(Click to enlarge charts)

What happened yesterday

The German 30 Index (proxy for the DAX) has broken below the 10600 support (lower neutrality level) and hit the expected target at 10400/10370.

Please click on this link for a recap on our previous daily outlook.

Key elements

- The Index has broken below the 10600 level continued to plunge lower and it is now just above the next key long-term support at 10013.

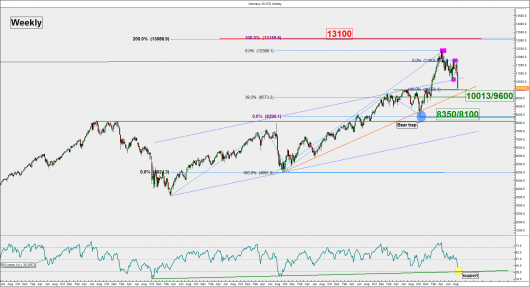

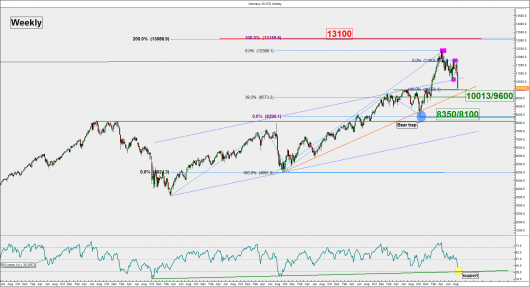

- This key 10013 support is defined by a long-term ascending trendline (in orange) joining the lows since 11 September 2011 which also confluences closely with the 1.00 Fibonacci projection from 05 April 2015 high to 12 July 2015 high (see weekly chart).

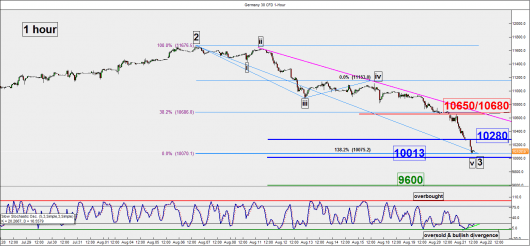

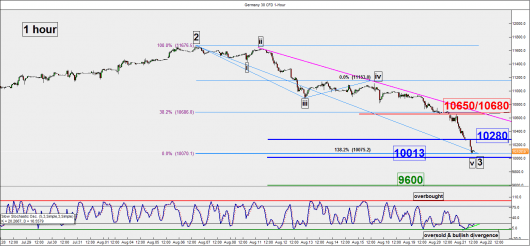

- On a shorter-term and based on the Elliot Wave Principal, the Index has traced out 5 down waves from the 06 August 2015 high @4pm with a 1.382 Fibonacci projection level that coincides with the current low of 10061 seen today, 21 August 2015 (see 1 hour chart).

- On the aforementioned observation, the Index appears to have completed a 5 down waves (i,ii,iii,iv &v) of a larger degree bearish wave 3 and a potential countertrend (up move-wave 4 ) is likely to occur at this juncture (see 1 hour chart).

- The short-term trendlline resistance (in pink) joining the highs since 11 August 2015 @4am stands at 10650 which also coincides closely with the 38.2% Fibonacci retracement from 13 August 2015 high to the current 21 August 2015 low at 10061 at 10680, a typical wave 4 target (see 1 hour chart).

- The hourly Stochastic oscillator has flashed a bullish divergence signal at its oversold region which suggests limited downside potential for the Index (see 1 hour chart).

Key levels

Support: 10013 & 9600

Resistance: 10280 & 10650/10680

Conclusion

The Index is coming close to its next key long-term support at 10013 and shorter-term technical elements (Elliot Wave & momentum indicator) are advocating for a potential countertrend upside movement at this juncture.

Only a break above the 10280 upper neutrality level is likely to add impetus for a potential countertrend rally to target the next resistance at 10650/10680.

On the other hand, failure to hold above the 10013 key support may see the continuation of the horrendous slide towards 9600 next.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.