Trading UK sector indices

-

Take a broad view

Trade an entire sector of companies, with a single position

-

Range of indices

14 tradable indices, from Finance and Healthcare to Telecoms and Tech

-

Go long or short

Go long or short, with just 10% margin required

Sector indices explained

-

What are sector indices?

Sector indices are a basket of sector-related shares that provide an overview of the industry that they represent. -

Why trade UK sectors?

Speculate on industry-wide trends without having to take multiple equity positions, hedge your portfolio or express a directional view of a market. -

Trade as a spread bet or CFD

Trade UK sector indices as a CFD position, or spread bet to benefit from tax-free profits.

Our UK sector indices

How to trade indices

If you believe that an Index such as the FTSE 100 will rise, you can place a buy trade on City Index’s equivalent market, the UK 100.

If the prices rise, you will make a profit for every point that the index rises. If the market falls, then you will make a loss for every point the index moves against you. Our trading platform tells you in real-time how much profit or loss you are making.

With City Index you can trade indices as a spread bet or CFD. Learn more about how to trade indices.

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

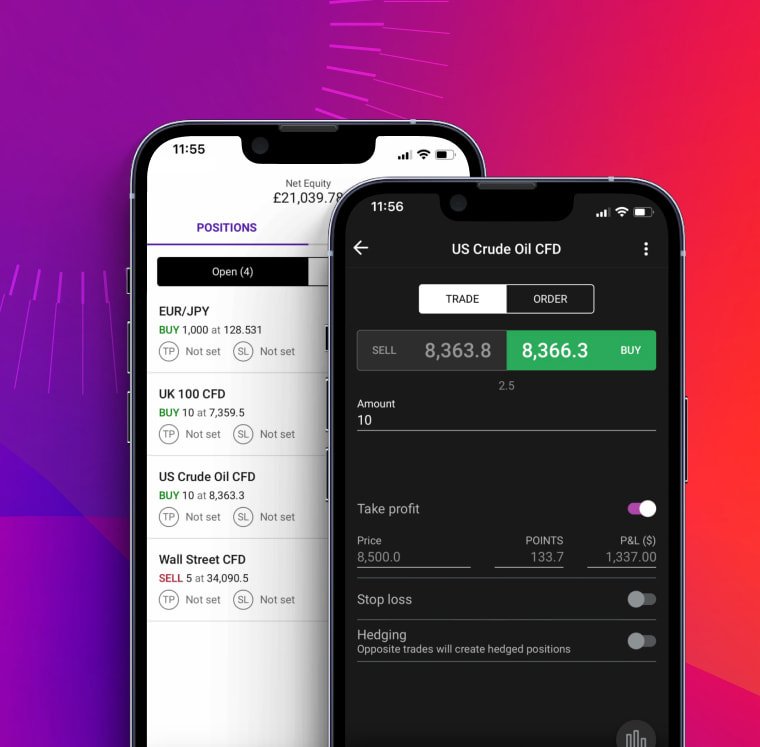

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Sector indices FAQ

What are sector indices?

Sector indices are a basket of stocks within the same market segment or industry. Sector indices represent the performance of the broader market, enabling you to speculate on broader trends without taking multiple positions.

Sector indices are also commonly used as a benchmark to measure the performance of individual companies against the average.

With City Index, you can trade 14 major sector indices including:

- Banking

- Mining

- Energy

- Healthcare

- Technology

Learn more about indices trading here.

How do sector indices work?

Sector indices work in the same way as other indices, by creating an index value by adding up the market capitalisations or the share price values of all the constituents and dividing the figure by that day’s divisor.

Each index will have different criteria for how it is constructed depending on what exposure it’s meant to give investors. For the most part, it’s usually dependent on how much of a company’s revenue is generated from activities within the industry.

For example, a mining stock would need proof of revenue being generated from the exploration of oil, mineral and natural gas deposits.

Learn more about how indices work here.

If you have more questions visit the FAQ section or start a chat with our support.