H2 Big Tech Outlook

Tech stocks took centre stage in the first half of 2023. Apple, Alphabet, Amazon, Meta, Microsoft, NVIDIA and Tesla – which collectively make up 55% of the Nasdaq 100 and almost 28% of the S&P 500 – outperformed the wider market and proved to be the propellant that pushed both indices to their highest level in over a year.

Some of this is thanks to the bounce back we have seen following the rout in tech stocks we saw in 2022, although some have recovered more swiftly than others. In fact, Apple and Microsoft both climbed to fresh all-time highs, as did Wall Street’s favourite AI stock NVIDIA, which tripled in value and joined the $1 trillion club.

The rally has also been supported by its wide appeal in the uncertain climate, attracting investors looking for wildly different things. The sector is not only appealing to those hungry for growth or exposure to AI and other breakthrough technologies, but also to those looking for a port in a potential storm as many of the largest players have bulging bank accounts, reliable cashflow and dependable earnings that will allow them to survive whatever is around the corner.

Big Tech: Rally will be tested in H2 2023

There is a wide valuation gap across Big Tech after some rallied quicker than others in the first half. Below is an outline of the price-to-earnings ratios of the seven largest members of the Nasdaq 100 based on estimates over the next 12 months, as per Bloomberg:

This means some may find it harder to justify their loftier valuations, especially those that are boasting a premium thanks to their prospects, in the second half of 2023. Others could become more attractive thanks to their discounts and recovery potential.

For example, there is a question about how many years of AI-driven growth have already been priced in at NVIDIA after seeing its value explode over $640 billion in just six months. Sometimes, the price of admission can be too high regardless of the ride that is on offer. At the other end, Meta and Alphabet still have a long way to go before returning to the highs we saw back in 2021 despite being far larger and more profitable today than before the pandemic hit, which could see them be due a rerate to close the gap and regain their premium if the advertising market rebounds as hoped.

Will Big Tech earnings rebound in H2 2023?

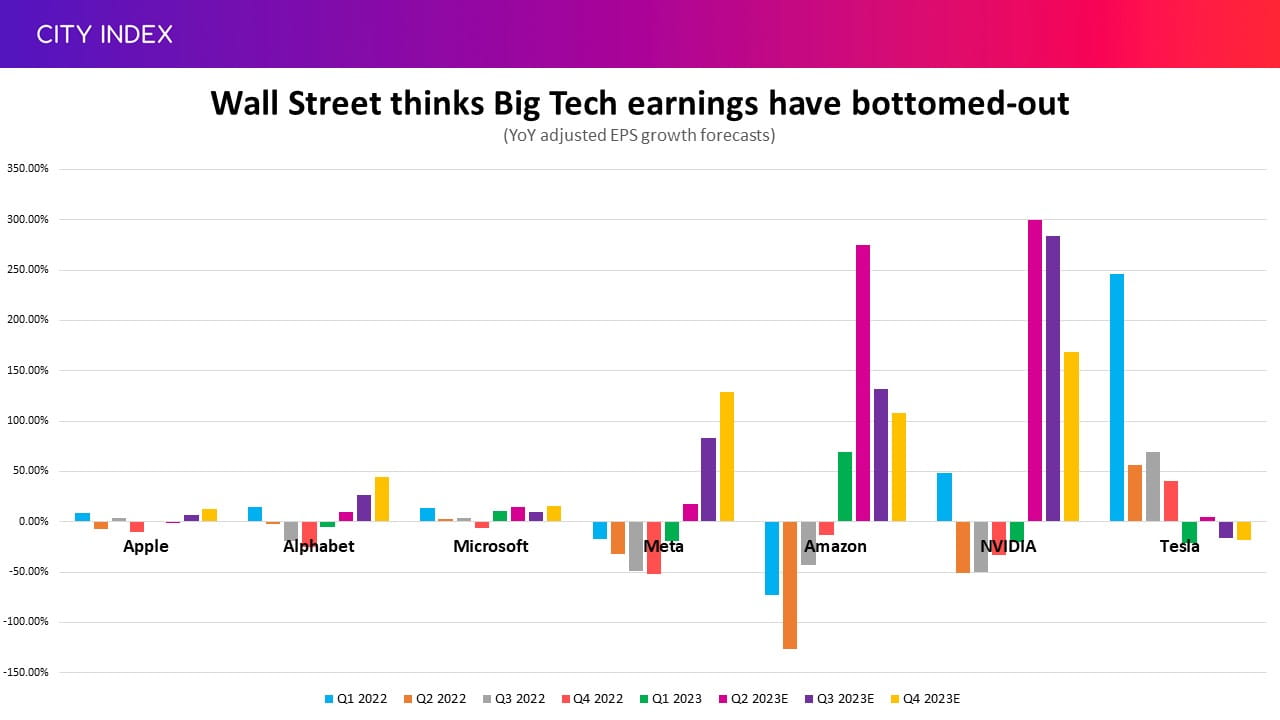

The reason for the valuation gap becomes more apparent when we look at expectations for earnings growth for the rest of this year.

Amazon and NVIDIA, with some of the highest premiums, are expected to deliver the fastest growth, while Apple and Microsoft’s multiples better reflect their more tepid forecasts. Alphabet and Meta sit somewhere in between on the growth scale, reinforcing the idea that their valuation multiples could rise in the second half.

The opposite is true for outlier Tesla, which enjoyed a better first half financially but is set to find things much tougher in the second. However, the stock continues to be driven more by its longer-term prospects compared to the rest of the group, and it has already unleashed new catalysts this year after opening up its charging network and boasting its AI credentials. Some analysts are starting to look at Tesla with a sum-of-parts valuation as it makes progress outside of making and selling cars and we believe this will remain a key theme for the company in the second half.

Wall Street has a rosier outlook for Big Tech earnings in the second half partly because the majority will be facing easier comparatives as most saw profits struggle in the second half of 2022. But analysts have been, generally speaking, lowering their earnings estimates for Big Tech this year and have incorrectly predicted their bottom lines would bottom-out in recent quarters – suggesting forecasts should be taken with a pinch of salt.

Plus, many of the issues that proved analysts wrong in the first half are still present as we enter the second, with markets still largely at the behest of the tough macroeconomic conditions – plagued by persistently high inflation driving up interest rates, which in turn is raising the risk of a recession. The outlook for the next six months looks more challenging than the last and the uncertainty ahead suggests the actual outcome for earnings is, if anything, geared more toward the downside than in the first half of the year.

Inflation, and the resultant monetary policy, will remain the key economic factor in the second half but hopes of a pivot from the Federal Reserve have been pushed into 2024. Other factors will include the pace of China’s economic recovery following a slower than expected start to 2023.

What is the outlook for AI stocks?

We can’t talk about Big Tech without discussing artificial intelligence. The breakthrough technology has become the hottest thing on Wall Street and, unlike the hype that we have seen over recent years about everything from the metaverse to NFTs, AI appears to have real-world solutions that are deployed today.

There is little doubt that AI will be a megatrend that won’t be going away anytime soon but it is very early days. We expect AI to be a bit of a rollercoaster for traders as some initial winners pull back and others come into the limelight as more products and use cases are explored, but this could present opportunities for long-term investors.

The pick-and-shovel stocks like NVIDIA that provide the critical hardware and infrastructure needed to power AI are set to be the biggest winners this year as companies upgrade their systems to handle the technology, while some of the larger players at the forefront of the market like Microsoft and Alphabet could also reap financial rewards. However, we believe AI won’t start meaningfully driving financial results for many in the broader tech space until 2024 and beyond as companies find their footing in what is proving to be a rapidly developing industry.

Conclusion

Big Tech came into its element in the first half and will continue to be key in deciding the fate of wider markets in the second.

The valuation gap across the sector should narrow in the second half as those with loftier price tags are tested and those trading at a discount are rerated. It should mark a turning point as easier comparatives allow earnings to return to growth, but the outcome will be highly dependent on how the economy performs given sticky inflation, rising interest rates and increased risks of a downturn – all of which are painting a more challenging backdrop for equities over the next six months.

Estimates have been falling this year and there are plenty of risks that could see them come down further. The risk-reward profile of equities has changed dramatically over the past six months. Tech stocks started 2022 at a low base and the economic situation was better (albeit far from rosy) but now the opposite is true, with much higher valuations and the economy under far more pressure. With that in mind, it is worth remembering that tech stocks tend to outperform in the good times and underperform during the bad.

Still, Big Tech will remain popular thanks to their size and ability to survive whatever is around the corner, twinned with the fact the group is primed to be among the biggest beneficiaries when conditions do finally start to improve.

AI remains a wildcard over the short-term but will undoubtedly remain supportive for share prices overall. Buckle up for a bumpy ride.

Please read the other reports in our H2 2023 Market Outlooks for insights on how these dynamics will impact specific markets that you may be trading and the key trends to watch moving forward.

Happy trading!

Written by Joshua Warner, Market Analyst

Follow Josh on Twitter @CityIndex_Josh