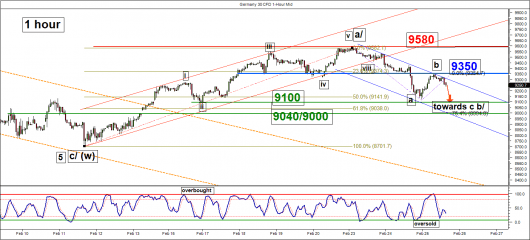

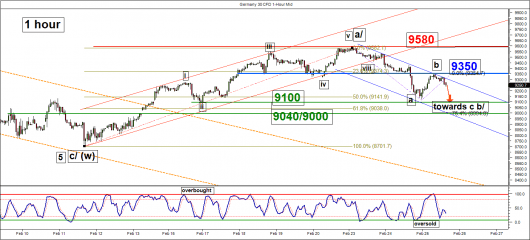

- Yesterday, price action has tumbled to hit at low 9123 in the late European session and staged a steep push up of 2.2% in the U.S. session in line with the recovery seen in WTI oil and the U.S. benchmark stock indices.

- In today’s Asian session, the Index has a positive follow through but stalled at the 9350 resistance. Interesting, the 9350 resistance is derived from a confluence of technical elements (the upper boundary of the short-term descending channel in place since 23 February 2016 high + 50% Fibonacci retracement of the down move from 23 February 2016 high and yesterday low of 9123 + the former swing lows area of 18 February 2016 and 19 February 2016 now turns pull-back resistance).

- Based on the Elliot Wave Principal, the Index is likely to have completed the bearish wave a at yesterday low of 9123. The on-going rebound seen is considered as a corrective wave b (relief rally) with the resistance at 9350 (the 50% Fibonacci retracement). Current price action is suggesting a potential start of the bearish wave c of b/ with potential end targets at 9040/9000 (a key Fibonacci cluster – 61.8% Fibonacci retracement of the rally from 11 February 2016 low to 23 February 2016 high + the 0.765 Fibonacci projection from 23 February 2016 high).

- The daily (medium-term) RSI oscillator is bearish as it just retreated from its descending resistance. In addition, the hourly Stochastic oscillator has turned down towards the oversold region which suggests a revival of downside momentum.

Key levels (1 to 3 days)

Pivot (key resistance): 9350

Supports: 9100 & 9040/9000

Next resistance: 9580

Conclusion

Technical elements in conjunction with the Elliot Wave Principal are suggesting the start of another potential downleg of this on-going pull-back/consolidation phase below the 9350 short-term pivotal resistance to target the 9100 support (our medium-term downside target for this week as per highlighted in our latest weekly outlook/strategy) with a maximum limit set now at the next support zone of 9040/9000 (a key Fibonacci cluster as abovementioned).

On the other hand, a clearance above the 9350 short-term pivotal resistance may invalidate the pull-back scenario to see a squeeze back up to retest the 23 February 2016 swing high area of 9580.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.