(Click to enlarge chart)

What happened yesterday

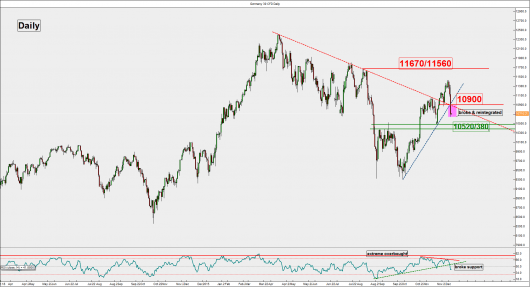

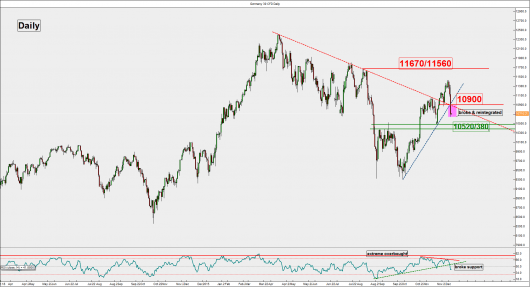

TheGermany 30 Index (proxy for the DAX) has broken below the 11130 weekly pivotal support and even pierced below the trendline support that has linked the higher lows since 29 September 2015 low.

The sell-off in global equities was caused by market expectation on the latest European Central Bank (ECB)’s monetary policy decision. The market was expecting a 15 to 20 basis points cut to interest rate on the deposit facility but ECB just reduced it by 10 basis points to -0.30%. In addition, Mr Draghi, the ECB’s central banker did not deliver the expected increase on its quantitative-easing bond buying programme but instead chose to maintain its current pace at 60 billion euros of eligible government bonds and extend the programme to end of March 2017 or beyond from the previous deadline of September 2016.

Key elements

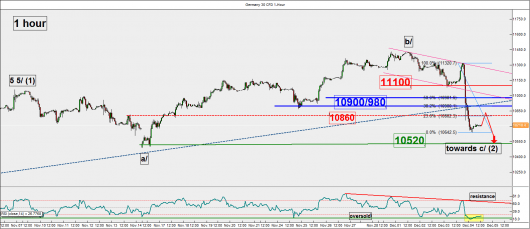

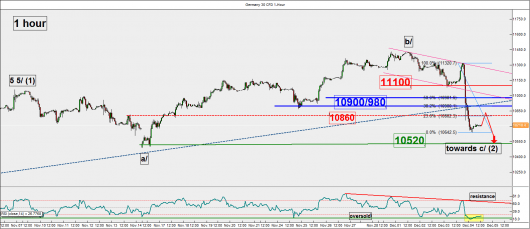

- Yesterday’s plunge in the price action has altered the technical picture for the DAX. The expected medium-term (1 to 3 weeks) upside movement is now put on hold as the initial over positioning of “long” positions established in the run-up to yesterday’s ECB meeting are being unwound.

- Price action has pierced below the trendline support (in dotted dark blue) that has linked the higher lows since 29 September 2015 and reintegrated back below the former pull-back support (in dotted red). All these trendlines concide at the 10900 level which is now acting as a resistance for the Index (see daily chart).

- The 10900 resistance also confluences closely with the 10980 level which is the 38.2% Fibonacci retracement of yesterday’s steep down move seen from 03 December 2015 high @6pm to today’s current low of 10639 .

- The next support rests at the critical zone of 10520/10380 which is the pull-back support of the “Double Bottom” bullish breakout (see daily chart).

- The hourly (short-term) RSI oscillator has dipped into its oversold region which suggests that the current downside momentum is being “overstretched” and a snap-back in price action is likely at this juncture.

Key levels (1 to 3 days)

Intermediate resistance: 10860

Pivot (key resistance): 10900/10980

Support: 10520

Next resistance: 11100

Conclusion

Technical elements have turned bearish in the short-term. Right now, any potential rebound in price action after yesterday’s steep decline is likely to be capped by the intermediate resistance at 10860 with a maximum limit set at the 10900/980 daily (short-term) pivotal resistance before another potential decline materialises to target the upper limit of the critical support zone at 10520.

Only a break above the 10900/980 pivotal resistances may negate the bearish tone to see a squeeze up towards the next resistance at 11100.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.